Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Joint venture banks: 50 years of complex evolutions

The expression of "joint venture banks" represented an innovation 50 years ago in Romania. As a matter of fact, the joint venture banks with Romanian and foreign capital, functioning both in the country and abroad were established starting with the second part of the XIX-th century, soon after the unification of Wallachia and Moldova Principates in January 1859. A more detailed look at the Romanian practice in this field is worthwhile to undertake. We hope that this modest endeavour to present the evolutions over the last five decades will add a new page to the history of the Romanian banking system, which was heavily tested over times*.The Republic of Moldova (Moldova in this article) has a shorter banking history due to the specific historic conditions in which the Moldovan state was created after the proclamation of country’s independence on 31 August 1991.

1. Early start of the Romanian joint venture banks abroad

The oldest Romanian bank, Bank of Roumania Ltd., was established in London based on an approval by Ruler Alexandru Ioan Cuza on 17 October and renewed on 20 October 1865. This was followed by many other banking societies with foreign and/or Romanian capital, amongst which Banca Franco-Romana established in 1914 as well. In accordance with the Enciclopedia României (Encyclopaedia of Romania), there were 222 banks in 1918 (including the National Bank of Romania - NBR). The Romanian banking system was dramatically changed during the First World War, without the ownership and organisation forms being altered. However, a more dramatic change was to come after the nationalisation of the main means of productions on 11 June 1948. Even NBR (the Romanian central bank) changed its name (quite a few times) and its structure, despite the fact that it was the central bank of the country, with the right to issue currency and to coordinate the monetary policy.

Despite the fact that the ownership and the political and economic system in Romania (meanwhile renamed as the Socialist Republic of Romania) were fundamentally different as compared with those prevailing in the developed countries, during the 1970’s, an attempt was made to build up a distinct/independent place within the socialist block of which Romania was part until the tumultuous events of December 1989. Without any exaggeration of the merits of the Ministry of Finance and of the National Bank of the Socialist Republic of Romania (NBSRR), the country became member of the International Monetary Fund (IMF) and of the World Bank Group in December 1972. This was a real major achievement of Romania’s international financial relations, a socialist country in those days. Romania’s example was followed by the former Czechoslovakia, Hungary and other communist countries.

Under such circumstances, Romania took bold measures for a communist country in the financial and banking filed as well. Manufacturers Hanover Trust (MHT), which changed its name to Chemical Bank and then again to Chase Manhattan, opened a branch in Bucharest, which at the time was the only Western bank in Eastern Europe. This will be followed soon by Société Générale, France. This is the historical context in which the Romanian Bank for Foreign Trade (RBFT) opened a few representative offices in London, Zurich and later in New York and Moscow, an act which was gradually followed with the opening of 5 external subsidiaries in the main international financial centres. A summary of these is presented in Table 1.

All these banks opened branches in Romania later on in order to attract local customers by offering them banking services at international standards and/or specifically designed based on their respective needs. In this respect, the first were BFR and FBB which opened branches in Bucharest, Sibiu, Timişoara and Constanţa. BFR was well received in Romania and internationally as it had a key role in supporting the Romanian exports, especially those of oil industry, foodstuff and light industry as well. The same type of activities developed FBB in the then West Germany. Misr-Romanian Bank had implemented specific activities for its geographical zone (Egypt), especially in specific project of economic international cooperation through financing of the building activities or by financing desalination plants for seawater.

2. Anglo-Romanian Bank Ltd., London

Amongst the joint venture banks mentioned above, Anglo-Romanian Bank Ltd. (ARB in short) established in 1973 in London will play a distinct role during these years. The initial capital of this bank was rather modest by modern standards (GBP 3 mln as subscribed capital, of which GBP 1.5 mln was originally paid-in). A great attention was given to this event with a discrete publicity and an understanding that at the highest level of the Romanian state this was implicitly known, recognized and accepted. The official newspapers of those years (Scânteia, România Liberă, Munca, Scânteia Tineretului and others) announced on 31 August 1973 that Sir Charles Leslie Glass, President of Anglo-Romanian Bank, together with Emil Radu, General Director of the newly established bank in London (see Fig. 1), were received at the Council of Ministries (the Government).

This opening was also announced to the international financial circles through some prestigious newspapers such as the Financial Times, The Times, New York Times, Journal of Commerce, the Guardian and others. This event was clearly seen as a remarkable act of the Romanian authorities.

It is worthwhile to note that in those days, the banks from Eastern Europe had a limited number of agencies in London (the former Czechoslovakia - Zivnostenska Banka, the former Union of Soviet Socialist Republics (USSR) - Moscow Narodny Bank (established since 19 October 1919) and also China - Bank of China and Cuba - Havana International Bank). Anglo-Romanian Bank Ltd., established as a joint venture with Romanian, American and British capital by the former RBFT (which was taken over by BCR and which subsequently became BCR Erste), Barclays Bank and Chase Bank started its activity at a prestigious address, namely Cunard House, 88, Leadenhall Street, London, in accordance with the Financial Times dated 10 July 1973. 3. The legend, the realities of the balance sheets and the end

3. The legend, the realities of the balance sheets and the end

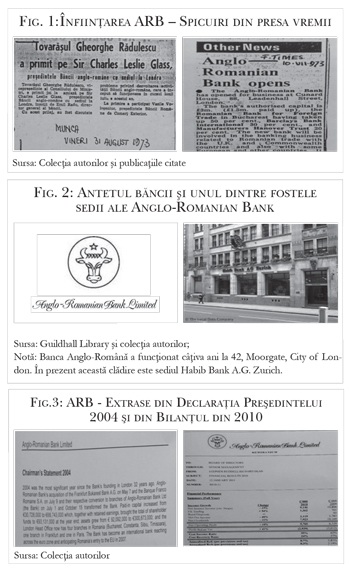

The logo of the bank presented in Fig. 2incites us to a short incursion on the fascinating land of legends. The buffalo’s head ("zimbru" or "bour" in Romanian) which served as logo for ARB has its historical origins in a legend according to which Bogdan came with a whole hunting processions in 1359 from Maramureş to the north of Moldova to chase the famous buffalo which was wondering in those magnificent lands. The legend has it that a little she-dog namely Molda, which followed Bogdan, was lost during the buffalo hunting, but her name survived up to today in the form of the name of a large region of contemporary Romania (Moldova). One other legend, this time published as poetry in the Revista Romană in 1861 by the great Romanian poet Vasile Alecsandri, is also telling us about a hunting in which, this time, Dragoş met a girl with the name of Moldova. They fell madly in love with each other and decided to settle in the territories which today form the Romanian Moldova. However, Dragoş had to fight a fierce buffalo which "stomped" all over Moldova. Dragos’s success following a fierce battle gave the buffalo a special status and designation of buffalo’s head as logo of the ARB was, we believe, an inspired choice. We also like to mention that the same symbol was also used in the most famous Romanian stamps issue (buffalo’s head or the famous "Cap de bour" editions in the Romanian language).

Anglo Romanian Bank developed in London an activity which was in support of the Romanian foreign trade with Great Britain and other geographical zones. Apart from this main activity, the bank performed also other more special activities which remarked themselves through the complexity level and professionalism which characterises the famous City of London. We are referring here to issuing of CDs (certificates of deposit) on its own account and on its own risk, discount and forfeiting international trade papers and to the participation of syndicated loans in various foreign currencies for banks or other bodies from very different zones such as Poland or former S.F.R. of Yugoslavia and from Cuba, Morocco or other countries from Central and South-Western Asia.

Other part of its activities was dedicated to buy-back on the secondary markets of some state-issued bonds (including those issued by Romania) at very advantageous prices due to initial scepticism of the international markets with regards to financial and banking sector standing in various countries of Eastern Europe. In the case of Romania, this was due to favourable evolutions and, first of all, due to the professionalism of the National Bank, which resulted in moving prices to higher levels as compared to the ones paid at acquisition. As a results, this had generated very good profits for the bank, for BCR as its key shareholder and, more generally, for the Romanian state.

By the end of ‘90, the Romanian Commercial Bank (BCR), the main shareholder of Anglo-Romanian Bank, purchased all other shares from the Western shareholders (Barclays and Chase Bank) and thus its capital became 100% Romanian owned. During 2004, the management of BCR took the initiative to merge its Paris and Frankfurt subsidiaries; the capital of the bank increased to almost €100 mln (the largest Romanian investment abroad of all times). Fig.3-right shows a short version of bank’s balance sheet in 2010, which in fact confirm the general statement of the President of the bank in his 2004 annual Declaration (see Fig. 3-left). Up to 2011,the bank continued to register important profits for both its activities in London, but also at its Romanian branches in Bucharest, Sibiu, Constanţa and Timişoara.

The management of the bank and that of BCR (now the only shareholder), together with the management of the NBR, informed the Romanian authorities over the years regarding the need to take actions to preserve this Romanian brand in the financial citadel of the world which is London and its famous City, a thing which would have implied a small cost of some GBP 50,000. However, in those days it was not possible to defeat the politicians’ inertia. As such, in 2011, after 38 years of activity in London, the bank was closed by its key shareholder which meanwhile became BCR/Erste. Unfortunately, the name and its logo (which were registered trade marks) were lost. The decision to close the bank was justified through commercial reasons which are related to the fact that Erste Group had already a branch in London at the time the Group became the majority shareholder of the former BCR in Romania.

Looking back, it could be said that ARB played an important role in promoting the Romanian interests, both during the socialist times up to December 1989 and during the transition period as well up to its closure. With the benefit of hindsight, looking back at the evolution of the joint venture banks ten years after their disappearance, one could say that during the transition period to a market economy many things from the socialist era were changed/abolished without, however, replacing them with anything else. Such a statement is also valid in ARB’s case, like in many other fields of activity. Keeping a Romanian bank with a valid licence in London (maybe with other Romanian shareholders, state-owned and/or private ones) would have been, no doubt, beneficial for the Romanian state.

But things have changed and life, with good and bad, goes on! This is also the case of Anglo-Romanian Bank which legally ceased to exist during the complex times of transition to a market economy, but its pioneering role in the banking field cannot be denied. The cruel irony is that Anglo-Romanian Bank Ltd. has been established during socialist times, based on capitalist rules, and was closed during capitalist times, based on rules with socialist connotations.

4. The case of the Moldovan banks

The first private Moldovan banks were established in December 1989, well before the dissolution of the former Soviet Union, such as the case of Commercial Bank Victoriabank. The licensed banks authorised to function in the former Soviet Union were re-registered after the independence declaration on 31 August 1991 and after the establishment of the National Bank of Moldova (NBM) as the central bank of the young Moldovan state. The large commercial banks such as Moldova-Agroindbank (currently renamed as "maib"), Moldindconbank, Banca Sociala and Banca de Economii were created through the taking over of the assets and liabilities of the former branches of the specialised former state-owned Soviet banks. Later on, these entered in various privatisation processes through which, together with the state, the clients of the banks, trade unions and/or the employees became shareholders. The result was that up to the last 4-5 years, the shareholding of the banks was much diversified. This was followed by profound changes in the Moldovan banking sector** (including by a fraud of large proportions) which led to the bankruptcy of the last two banks mentioned above and of many more private banks established during Moldova’s transition to a market economy.

The Moldovan banks did not have participation in joint venture banks established abroad. However, a distinct feature was in the case of those banks which had branches in the so-called Transnistrian Republic (unrecognised on international stage) and which, in fact, were under the jurisdiction of the Central Bank of Transnistria (Transnistrian Republican Bank). Taking into account the risks involved by the activities of such branches (they were usually very small by the size of their assets), the international financial organisations advised for their closure. This was finally decided by the shareholders of the respective banks which held such legal structures.

Today, eleven commercial banks are licensed in Moldova and their activities were properly monitored by the NBM. The structure of the shareholders for most of the banks which are currently licensed has fundamentally improved during the last 3-4 years. Moreover, some of the largest commercial banks are implementing measures to be listed on the stock exchanges in the largest financial centres of the world in order to further attract foreign investors.■

______________________________________________________________________________________________________

Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London and previously of the BFR Bank, Paris.

Alexandru M. Tanase, PhD, is an independent author and former Associate Director, Senior Banker at the EBRD and former IMF Advisor.

These are personal views of the authors and are not of any quoted institution (including, but not limited to, those of the EBRD, IMF, NBR and NBM or any quoted commercial bank). The assessment and data are based on available information as of early-April 2022.

______________________________________________________________________________________________________

* The full article signed by the same authors with the title of "Joint Venture Banks- 50 years of evolution" can be read in Magazin Istoric Revue no. 4/April 2022, Bucharest (in Romanian language).

** See in this respect Alexandru M. Tănase - The Birth of the Moldovan Banking Sector in the Republic of Moldova. The First Decade, in Magazin Istoric Revue no. 6/June 2021.

Adauga-ţi comentariu