Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Cryptocurrency euphoria during the pandemic

In an article published on 19 April 2021 by BNE Intellinews, London, we have signalled the potential risks of a certain unregulated asset, which currently has a market capitalisation of over $2 trillion. It is called cryptocurrencies. Since then, countries like Turkey prohibited any transactions with such assets, but other countries in Eastern Europe let the market forces drive the process of mining (the process of creating criptocurrencies), circulation (buying, selling and holding), pricing and, in some cases, supporting the consequences of investing in unregulated and volatile instruments. The Russian Federation, Ukraine, Serbia, Romania and the Republic of Moldova (Moldova in this article) are just a few countries in this latter group.

Long before the current pandemic, we signalled in an article published in December 2018 by Emerging Market, London, that the issue of cryptocurrencies had become one of the utmost importance for all the countries in transition from the old socialist system to market economies. However, it is easy to observe that in many countries the transition has not finished yet. This process will continue for some time. During the first three decades of transition, some countries such as Poland and Romania have been declared market economies, but for many others, such as Moldova, Albania, Kosovo, North Macedonia, Mongolia and others, achieving the same goal will need more time and more persistent efforts, assuming that the global markets will continue to favour the transition process and that the pandemic will be over for good.

The unprecedented development of cryptocurrency

During its virtual Spring Meetings held in April 2021, the International Monetary Fund (IMF) published revised figures for global GDP growth in 2021-2022, from an original forecast of a 5.5% annual increase to 6% for 2021 and 4.4% for 2022 (after -3.3% in 2020). For emerging Europe, the projections are more modest at 4.4% in 2021 and 3.9% in 2022 (after -2% in 2020). These projections are of course subject to material successes in combating the current coronavirus (COVID-19) pandemic, which required huge human, material and financial resources to weather its disastrous negative impact. Meanwhile, without any apparent link to the pandemic, a new issue became the centre of attention everywhere in the world, including in transition countries, namely the cryptocurrencies (abstract and stateless assets based on electronic strings of codes*) and the whole range of issues they have generated so far.

This development is unprecedented. Three years ago, there were estimations that over 1,650 such cryptocurrencies were in circulation with a total market capitalisation of $369 billion as of March 2018. The situation could not be more different now. The key cryptocurrency which has gone on to dominate the market, namely Bitcoin (BTC) which holds 47.6% of the total market capitalisation of cryptocurrencies, evolved from a modest market capitalisation then to $1,093.9 billion as of 3 May 2021. The number of cryptocurrencies is estimated currently at 9,537 (9,257 some 15 days ago!), of which the most used and known include Bitcoin, Ethereum, Binance Coin, XRP, Tether, Dogecoin,and Cardano, with a total market capitalisation of around $2.2 trillion. These are staggering figures and, strangely enough, these instruments using blockchain technology are not regulated by central banks or indeed by any other financial authorities. During the last five years, there were signals from the central banks (such as the Bank of England in December 2017) that such instruments are not regulated as they should be and that investors should be aware of the risk they are undertaking. But this was far from being sufficient. Moreover, the declarations of key financial institutions such as the FED (US Federal System of Reserves) and the IMF in 2020-2021, although expressed, were not firm enough to dampen the euphoria of many investors. Also, the role of speculators using dirty money or aiming for money laundering was not scrutinised well enough. There were even unfinished debates over whether such cryptocurrencies are legal means of payments or if they are money as many people tend, by mistake, to believe. Blockchain technology has not proved its usefulness in other fields yet.

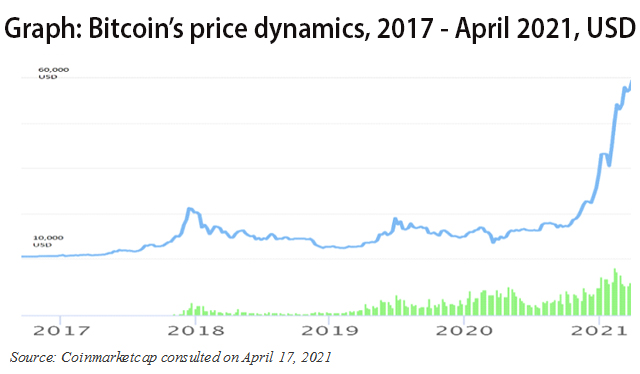

The situation has changed dramatically since the 2017 peak for the price of Bitcoin of $19,666 on 17 December 2017 and of many other cryptocurrencies, as presented in the graph.

The cases of Romania and Moldova

There are no clear-cut dates for when Romanians or Moldovansstarted to get involved with cryptocurrencies. However, the habit of playing financial games could easily be dated to the start of the transition to a market economy in 1990. The euphoria surrounding cryptocurrencies was not the first one in the transition history, although differences did exist. The first and most famous game was Caritas, a "Ponzi scheme" in which large returns on very short terms were promised to naïve Romanians. Understandable to a certain extent due to the poverty of the population during the final years of socialism, the appetite was high, with families selling their most precious possessions to deposit the money with Caritas, which had its headquarters in Cluj-Napoca. This was done in the context of an evident lack of legislation or basic regulations on what was and was not possible. Soon after this first start, many others followed (Procent-Caritas Constanta, FNI (National Investment Fund) and SOV investments, to name just a few in Romania), with some variation on promises for depositors, but in fact, all being games organised according to the same recipe and based on a key common ingredient, namely the burning desire to become rich quickly. However, the collapse of such schemes was in sight (see photo below, right) for those who wanted to see it.

Fast forward 25 years and Romania and Moldova started to sense a new opportunity, namely cryptocurrencies. It’s easy to say that the early transition pyramid schemes have nothing to do with this new type of assets. Possibly, but the underlying desire of people to enrich themselves is the same in both cases. Currently, many people regret that they did not dare to put their spare money or savings into cryptocurrencies. To be fair, an investor buying, for instance, a Bitcoin before the December 2017 peak at let us say $3,000/unit would have today a code which was quoted briefly in April 2021 at almost $65,000 (obviously very volatile prices!). The fundamental question here for many Romanians (like for everybody else) is, however, if one can (easily) cash the gain or use the respective cryptocurrencies for goods and services needed for day-to-day life. Until recently, the use of cryptocurrencies was extremely limited, but since 2020 well-known companies such as PayPal started to accept payments in selected cryptocurrencies. VISA and Goldman Sachs recently announced their intentions to participate in these flows. Moreover, in Romania, some education units (such as University Lucian Blaga in Sibiu) started to allow students to pay their tuition fees in cryptocurrencies. Start-up companies were founded to facilitate the process, as the universities finally need lei, the official Romanian currency. Also, cryptocurrencies founded by Romanians such as Elrond eGold started to be circulated and cryptocurrencies started to be used more and more to buy expensive objects of art such as paintings. These have been important developments to be further monitored to see if in real life such instruments could be of actual use over a longer period, or if it is just a passing fashion. Meanwhile, many Romanian celebrities (ex-famous footballers, dissident poets, influencers etc.) started to present their investments and gains in mass media (TV channels mainly). This has had a huge impact on the appetite of many small investors who dream of getting rich overnight. The euphoria of the ’90s of the last century is back again.

Over the Prut River, some peoples of Moldova also started to become interested in these assets. The so-called unrecognized Transnistrian Republic offered a very permissive legal and economic environment to those mining cryptocurrencies. The electricity is very cheap or heavily discounted as it is produced at Cuciurgan Thermo-Power Station with natural gas imported from Russia and paid for by Moldovagaz. There are many "farms" in the Tiraspol area in which very powerful computers and cooling equipment are used 24/7 to mine new Bitcoins and other cryptocurrencies. The electricity consumption of such farms from Tiraspol alone is estimated to be equal to that of Balti, a relatively large city in Moldova.

Firm regulations or else

During this time, the monetary and financial authorities in Romania and Moldova (mainly central banks – National Bank of Romania (NBR) and National Bank of Moldova (NBM), respectively) pointed out from time to time that cryptocurrencies are not regulated instruments and that the risks could be major, including the total loss of invested money. However, like in many other countries, such calls were not strong enough and more importantly they were not followed by strict regulations. Basically, cryptocurrencies are unpredictable and unstable instruments. Buying, mining and/or holding cryptocurrencies are highly speculative and have high energy consumption. The carbon footprint is obvious, as it is estimated that the energy used to globally mine the cryptocurrencies is equal to the whole energy consumption of Finland. The IMF opined in the past that the matter should be properly regulated. It is very likely that these virtual assets will eventually deflate and will "end up as short-lived curiosities", as pointed out by the president of the Bank for International Settlements (BIS). One pertinent question would be: when? But the answer to such a simple question is not very obvious. For the time being, the incredible increases in the price of Bitcoin (see Graph) and, in tandem, of all other cryptocurrencies is determined by lack of clear regulations and by a large amount of money (estimated at $1.5 billion) invested in January 2021 by internationally well-known tycoons who are very active in this field. Such a large investment has obviously impacted Bitcoin prices (see Graph), while the debate of some 80 central banks on digital currencies still continues. The low level of interest rates granted by commercial banks in the European Union (including in Romania), the United States and other key developed countries (the UK, Switzerland, Japan etc.) and, in a way, in transition countries like Moldova, granted on increasing deposits is yet another contributing factor to the present euphoria. The same is valid for the very high price of gold, which used to be the "refuge asset" for many, but which is not affordable for a large number of small investors anymore. The need for clear fiscal regulations is obvious in both Romania and Moldova which registered for many years sizable public budget deficits, while the sizable capital gains resulting from such instruments as cryptocurrencies remained untaxed. This is a paradox that is difficult to understand both in normal times and more so during the current pandemic when financial resources are in high demand.

The low level of interest rates granted by commercial banks in the European Union (including in Romania), the United States and other key developed countries (the UK, Switzerland, Japan etc.) and, in a way, in transition countries like Moldova, granted on increasing deposits is yet another contributing factor to the present euphoria. The same is valid for the very high price of gold, which used to be the "refuge asset" for many, but which is not affordable for a large number of small investors anymore. The need for clear fiscal regulations is obvious in both Romania and Moldova which registered for many years sizable public budget deficits, while the sizable capital gains resulting from such instruments as cryptocurrencies remained untaxed. This is a paradox that is difficult to understand both in normal times and more so during the current pandemic when financial resources are in high demand.

By taking a low-key approach, the key international financial institutions, starting with the IMF and central banks, including the American FED and key European banks, are not fulfilling their respective roles in accordance with their charters. As it is very likely that the issue of cryptocurrencies will be around for the foreseeable future, such attitudes are full of perils. The magnitude of the risks involved (some $2.2 trillion market capitalisation altogether) is far higher than those associated with the "innocent local" pyramid schemes in Romania from the early ’90s when the transition started. Together with other countries, both Romania and Moldova should clearly define their positions on cryptocurrencies until is not too late.■

* For more basic details on cryptocurrencies, see A. M. Tanase – Cryptocurrencies – future of money? Published by Finance and Banking review – Profit no. 4 / April 2019 (English and Romanian).

Adauga-ţi comentariu