Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Romania and Moldova - modern evolutions of banknotes

The great Irish writer Oscar Wilde is mentioned many times for a quote on money, maybe even more than for his writings. He said: "When I was young I thought that money was the most important thing in life; now that I am old I know that it is". Apart from the freedom to decide in one’s life, money offers to its owners the possibility of a decent life and the certainty of tomorrow. The importance of money for the population, both in Romania and in the Republic of Moldova (Moldova in this article) cannot be emphasised more. With good and bad things, the Romanians became emotionally attached to their own currency, despite the fact that this could be ditched in favour of the Euro (in the medium or probably long term). For Moldovans, their Leu will be the reference currency in a long term, and the country’s links with the outside world and the recent political changes could positively define its future.

In Romania, the year 2022 will mark the 70-th anniversary from of great 1952 stabilization, an event which most likely will not be remembered by the Romanian mass media. The Second World War (WWII) had a heavy impact on Romania, not only in terms of human losses, but also from its macro-economic equilibria. That was followed by a terrible drought which is still remembered by the older generation as a bad dream and which aggravated, even more, an already precarious situation. The political changes on 30 December 1947 and then the nationalisation of the main means of production on 11 June 1948 had brought in power new Governments, controlled by the former Soviet Union (USSR), which Governments did not manage to control the derailment of the Romanian economy. Under such circumstances, the Romanian currency-the Leu had a difficult fate for a good part of the last seven decades. The history of its divisionary metallic coins is also a very interesting one and deserves special analysis.  The great stabilization and re-certification

The great stabilization and re-certification

The first great stabilization from 1947 was implemented at a time when inflation was very high and the trust of the population in Leu was substantially eroded. The issuance of banknotes with large denominations (1,000,000 and 5,000,000 Lei) clearly foresaw that the currency was in trouble. The 1947 and 1952 stabilizations had strong psychological effects on the population. The emotional impact was high and came back easily in the public conscience during Romania’s transition from the socialist system to a market economy after the December 1989 events. Leu’s exchange rate evolution and the issuance of new banknotes with large denominations (1,000,000 lei) again remained up to today in the public mind. In the rural areas, the Romanians are still speaking in 2021 in terms of millions of the old currency.

Both stabilizations mentioned above were not simple changes of currencies. The Romanian authorities in those days explicitly intended to redistribute a share of the national wealth through the limits on the amounts of money allowed to be changed and through the exchange rates used to buy the old currencies against the newly issued ones. The key principle used in both stabilizations was that those having large amounts of money should not be able to change them except under very limited conditions. The monetary base was dramatically reduced to 24.3 billion Lei during 15 August - 31 December 1947. Similarly, the monetary base, which meanwhile increased substantially again from 26 billion Lei as of end-1947 to 54 billion Lei as of December 1951, was also dramatically reduced during the second stabilization done in January 1952. The last Governor whose signature appeared on the Romanians’ banknotes before 1989 was A. Vijoli, later accused of "sabotage of the national economy", but never found guilty. This is how the saga of Romanian money started during the last seven decades. The major political changes which followed had their marks on the banknotes issued by the NBR, an institution that itself suffered big changes after 1947 and once again after 1989.

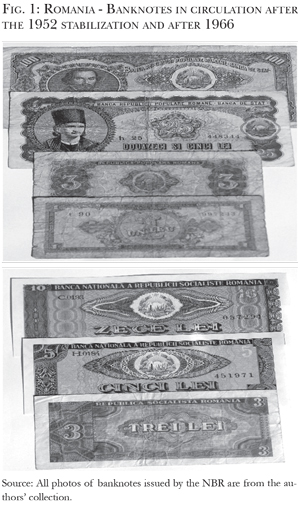

This series of banknotes (Fig. 1, above) was put in circulation in January 1952 and remained in circulation up to 16 April 1970. In 1966, a new series of banknotes was again issued to reflect the change in the name of the country from the Romanian People’s Republic into the Socialist Republic of Romania. A short selection of this new series is also presented in Fig. 1, down.

There are multiple distinctions between the two series of banknotes, starting with the name of the issuing central bank. The label "Bank of Romanian Peoples’ Republic. State-owned Bank" on the obverse of the currencies became "National Bank of the Socialist Republic of Romania". The country’s coat of arms was also changed with the new name of the country and a star was being added. In both cases, the banknotes issued in 1952 and those issued in 1966, had not the signature of the Governor and the Central Cashier anymore as the Romanian traditions used to be for more than 100 years up to these last two series; moreover, the nature in the images on obverse and reverse of the banknotes has become increasingly proletarian (quarries, ports, crops of wheat being harvested etc.).

If anything, these were changes of forms, designs and the theme/chromatics utilised. Much more important were changes of substance. The 1966 banknotes were representing an economy that made good efforts to erase the marks of WWII. The leadership of the country was changed in March 1965. Money purchasing power started to consolidate and inflation was reigned through various ways, including/or especially through administrative ones. To the surprise of the international community, the Romanian authorities decided to become a member of the International Monetary Fund (IMF) and the World Bank Group. The IMF Charter was signed in Washington DC on 15 December 1972. These memberships were an extraordinary achievement (only the former, SFR of Yugoslavia was a founding member at the IMF then), and belonging to these prestigious international institutions conferred to the Romanian Leu solid financial support in its efforts to become a trusted currency. The loans granted, the implemented projects and the technical assistance extended by both institutions had offered favourable support for Leu’s strengthening. However, both the official and commercial exchange rates for external transactions were over-valued for political reasons. A complex system of exchange rates deviations was then planned and constantly monitored by the Ministry of Finance, but the IMF did not accept these and they were reported under "Errors and omissions". The state played a very interventionist role and in 1974 the Leu’s convertibility was declared as an economic policy objective. Of course, this was not achieved then. In 1980, the unique commercial exchange rate was introduced, but the depreciation of the Leu continued.  Romanian banknotes in transition to a market economy

Romanian banknotes in transition to a market economy

After December 1989 events, the foreign exchange regime was relaxed in Romania and the convertibility of the Leu was an explicit goal. On 1 February 1990, both the commercial and non-commercial exchange rates were unified at 21.00 lei/USD (from 8.74 lei/USD for non-commercial and 14.23 lei/USD for the commercial one). But even this new level of Leu’s exchange rate was not the equilibrium and thus many other depreciations followed. Then the price liberalisation started, the banking system was reorganised in a structure with a central bank (NBR) and commercial banks (state-owned and/or private ones). At the same time, the first privatisations started within the economy. However, the dramatic changes of the Leu were to continue. The currency was not able to avoid the nightmare of the market parallel exchange rates. Meanwhile, a "confiscation of foreign currencies" took place with all the holders of foreign currencies being forced to exchange them against Lei with the banks at over-valued exchange rates prevailing in 1991. Despite many depreciations, the exchange rate did not stabilize and the trust of the population in the new banknotes issued in 1991 by the NBR declined constantly. As a matter of fact, some of these new monetary signs were withdrawn in 1992 when a new series of banknotes was put in circulation, with larger and larger denominations. A new banknote of 10,000 Lei with N. Iorga on the obverse was soon introduced in 1994. The cultural symbols on the reverse (Brâncuşi sculpture, Putna monastery etc.) started to be used and the signatures of the Governor and Central Cashier were added.

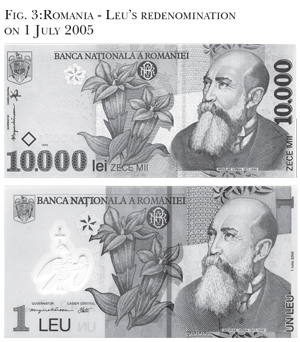

The fundamental factor which was needed to offer the Leu the required support (the economic growth and the consolidation of macro-economic equilibria) was still missing. This led to a situation in which new issues of new banknotes were needed in 1992 and 1996, and in 1999 the first issue of Romanian banknotes was made out of polymers. The paper support was abandoned to the disappointment of many Romanians who had and still has to date an aversion to plastic money. The series of banknotes printed in 1999 started with a small denomination of 2,000 Lei and finished with the banknote of 1,000,000 Lei with I. L. Caragiale on the obverse. This fact did not foresee something good for Leu’s fate. These activities have eroded again the trust of the population and the final is well known – redenomination of the 1 July 2005. From 14.44 Lei/USD as of end-1989, the Leu’s exchange rate already reached to 29,100 Lei/USD as of end-2004. A new term was invented (redenomination) to avoid as much as possible an unfavourable and/or alarming parallel with the stabilization in 1952.

Redenomination of 1 July 2005

The Leu’s exchange rate during the first 15 years of this century was not sustainable, and the accounting system was suffocated by very large numbers which were not possible to be recorded/monitored with the IT systems in those days. The move of cash amounts was very slow and, most importantly, the trust of the population was lower and lower. In such circumstances, on 1 July 2005, NBR took the right decision to redenominate its currency by changing the old leu with a new leu (the heavy leu). A banknote of 10,000 lei was changed against a new one of 1 leu (see Fig. 3).  The monetary authority did not intend to implement a new stabilization and no restrictions were imposed in changing the money. In fact, during a period of six months the old banknotes circulated in parallel with the new ones. One could say that this action of the NBR facilitated the accounting system and computation of statistical indexes. At the same time, the use of ATM cash machines brought in the country by the banks after 1989 was greatly facilitated as the new banknotes had the same dimensions as those of Euro. This whole exercise was presented as a step forward in the right direction with regard to Euro adoption, an objective of which the final deadline was changed many times due to the Euro itself and due to Romania as well. The psychological impact of redenomination was significant, a fact which demonstrates the importance of money for thinking and behaviour of the general public.

The monetary authority did not intend to implement a new stabilization and no restrictions were imposed in changing the money. In fact, during a period of six months the old banknotes circulated in parallel with the new ones. One could say that this action of the NBR facilitated the accounting system and computation of statistical indexes. At the same time, the use of ATM cash machines brought in the country by the banks after 1989 was greatly facilitated as the new banknotes had the same dimensions as those of Euro. This whole exercise was presented as a step forward in the right direction with regard to Euro adoption, an objective of which the final deadline was changed many times due to the Euro itself and due to Romania as well. The psychological impact of redenomination was significant, a fact which demonstrates the importance of money for thinking and behaviour of the general public.

During all this period of time, the key role of the NBR was that of controlling inflation. Looking back one could say that the central bank satisfactorily fulfilled this statutory task. At the same time, the NBR managed to keep an adequate balance between inflation and interest rates, so that the interest rates would cover at least the level of inflation. As a result, a Leu exchange rate emerged and this was relatively constant after the redenomination presented above. However, during the first part of the transition, the NBR had to challenge major political pressure, which led to situations in which this equilibrium was sometimes ignored and/or impossibleto be implemented or consolidated. Anyway, except pioneering years up to redenomination(with many harsh challenges for the Romanian economy), one could say that up to the present the NBR’s control over interest rates/inflation was done professionally. The birth of the Moldovan Leu

The birth of the Moldovan Leu

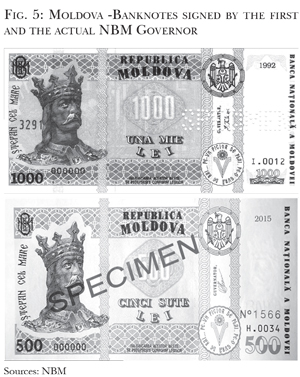

The Moldovan Leu has a shorter history (it still has to mark its third decades anniversary), but an interesting one at the same time. This "young" currency had celebrated a quarter of a century on 29 November 2018. However, what is extraordinary in the case of Leu is the difficult geopolitical environment in which this Leu was issued and in which it has existed so far. Before its independence on 27 August 1991, Moldova used the Soviet ruble and, for a short period, the Russian ruble. By August 1992, Moldova became a full member of the IMF and the World Bank Group. Also, for a very short period, Moldova printed its coupons before the introduction of its currency. Thus, the birth date of the Moldovan Leu, with the effigy of Stefan the Great and Saint on the obverse of its banknotes, was 29 November 1993, when, with the support of the IMF, the National Bank of Moldova (NBM) issued its Leu, as it was signalled in Historia Review (see A. M. Tănase - The Moldovan Leu, a quarter of a century of monetary evolutions, in issue no. 197/June 2018).

In November 1993, Leu’s first exchange rate was administratively fixed by the NBM at 3.85 lei/USD. From an economic point of view, some conditions were met for a stable currency in those days, such as no external debt and the good potential of the agricultural sector. These were premises of major importance, but it should be noted that Moldova did not have any foreign currency reserves and no gold holdings at the time when this currency was born. In fact, the lack of gold reserves had haunted the currency up to nowadays. Based on the good results in the implementation of reforms, the Leu managed to remain stable during the first five years of its existence around the level of 4.50-4.70 Lei/USD. However, at the time of issuing its currency, Moldova registered a sharp economic decline. Inflation was extremely high (1,283% in 1993), the state budget deficits were also very large (some 5-8% of GDP). Moldova started its transition to a market economy with its external debt at zero, but this started to accumulate at a rapid pace. As of end-2020, the external debt reached an impressive level of $8.36 billion (70% of GDP), with a modest reduction as of 31 March 2021.

During the first years of Leu’s existence, the NBM conducted a very restrictive policy. The refinancing rates for commercial banks reached a very unusual level (377% in March 1994) and the minimum reserves requirement were kept at very high levels (for instance, in 1994 at some 28%). The refinancing rate level had been constantly relaxed thereafter (2.65% in July 2021), and the minimum reserves requirement were also reduced. Some of these actions represented good achievements in those days and they were reflected as such in the relative stability of the Leu in the very beginning.

Despite all these, the evolution of this young currency was to register dramatic events in the following years. From its very day in circulation, the Moldovan Leu was not the official currency for all Moldova’s territory. The so-called unrecognized Transnistrian Republic established its own central bank (BRT) on 22 December 1992 in Tiraspol. In August 1994, BRT put in circulation a new Transnistrian ruble, using the parity of one new Transnistrian ruble equal to 1,000 old rubles (Soviet or Russian ones). Since 1994 up to date, BRT has implemented many monetary issuances but these are not recognized anywhere apart from Transnistria.

Despite all these, the evolution of this young currency was to register dramatic events in the following years. From its very day in circulation, the Moldovan Leu was not the official currency for all Moldova’s territory. The so-called unrecognized Transnistrian Republic established its own central bank (BRT) on 22 December 1992 in Tiraspol. In August 1994, BRT put in circulation a new Transnistrian ruble, using the parity of one new Transnistrian ruble equal to 1,000 old rubles (Soviet or Russian ones). Since 1994 up to date, BRT has implemented many monetary issuances but these are not recognized anywhere apart from Transnistria.

The Moldova Leu’s evolutions

The Moldovan Leu was to have a very sharp depreciation in the aftermath of the 1998 global crisis. The second such large depreciation followed in 2014.There was a need for a strong economic recovery in order to maintain Leu’s stability. The Moldovan foreign debt had and continue to have a material impact on Leu’s fate. During the last 10 years, Moldova has indeed received on an annual basis an average of $1.3-1.4 billion as remittances from around one million Moldovans who are working abroad-the Russian Federation, EU, USA, Great Britain, Israeland many other countries, but the majority of this money is used for consumption, a tendency which is probably not the best. In addition, the level of corruption and large frauds were crucial factors for the fate of this currency.

The Leu, both internally and externally, was under high pressure up to the end of March 2016,as the NBM banking supervision was not at the level of the standards required by the banking prudence. The banking sector has been confronted with major scandals, of which the so-called the "Moldovan Laundromat" and the large banking fraud of over $1 billion were the most damaging for the Moldovan Leu. A new NBM Governor was appointed by the Parliament of Moldova and measures started to be implemented to correct such an unacceptable situation. Even under such circumstances, the currency has depreciated to 21.3989 Lei/EUR and 17.9755 Lei/USD, respectively, as of end-June 2021 (the highest level was at 24.01 Lei/EUR on 18 February 2015). This shows the fragility of a young currency that has to cope with a lot of difficulties of harsh internal and external conditions.

Our daily money Until the adoption of the Euro, which is agreed upon by the majority of Romanians (over 75%, increasing from 63%) in accordance with some recent surveys, the Romanian Leu will continue its sinuous way which it had during the last seven decades, and more so, during the transition years to a market economy. During the last 16 years since the introduction of the "heavy Leu" (RON), this has been following the tumultuous evolution of the Romanian economy. The situation of the two currencies analysed in parallel confirms once more time that only a healthy economy can sustain a strong currency. This theory which was formulated during the interwar period by the Romanian professor V. Bădulescu argues that: "A good economic order is the first and the required condition to any monetary health. We can imagine a healthy economy with a damaged currency, but we do not believe as possible to have a healthy currency in a disorganised economy". We fully subscribe to such a theoretic endeavour.

Until the adoption of the Euro, which is agreed upon by the majority of Romanians (over 75%, increasing from 63%) in accordance with some recent surveys, the Romanian Leu will continue its sinuous way which it had during the last seven decades, and more so, during the transition years to a market economy. During the last 16 years since the introduction of the "heavy Leu" (RON), this has been following the tumultuous evolution of the Romanian economy. The situation of the two currencies analysed in parallel confirms once more time that only a healthy economy can sustain a strong currency. This theory which was formulated during the interwar period by the Romanian professor V. Bădulescu argues that: "A good economic order is the first and the required condition to any monetary health. We can imagine a healthy economy with a damaged currency, but we do not believe as possible to have a healthy currency in a disorganised economy". We fully subscribe to such a theoretic endeavour.

Despite the fact that it was formulated during the interwar period, this theory is more relevant nowadays than ever. The relative stability of the Romanian Leu during the last 16 years since its redenomination has been based on an economic growth focused more on consumption rather than investments. But the most worrisome part of the current Leu situation is the external debt of the country which has been accumulating at a speedy pace during the last years (126.9 billion Euro as of end-May 2021, as compared to 99.3 billion Euro, the level recorded on 1 December 2018). This is a large macroeconomic imbalance which will not help Leu’s stability. In addition,the financial support of the European Union (EU) is not fully absorbed, and the approval process of the National Plan for Recovery and Resilience (NPRR), under which an amount of 30 billion Euro was allocated for Romania (as grants and loans), does not bode well for a successful implementation. The whole country is required now to undertake efforts to ensure that the Romanians’ money has good purchasing power both internally and abroad. Otherwise, the story and the tumultuous evolution of the Romanian Leu is not yet over.

On the other side, the Moldovan leu has existed under difficult conditions from its very beginnings. It is very likely that this environment will continue (even with a reducing intensity due to the external support), but this currency has already "learned" to survive, a skill that will be further required. After all the problems brought in during 2020-2021 by the Covid-19 pandemic and after the recent political and constitutional blockage, the new political openings predicted by the Parliamentary elections on 11 July 2021 and the external support of the developed states and of the international financial organisations could be an extraordinary chance for the favourable evolution of this currency, with the image of Stefan the Great and Saint as the national symbol.■

Adauga-ţi comentariu