Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Prices and interest rates in convoluted times in three distinct countries

Debates on prices and interest rates are more than factual in many countries, not only for the banking and governmental circles but, even more so, for the ordinary citizens who have been confronted with rampant inflation during the last year and with unprecedented raises of interest rates unseen in recent history.

Both topics have been scrutinised in summary in an article called "Prices and interest rates in convoluted times"*, published by the Financial Newspaper, Romania, on 4 April 2023. The implications of price and interest rate increases on living standards are direct and have political resonance, especially during election years.

These price increases translate into rampant inflation which has done and is still doing a lot of damage in the whole of Europe and effectively in the whole world and have multiple causes according to well-known analysts. The most frequently mentioned are the energy crisis and a Covid-19 pandemic of biblical proportions that started in March 2020 and was declared as being finished only in May 2023, according to data published by the World Health Organisation (WHO). In the case of many European countries, and even more so for Romania and the Republic of Moldova (Moldova in this article), one other factor repeatedly brought into discussion is the negative consequences of the Russian Federation’s aggression against a sovereign state, namely Ukraine, which started in February 2022 and which has no clear or certain prospects of a peace agreement. Also, there is no calculation of the costs involved or the source of financing. Moreover, all of these have overlapped with major fluctuations of crude oil quotations (brought into discussion especially when the quotes on the international markets seem not to respond anymore to the fundamental law of supply and demand). Finally, the banking crisis in developed countries such as USA and Switzerland and the major fluctuations in the cryptocurrency industry as well as many more causes are also mentioned as being the main culprits. The consequence is that ordinary citizens suffer when they purchase their essential items for daily life or when borrow from commercial banks.

1. United Kingdom – decreasing inflation, but a very modest economic growth

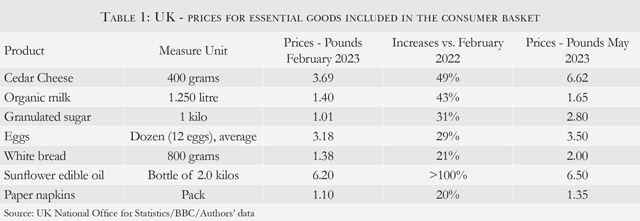

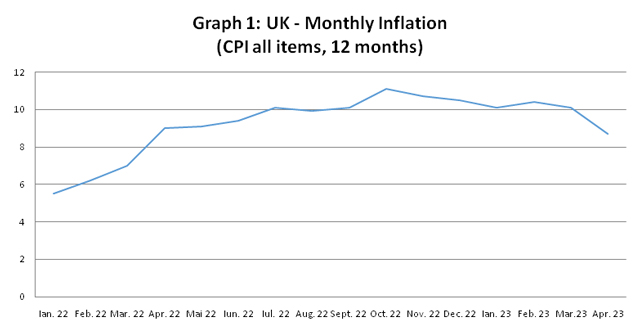

Inflation has had an unprecedented evolution in recent times in the developed countries from Europe and especially in the United Kingdom of Great Britain and Northern Ireland (UK). In this latter case, apart from the factors mentioned above, the economic consequences of Brexit need to be brought into discussion. UK has voluntarily renounced to a large export and import market which existed in its immediate geographical proximity, namely that of the European Union (EU) which has evidently contributed over the years to the price increase for consumers. The agreements signed to exit the EU still have many parts with not very well negotiated/regulated provisions or which have been found very difficult to implement and non-efficient when it comes to human, monetary and political costs. The 2023 renegotiations of some of the Customs Treaty for Northern Ireland (which is a part of the UK having a joint land border with an EU member state) is just one single example. All these factors have led to a level of inflation which could only be labelled as historic. The data presented in Table 1 and Graph 1 are very illustrative in this respect.

Moreover, irrespective of how much consumer prices increased, in some cases and during certain periods of time, the large supermarkets were forced to rationalize the selling of some goods (especially vegetables, as was the case of fresh cucumbers). Such situations brought back in the memory of the general public the restrictions of basic products after the Second World War. One other aspect, even more painful for the ordinary consumer, was the fact that inflation for basic foodstuffs was much higher compared to the general monthly inflation shown in Graph 1 or compared to the annual average inflation recorded for 2022 of 9.1% or that of 8.7% in April 2023 (smaller, however still almost double as compared to USA inflation). A simple comparison with the Bank of England (BoE) targets inflation of 2% (which is practically irrelevant under the current circumstances (the model is 30 years old) and should be reassessed) and cannot do more than show the significant proportions of price increases in this country and other developed states such as the USA or those in the EU zone. Despite the fact that the price increases have calmed down during the last few months (especially visible at the gas stations where the price of unleaded gas has decreased from over £2.00/litre some three months ago to the current one of £1.45/litre) they still remain high.

Source: UK Office for National Statistics/Authors’ data

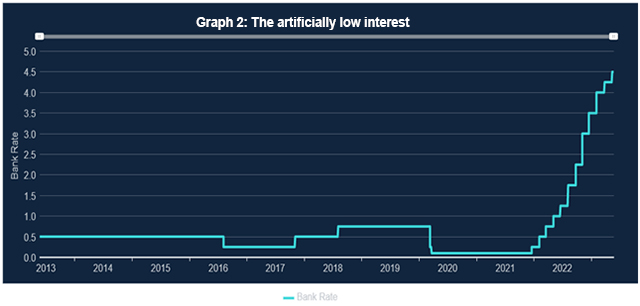

Under these circumstances, the BoE, a fundamental institution of the state older than 300 years, was forced the abandon its policy of cheap money created through the famous Quantitative Easing (QE) in the aftermath of the 2008 crisis. Graph 2 shows the artificially low-interest rate of 0.25% held for a long period (2016-2017 and then since the start of 2020 just before the pandemic explosion).

Source: Bank of England- 11 May 2023

The increases of interest rates which started in December 2021 to date (the most recent one was decided by BoE on 11 May 2023 at the level of 4.50%) were meant to calm down inflation. However, the immediate question which could be raised was: did they fulfil their intended role?

The answer is neither positive nor simple. One thing was, however, clear during this period of time, namely that adjusting the interest base rate is not sufficient anymore. Reduction of inflation cannot be obtained through the utilisation of this monetary instrument alone. We have signalled in many articles that there is a need for the parallel utilisation of another instrument, Quantitative Tightening (QT) respectively, to absorb a part of the artificially created monetary mass which was with us after the 2008 crisis and COVID pandemic. However, the utilisation of these two instruments (alone or corroborated) is not without risks. One of these is stagflation. During 2023, Great Britain will, most likely, have an especially modest economic growth reflected by its GDP increase of only 0.4% in accordance with the latest estimation (revised, increasing) of the International Monetary Fund (IMF).

It is quite clear that both the BoE and other central banks in the world will have an unenviable position, something like walking on a very narrow path with huge ravines on both sides. Ensuring the monetary equilibrium will mean that both those who borrow from the commercial banks (mortgages, leasing, personal loans etc.) and those who keep their savings with the same banks need to be able to repay their instalments on the contracted credits or, respectively, to preserve the actual value of savings in case of real negative interest rates (when inflation is higher than the base rate).

2. Romania – rampant inflation, especially for foods and interest rates on hold

Mutatis mutandis, the task of the National Bank of Romania (NBR) is not easier either. Inflation in Romania was much higher than that registered in the UK or EU. As such, NBR was forced to increase the rate of monetary policy all along during the last year. The current level is at 7% (reconfirmed on 9 February, on 4 April and again on 10 May 2023), but this level must be compared with the latest data regarding the price increases as published by the National Institute for Statistics (INS) of 16.37% for December 2022, of 15.52% for February and of 14.53% for March 2023. The ROBOR increases (currently at 6.67% for 6 months, slightly decreasing as compared to April 2023) and that of the Reference Index for Consumers Credits (IRCC) (currently at 5.87% on a yearly basis, with a slight decrease as well as compared to the maximum of 6.26% registered on 20 March 2023), no matter how painful this has been for borrowers, were just normal consequences of a long inflationary period during which Romania, together with many other states of the world, has to face the unwanted consequences of war at its north-eastern border.

Furthermore, Romania made major mistakes in fighting the COVID pandemic. That had human implications and, more disturbingly, grave economic consequences reflected in the alarming increase of its foreign debt at over €154 bln as of 31 March 2023, of internal public debt and of budgetary deficits (1.42% of GDP during the first quarter of this year and even more for the first four months). At the same time, those saving with commercial banks in Romania, especially those with deposits denominated in Lei, register losses of real purchasing power for their saved money. NBR cannot be envied in its current position in which it needs to keep firmly a very delicate balance during these extremely turbulent times.

3. Moldova – decreasing inflation, but interest rates still high

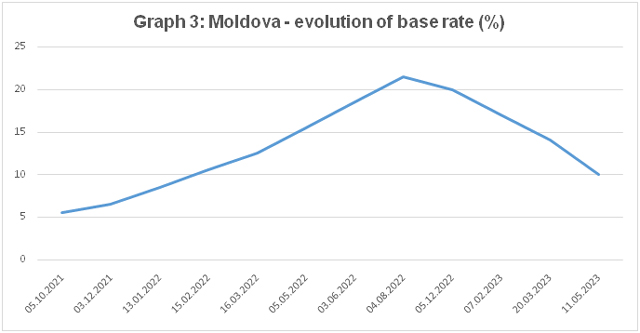

Struggling with inflation, Moldova has suffered the negative impact of all the inflationary factors mentioned above. In addition to that, this country has hugely suffered because of the military conflict in Ukraine and is in a situation in which thousands and thousands of refugees transited Moldova or (some) even decided to remain here for an undermined period of time. The human, material and economic consequences of this and of the unprecedented human exodus are still to be computed, but what is clearly known is that inflation was at record levels. Let us remind only the peak of this registered in November 2022 of 34.62% which had recently plateaued to 18.1% in April 2023. The National Bank of Moldova (NBM)’s forecast for this key indicator is now at 13.3% for 2023 and 5.1% for 2024. However, we have to mention that the uncertainty interval is quite large and the factors with direct contribution are many. Let us list here: the uncertain situation of the conflict in Ukraine, the geo-political prospects regarding the EU membership of Moldova and, last but not least, the level of remittances received by Moldova from the more than one million Moldovans working abroad.

Source: Computed based on the NBM’s data

Under such a dire situation, the NBM has had an even more difficult task as compared to other countries. The base rate was increased up to a peak of 21.50% on 4 August 2022, after which the NBM implemented a wise process of gradually reducing its refinancing rate up to the current level of 10% which is in force since 11 May 2023.

4. What does the future have in store for us?

A very simple question, but without a precise answer! Many things actually, but banking, monetary and financial evolutions (inflation, economic growth, interest rates, budgets etc.) from all over the world, and from the three presented countries as well, will depend on the closure of the war in Ukraine as soon as possible. Our hopes that this unjustified conflict will end soon could well be in vain for a good period of time, but, like in the case of many other conflicts from all over the world, this one will have to end as well. No doubt that after the end of this war (victory/no clear victories/peace negotiations and agreement/frozen etc.) a long reconstruction process will have to follow and this will require huge financial resources. We tend to believe that the developed countries will most likely help Ukraine and the other countries from the region affected directly by the conflict. Some international financial organisations have already announced substantial financial packages. The private capital, both domestic and foreign, will also play an important role. Finally, the roles played by USA and China, by Great Britain and the EU, respectively, will be decisive for the reconstruction process and for maintaining security in the region. The interest rates will be adjusted as we march along and inflation will be finally controlled through adequate monetary instruments and financial adjustments as required.■

__________________________________________________________________________________

* See also the original article signed by the same authors, published by Financial Newspaper/Ziarul Financiar, Romania, on 4 April 2023.

__________________________________________________________________________________

Alexandru M. Tanase, PhD, is an Author and Ex. Associate Director, Senior Banker at EBRD London and former IMF Advisor.

Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris.

Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris.

These represent the authors' personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions/sources quoted. The assessment and data are based on information as of end-May 2023.

__________________________________________________________________________________

Adauga-ţi comentariu