Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

GDP growth based on consumption financed by external debt. The cases of Romania and Moldova

An opinion published by the prestigious Romanian publication Ziarul Financiar in April 2023 concluded, "The population continues to go shopping and produce GDP" [*]. This is correct, but a more detailed analysis must be made[**]. We have endeavoured to do this in June 2023 for the case of Romania, which was hosted for the first time by the same publication mentioned above. Our research was later extended to the Republic of Moldova (Moldova in this article) as well. The result of our efforts is presented below in a summary. Conclusions are strikingly similar.

Romania - growth, consumption and external debt

The specialised economic literature in Romania has not debated at great length during the last few years what the economic growth model of this country would wish to adopt and implement. Romania currently has only fragmented programmatic documents, of which some, we have to be frank, were requested from abroad, as is the case of the National Program of Reconstruction and Resilience (NPRR), prepared and negotiated under the guidance of the European Union (EU). Over time, various Governments came with the so-called Governing Programs, which were either not fully implemented or, pure and simple, abandoned for good when the respective Governments changed. In short, there is no country strategy in the medium and long term, which generally should be the solid base for actions by the whole nation.

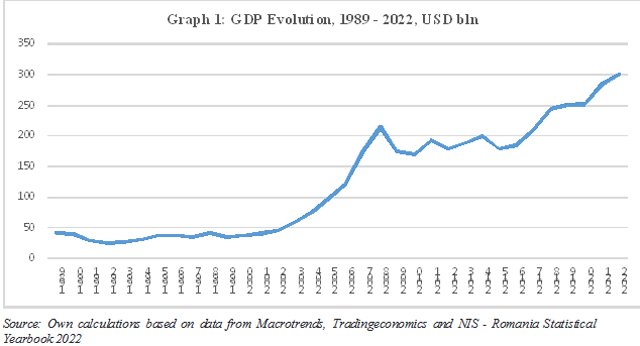

Due to this fact, after the December 1989 events, Romania adopted from the Western literature and practice a key indicator to measure its economic growth, namely the Gross Domestic Product (GDP), which replaced the Total Social Product and National Income indicators. This indicator offers valuable information about the development phase of a certain nation, including its better-known and more utilised version, namely GDP per capita. By doing this, the Romanian statistical standards were aligned with those in the developed countries. In accordance with the data published by prestigious agencies, Romanian and Western as well, the Romanian GDP has evolved from $42.1 bln in 1989 to an estimated level of some $301.2 bln in 2022 (Romanian Lei 1,412 bln (+4.8% as compared to 2021), based on the yearly average exchange rate Leu/USD as published by the National Bank of Romania (NBR)). This fundamental indicator’s evolution during the 33 years of transition and market economy is presented in Graph 1 below. It is pretty clear that Romania’s memberships in NATO in 2004 and then in the EU on 1 January 2007 have had an extraordinarily favourable impact on the total GDP increase, despite the circumstances in which the Romanians’ exodus (especially of the young ones) to foreign countries had started already.

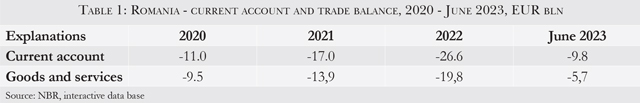

It is well known that in Romanian practice and economic theory, the GDP represents "the final result of the production activity" (in the broad sense of notion) of resident producers. The computation methods are well known: a) production method, b) income method, but the best known is c) expenses method, according to which GDP = FC + FCGF + SV + (E - I), with the following notations as per the National Institute of Statistics (NIS): FC = actual Final Consumption; FCGF = Fixed Capital Gross Formation; SV = Stock Variation; E = Exports of goods and services; and I = Imports of goods and services. During the previous years and the first quarter of this year, the most significant contribution to the formation of the Romanian GDP was population consumption (trade, services, and transport, which were the main contributing branches over two-thirds), followed by the public administration's consumption. The gross capital formation (investments) had a relatively small contribution, especially if we compared ourselves with what is needed in the country. The investment plans were abandoned a long time ago as they were deemed of a socialist nature. This has had grave consequences. Measures to put this situation right are needed as a national emergency. One other definitive characteristic was that the Romanian exports of goods and services were permanently overtaken by imports. The commercial imbalances registered during the last three and a half years (up to end-June 2023) are presented in Table 1.

The correction applied to GDP’s growth for the first quarter of this year for the disequilibrium registered by trade and services balance is actually minor (-0.8%), but the fundamental problem is that the population buys and consumes priority products made in other countries. Romania is currently importing potatoes from Egypt, milk and flour from Hungary, tomatoes from Turkey and Syria etc., to mention just a few examples. Romanian agriculture has practically remained an under-developed sector, the irrigation systems financed via loans from the World Bank were destroyed or have been left to decay, and the labour force that still lives in the rural zones is very old, to cite just a few of the most severe problems. In many other articles, we have endeavoured to suggest a fundamental change in this wrong attitude, which is even dangerous for national security.

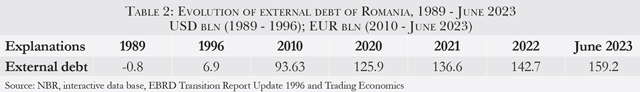

The financing of internal consumption (population’s households and public administration) with external loans, which was the practice of the last three decades, seems to us to be wrong. Romania has accumulated a substantial external debt (see data in Table 2), which should be presented to the population as such. However, the Romanian politicians are scared to do this as they will lose their electorate, and the population is more and more adamant (long strikes, street demonstrations etc.). They ask for better wages and/or pension rights, which they consider justified under the current cost of living crisis.

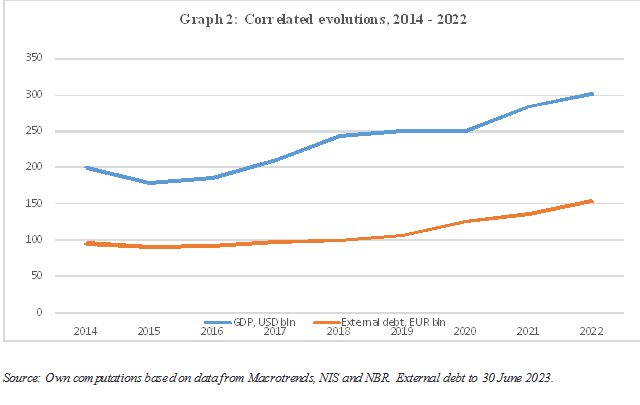

Under such circumstances, the presentation of the GDP growth annual changes as a pure Romanian achievement must be nuanced. The Romanian analysts should signal this more frequently and more intensely this anomaly. It is increasingly clear that there is a correlation between GDP's growth and the increase of external debt. The data presented in Graph 2 for the last nine years suggest, without any doubt, this positive correlation. If still needed, simple mathematical computations with the help of two main statistical functions related to the simple linear regression (=CORREL(x1:xn,y1:yn) or =PEARSON(x1:xn,y1:yn)), where "n" represents the number of years searched for the two statistical series), lead us to a determination coefficient of +0.92. This level (which is within the theoretical interval of this function from +1 (positive correlation) to zero (no correlation) and up to -1(negative correlation)) shows that an important part of GDP was financed through external borrowing during the period searched.

Moldova - similar evolutions in complex geopolitical situation

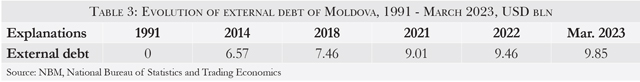

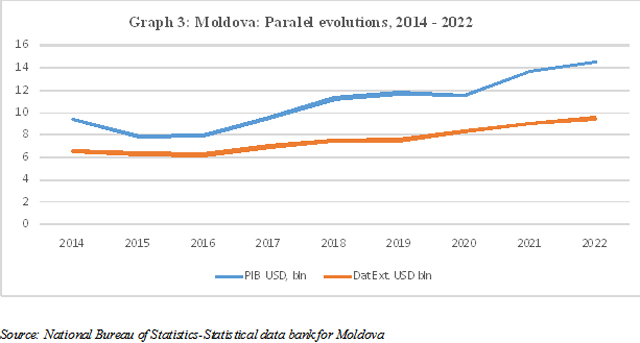

Based on the data published by the National Bureau of Statistics, National Bank of Moldova (NBM) and specialised firms in collecting and disseminating macroeconomic data, Moldova has a situation that presents evident similarities with that of Romania. Data in Table 3 and Graph 3 below are very conclusive. Moreover, in the case of Moldova, the positive correlation between the GDP’s evolution and the increase of external debt, as presented below in Table 3, is even more vital.

Like in the case of Romania, the mathematical computations using the two formulas mentioned above (=CORREL(x1:xn,y1:yn) or =PEARSON(x1:xn,y1:yn)), where "n" represents the number of searched years for the two statistical series, led to a determination coefficient of +0.968 for Moldova, which is very close to the +1 level. However, in the latter case, there are also some distinct features. We will try to summarise them as follows:

- In a distinct manner as compared to Romania, Moldova based itself on a solid inflow of remittances all along during its transition to a market economy. This was generated by the foreign currency sent home by some one million of Moldovans working abroad but which retained their Moldovan citizenship. According to the data published by the World Bank, the remittances' contribution to the Moldovan GDP formation was much higher (in some years, this reached the level of up to 14-15% of GDP) as compared to Romania, where the remittances' contributions, although also essential, was nonetheless much smaller;

- The indebtedness process of Moldova (the external debt of the country reached $9.85 bln by the end of March 2023 or 65.6% of GDP) was different as compared to that of Romania, despite the fact that both countries started their transitions with zero external debt. However, Moldova did not have permanent access to the international capital markets from where Romania has borrowed heavily (it could be said that it was even an over-borrowing process, especially under the current circumstances of higher interest rates). As such, the share of its external debt from the IMF, World Bank, EBRD and other international financial organisations in the total foreign debt was much higher as compared to Romania's case;

- Finally, the third most crucial distinction was the significant negative impact of the war started by the Russian Federation against Ukraine in February 2022. Moldova has had an influx of Ukrainian immigrants (which had transited or some of them remained in the country) much more extensive than that registered in Romania, especially considering the size of the Moldovan economy and its demographic dimension.

There were some economic, monetary, banking, economic structure and other particularities (Moldova has a high share of agriculture in its total GDP), which in the case of Moldova has developed distinctly, but the quantification of the main three features described above will offer us pertinent explanations (even if partial ones) on why the higher correlation between GDP, consumption and its external financing in the case of Moldova. The impact of remittances and external debt on consumption and implicitly on GDP is evident.

A short conclusion

For a balanced presentation of this sensible issue, one should note that other countries, especially the developed ones starting with the USA, EU, Great Britain, Japan and others, implement a similar system of financing their economic growth, but this is done via monetary issues. Part of their currencies are kept as international reserves by other countries.

Regarding Romania, it should focus on investments via which jobs will be created, especially for young Romanians, who are increasingly tempted to leave to work abroad. At the same time, the creation of GDP via public sector consumption is not sustainable. The fiscal deficits must be kept under control. The size of state governmental institutions and of the hundreds of state agencies established during the last decades (the current Government’s efforts to reduce them have produced modest results only) are abnormal for the economic potential of the country which has lost more than four million persons since 1990, especially young ones and active labour force. Even more, granting special pensions to some categories of public sector employees is immoral in a situation in which millions of older people are living on minimum pensions.

The case of Moldova (currently under accession to the EU) is similar to that of Romania with regard to the GDP formation based on consumption financed in its most significant part through external debt and remittances, but its geopolitical situation is much more complex than that of Romania, a NATO and EU country. The creation of a false impression that the GDPs of both countries have healthy growth and, implicitly, improve the population's standard of living cannot be accepted any longer without major risks for the respective nations. The full picture should be disclosed and assumed by the authorities.■

__________________________________________________________________________________

* See Adrian Vasilescu, NBR: Population get out for shopping and make GDP - in Ziarul Financiar dated 28 April 2023.

** See Alexandru M. Tănase and Mihai Rădoi -GDP’s evolution and external debt evolution. Creating a false impression that the Romanian GDP has a healthy growth and, implicitly the standard living of the population, without telling the full truth, cannot be accepted any further without major risks for the whole nation - in Ziarul Financiar dated 25 June 2023.

__________________________________________________________________________________

Alexandru M. Tanase, PhD, is an Author and Ex. Associate Director, Senior Banker at EBRD London and former IMF Advisor.

Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris.

Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris.

These represent the author’s personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions/sources quoted. The assessment and data are based on information as of end-August 2023.

__________________________________________________________________________________

Adauga-ţi comentariu