Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

MAIB: 30 years of challenges, sustained efforts and successes

BC Moldova Agroindbank S.A. (MAIB) has a history of 30 years, during which period it has succeeded to consolidate its positions and creating a good brand name in the Moldovan banking market. All its actions during all these years have had as the target - to maintain its leadership role in the banking sector of the Republic of Moldova (Moldova in this article). The fact that MAIB had evolved from total assets of 28.9 bln of Soviet roubles as of end-1991 to €1.45 bln as of January 2021 shows the potential of this bank. As it turns 30 years, MAIB is not only happy with the results so far, but it is ready to continue to focus its efforts to further consolidate its leading position based on organic, efficient and healthy growth.

During a discussion in the financial circles in London, in which I took part during the early days of transition, the leader of a commercial bank from a country which already started its transition, after the Soviet Union dissolution in 1991, was asked if the bank which he represented had a history which would allow a qualification as a good partner. The President of that bank responded very proudly that the bank he represented was established three years ago and that it had good results. The leader of the British team which was present at the negotiations smiled with some benevolence and responded that generally speaking the British banks had historical records of some 150-300 years. However, the fact was that nobody knew at the time how the transition will actually take place from the socialist system to a market economy and how long will take such a process. The definitive answers to these questions were never found even as of today, so the firmness of the President visiting London in those days was in a way justified by the subsequent events. A period of three years for a bank just established on the ruins of the Soviet banking system was in a good way equivalent to several decades of banking activities in a stable country as it was, for instance, the United Kingdom of Great Britain and Northern Ireland.

The establishment of the bank

The case of MAIB, bank No. 1 in Moldova, is similar to a certain extent. This bank officially started its activity on 8 May 1991. MAIB was established through the reorganisation of the regional divisions from Moldova of the Agroindustrial Bank of the former Soviet Union. Moldova inherited the branches/regional divisions of the former state-owned specialized banks of the Union of Soviet Socialist Republics (USSR), amongst which it was also the bank for foodstuff industry and cooperative trade. During those years, the accounts of the public/state budget, including the financing of the budgetary sector, were opened with all these banks. Apart from MAIB, the activity of these state banking divisions was taken over by another two commercial banks (joint-stock companies) following the Government of Moldova's Decision dated 8 May 1991. During the first few years, the banks resolved the question of the state patrimony which was attributed to them. The new banks were soon developed as universal banks. Also, initially, these banks were established as closed joint-stock companies. However, in 1997 legislative changes were introduced, according to which these banks were transformed into open joint-stock companies.

On 27 August 1991, Moldova declared its independence and the National Bank of Moldova (NBM) was established a little bit earlier on 4 June 1991. On 29 November 1993, Moldova introduced its currency (the Moldovan leu). All former Soviet and Russian roubles and the Moldovan coupons were thus eliminated, an event which will have profound implications on the commercial banks, including on MAIB.

As of end-1991, MAIB started its transition with a balance sheet of 28.9 bln of Soviet roubles. The accounting standards used by MAIB in its early days were those inherited from the former Soviet Union. The secretarial works and the correspondence, including those related to interbank payments and all basic banking terms were conducted in full in the Russian language. The introduction of the banking terms expressed in the Romanian language was a difficult and long process, in which, starting in 1993, the international financial institutions (EBRD, IFC, IMF etc.) had played a major role. MAIB had subsequently started to gradually implement modern accounting principles and international auditing. Looking back, one could say that MAIB had succeeded in a short period to integrate itself into the international banking system, although its expertise was rather limited in the very beginning.

The road from this very modest beginning to what is MAIB today was long and full of hardships and the merit of the bank is even greater as this healthy organic growth took place in an extraordinary complex geopolitical context. Moldova was and in a way still is at a "crossroads", placed by its historic destiny on a spot where the big geostrategic interests from East and West are still disputing their priorities and purposes.

Photo: The signing of the first transaction with EBRD in 1995. From left to right: L. Dumitrescu, V. Bădrajan, R. Freeman, G. Furtună, X. Dedullen, N. Vrabie, B. Balthazar, D. Hexter and A. Tănase - August 1995.

Opening to the external world

The first MAIB’s contacts with the international financial institutions were initiated and led in March 1993 by Mr. Grigore Furtună, the President of the MAIB in those days and by Mrs. Natalia Vrabie, the then Vice-president of bank. MAIB’s intention to cooperate with these institutions, among which, in the first place, the European Bank for Reconstruction and Development (EBRD) was genuine and had finally led to good results. However, from the very beginning, there were quite a few things that needed to be resolved. The first conditionality was regarding the accounts of the bank which needed to be audited by a reputable international auditor. There was a need to understand the whole financial status of MAIB, especially more so that the main item of its balance sheet was “Other assets”. The rouble denomination was yet another matter which was quite difficult to resolve. The first achievements in this respect were obtained by September 1994. This was the moment when the preparations started for the first credit line of $20 mln, finally granted in August 1995 (see photo). This credit line was fully utilised and 35 Moldovan companies had benefited from the funds made available to them.

The start was difficult but spectacular at the same time. Under the leadership of Mrs. N. Vrabie, which was promoted as the President of the bank, many other credit facilities and technical assistance were granted to MAIB by the EBRD and other international financial institutions such as International Finance Corporation, European Investment Bank, Black Sea Trade and Development Bank, Council of Europe Bank etc. In addition to the first credit line, EBRD has granted, for instance, financing for SMEs, including a special loan dedicated to the micro-sector, a subordinated convertible loan, an energy efficiency loan for private industrial companies and another one for the residential borrowers, and a line which was intensively utilised for granting trade instruments (TFP). EBRD was also the promoter on the external markets of the Moldovan wines through a special credit line and also participated together with MAIB and Horizon Capital in the financing of the Glass Container Company (GCC) Chisinau. The granting to MAIB of facilities has continued up to the most recent credit line extended in 2020. At the same time, EBRD was present in the equity of the bank up to 2005 and subsequently from 2018, which has facilitated the transfer of banking and institutional know-how to MAIB.

Temptations avoided and transparent shareholding

During the three decades of its existence, MAIB had prudent executive managements. This was a key factor in avoiding the great Moldovan banking fraud of $1 billion during 2012-2015, a unique event in the banking transition history in view of its grave circumstances. Similarly, the bank had managed to avoid the temptation of the “Russian laundromat”, which was possible in the context of grave deficiencies in the juridical system and in the banking supervision which was meant to be exercised by the NBM. There are many lessons learnt in both cases (not only for the commercial banks in Moldova or the central banks) and the cooperation with the international financial organisations was instrumental. The constant efforts to increase the transparency of the bank’s shareholding have finally yielded results. From 2018, the key shareholder became HEIM Partners Limited (with 41.09% of voting power). This is an international consortium of investors.The local shareholders (of which many are those who invested in the bank from its very foundation) continued to be present and very active.

Historical results

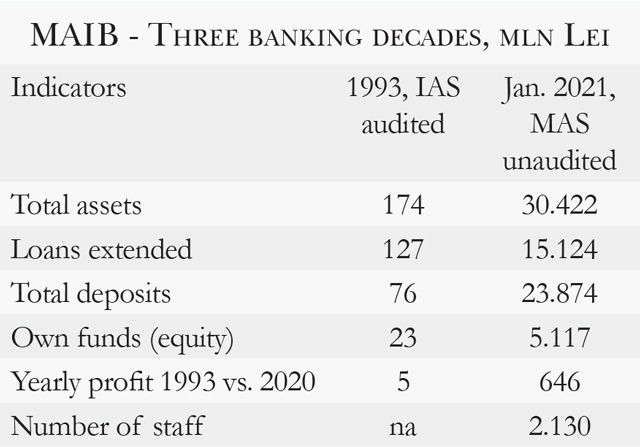

Through the sustained efforts of both the Supervisory Boards and the executive management, led successively by Mr. G. Furtună, Mrs. N. Vrabie and Mr. S. Cebotari (all of them as Presidents)and of the whole staff of the bank along the three decades of existence, MAIB has managed to increase its assets, total equity, number of clients, loan portfolio and attracted deposits. MAIB was declared 15 times, including in March 2021, by Global Finance as the best bank of Moldova. Synthetically, according to the published data, the results of the 30 years of transition of this bank could be summarized as follows:

MAIB has evolved from total assets of 28.9 bln of roubles as of end-1991 to €847 mln as of end-2015. The net profit of that year, which marked the 25-th anniversary of the bank, was of €17.6 mln. Under the leadership of the third President, Mr. Serghei Cebotari, as of end-January 2021 (when he finished his mandate), MAIB’s total assets had reached MD Lei 30.42 bln (€1.45 bln), and the net profit registered the last year was of MD Lei 646 mln (€30.5 mln). This was a performance under the current circumstances.

MANY HAPPY RETURNS! For the first 30 years!■ A message at the 30-th anniversary: For the results recorded during the three decades of a tumultuous transition, MAIB deserves the most sincere congratulations. Many Happy Returns! Three decades during the transition period could easily be compared with hundreds of years of banking evolutions in the developed and traditional capital markets. However, many more challenges lie ahead, even more so under the current conditions in which the health security of the entire planet, including that of Moldova, is not yet assured. The contribution of the bank to the economic relaunching of the country is clearly needed and international cooperation, including with the international financial organisations, should be an integral part of the bank’s strategy. I wish MAIB to have even greater achievements during its fourth decade!

A message at the 30-th anniversary: For the results recorded during the three decades of a tumultuous transition, MAIB deserves the most sincere congratulations. Many Happy Returns! Three decades during the transition period could easily be compared with hundreds of years of banking evolutions in the developed and traditional capital markets. However, many more challenges lie ahead, even more so under the current conditions in which the health security of the entire planet, including that of Moldova, is not yet assured. The contribution of the bank to the economic relaunching of the country is clearly needed and international cooperation, including with the international financial organisations, should be an integral part of the bank’s strategy. I wish MAIB to have even greater achievements during its fourth decade!

Adauga-ţi comentariu