Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Supervisory boards of commercial banks - How to make them better management tools?

Over the recent years, the corporate governance of the banks in Moldova suffered as the political influence was evident. Even more, in some cases banks have been materially abused by some of the key shareholders with the final results of their bankruptcies and subsequent liquidation. So far, sixteen banks have been liquidated or are under liquidation procedures. The supervision of the National Bank of Moldova was not to the highest standards up to March 2016 when a new Governor was appointed. Measures are now being implemented to correct the dire cases in the banking sector and the suggestions below are meant to help in this titanic work which is being undertaken by the NBM and commercial banks themselves, with the support of the international financial organisations.

I. Legal and statutory requirements

The two fundamental laws which prescribe the legal requirements for the National Bank of Moldova (NBM)’s activities (as the central bank) and for the commercial banks in the country are: a) Law on joint stock companies (Legea nr. 1134 din 02.04.1997 privind societăţile pe acţiuni) published in Monitorul Oficial in 1998 (as updated); and b) Law on banks’ activities (Legea nr. 202 din 06.10.2017 privind activitatea băncilor) published in Monitorul Oficial in 2018 and in force since 1 January of this year. The first law which deals with all joint stock companies (including banks) was changed repeatedly since its approval in 1997 which illustrates the efforts made by the Moldovan authorities to create and adjust a flexible environment conducive for good and sound activities by the commercial banks. Unfortunately, the numerous changes to the applicable law were not always based on the best principles of good corporate governance and, in practice, they did not help to create a very certain banking environment. The second law is very recent and its practical application should be tested first, but prime facia it seems to be drafted and approved with the clear objective of cleaning the banking sector of the disastrous consequences of the mis-management up to March 2016 when a new Governor of the NBM and a new senior managerial team were appointed. There are good hopes that the implementation process of the updated old law and of the recent new one will bring positive results, especially in a context in which the supervision of the NBM will be proper and effective. The suggested recommendations below do not necessary require further changes of the current legislative framework in all cases, as some of them could be incorporated in the relevant regulations/norms and guidance issued by the NBM in accordance with its role of the central bank of the country. In other cases, the recommendations could be simply incorporated in the commercial banks’ statutes/charters/bylaws and/or internal acts or introduced as best practices of corporate governance.

II. Real life and need to improve current practices

As Jack Welch, the former Chairman and CEO of General Electric between 1981 and 2001, put it: ″A leader's role is not to control people or stay on top of things, but rather to guide, energize and excite″, the quality of a Supervisory Board (SB) and its leadership will be proven by its vision, its ability to implement a rightly chosen strategy, integrity and the magic of convincing, together with the Executive Management, all the peoples in a bank to pull in the same direction and at the same time to accomplish the dedicated mission. Not all the Supervisory Boards (Council (Consiliul) or Council of Administration (Consiliul de Administratie) or Supervision Council (Consiliul de Supraveghere), as they are known in many charters and in real life) of the former and current commercial banks in Moldova would have met such high requirements. The reasons for this are multiple and some of them are even difficult to understand. Therefore, a closer look at key components, features, context and roles is warranted.

2.1 Few statistics and current gaps

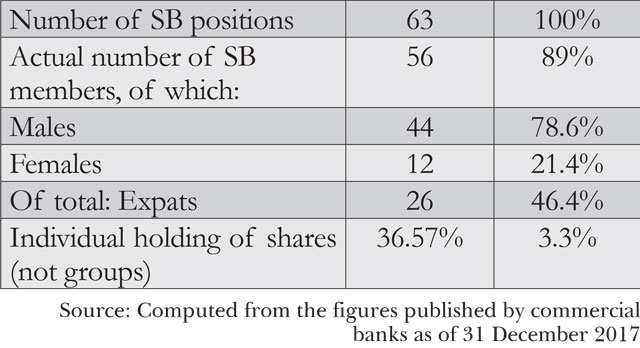

To start with, an overview of the current situation of SBs of commercial banks in the country is worthwhile as the cases could not be more diverse, as presented below:

It is quite clear from the figures above that not all SBs of the commercial banks in Moldova are complete which could be a serious cause for concern. Moreover, the gender gap which is a hot topic nowadays in Western societies is extremely high, with the number of males being three times higher than that of female SB members. Recent studies showed that diversity on SBs adds value. Also, the case for more expats (with their valuable international expertise) could easily be made. These gaps should be dealt with without delays by NBM and the commercial banks themselves.

2.2 Members of high professionalism and integrity

High professionalism and integrity are minimum standards, but there were many recent cases in Moldova in which these two fundamental requirements were not observed and the eventual results of such non-observance are well known. A transparent selection of the proposals for a Director position in a Supervisory Board is a very basic pre-condition to ensure that such Boards will perform. If we are looking retroactively at the recent practice in the country, one can easily detect cases in which vested interests were prevalent in preparing the proposals to be put forward to shareholders’ vote. The most recent cases of Banca de Economii, Banca Sociala and Unibank need no further presentation as the breaches of corporate governance, sound banking principles and high integrity were too frequent and too gross not to be observed. The supervision of the NBM failed until March 2016 when a new Governor was appointed and started to implement adequate measures to correct such an unprecedented situation. Tedious task lies ahead for the regulator to bring the whole banking sector to excellent standards as required by a good corporate governance. The new Moldovan law on commercial banks’ activities introduced in 2018 one additional concept in addition to banks of ″significant″ importance, namely that of ″honesty″ for SB members. This is very important, but in our understanding ″professionalism and integrity″ would include ″honesty″ as well. In all commercial banks, the SB members should sign and act in accordance with a proper Code of Conduct.

2.3 Elections of SBs and approval by the NBM

Many jurisdictions rightly offer great flexibility regarding the elections of the members of the Supervisory Boards. In most of the cases, what is of paramount importance is the support of the shareholders, especially in those cases where the strategic investors aim to elect their own representatives in the SBs of the commercial banks where they have invested considerable amounts of money, human resources and credibility. The cases of large strategic investors such as SocGen, Erste, Banca Transilvania (together with the European Bank for Reconstruction and Development) and Gruppo Veneto Banca SA (all present in Moldova) and others are well known. In all cases, the proposed members to be elected as Directors should have their respective Curriculum Vitae submitted in advance to all their shareholders, with a clear emphasis on their experience on running commercial banks or key companies in other related fields. Also, the proposed Directors should publish their own Statement of Desire to Serve, expressing their agreement to stand for elections and, more importantly, presenting their strategic visions on the future evolution of the banks. In Moldova (as well as in other countries to be fair), these are not requirements of the laws mentioned in Chapter I, but they should be at least part of very good practices.

Moreover, a more difficult case is that of the minority shareholders which many times act in an uncoordinated manner and do not manage to elect their own representative(s). The situation is even more stringent when the number of members of the Board is rather small (5-7 members). In such cases, to elect a Board member such groups of small shareholders need to gather at least 12.5% plus one share to be able to elect their nominee (if the total number is of 7 members, for instance). In reality the group of minority shareholders are in many cases (almost in all banks in Moldova) composed of hundreds and hundreds (in some cases thousands) of individuals holding anything from 1 share to maybe 0.1% of total voting shares. Although they have the right to participate in the debates of the General Meetings of Shareholders (be they the annual or extraordinary ones), in reality when it comes to voting power they do not manage to elect somebody to properly represent them or to pass decisions proposed by this group. The legislation should grant them more protection from this point of view or the same legislation should be more demanding regarding the ″independent members″ of the Boards. This will be in accordance with the good banking standards and the requirements of healthy corporate governance which should be a must in all countries, including Moldova.

In accordance with the law, the NBM plays a key role in approving the elected members of the Boards. In the past, this function was not always exercised properly by the NBM. The approval of the Board members (in one case (Banca de Economii) even of the Chairman) by the NBM was done in an opaque manner and as a result the respective bank is now under liquidation and the respective person is a key mention in Kroll-2 Report handed over to the NBM and the National Anti-Corruption Centre in December 2017. This is, of course, one of the most striking case, but in the past there were some other similar mistakes. The example of former Investprivatbank would be sufficient to reinforce the statement above.

2.4 Agendas

Prima facia, the selection of the topics to be discussed by the Supervisory Board must be a simple task, but such a statement is all wrong. It is true that determining the agenda in Moldova, like in other countries such as Serbia, Romania and FYR of Macedonia (to cite a few examples only), is sometimes a matter of obeying the legal requirements, incorporated either in the law or in the requirements of the NBM. For instance, the consideration of the annual financial unaudited or audited statements (balance sheet, profit and loss account and cash flow) is a strict requirement which is a must for all commercial banks. However, the ability of the Supervisory Board to focus on additional topics such as the strategy and policies of the bank, the competition in the market, the quality of human resources and the measures to improve the moral and enthusiasm of the staff, to mention just a few, are of similar importance. In some banks in Moldova, the Secretary of the Supervisory Board was formalised and there are adequate provisions in the charter. The Chairman of the Bank, together with the CEO and the Secretary, should act in a very coordinated manner to select the best items for consideration by the Board. This has not always been the case so far. Even more, there were cases in which they acted like enemies reaching the Moldovan courts aiming to suspend or paralyze the activity of the Board. This is unheard of, unprecedented and by no means would it be in accordance with good corporate governance. The law should be improved as soon as possible to avoid such situations for good. The role of the NBM should be enhanced with real powers to act in such damaging cases and restore the proper functions of the Boards.

2.5 Meetings

As mentioned in Chapter I, the classical provisions of most charters are that the Supervisory Board will meet as and when necessary, but at least once in a quarter. In some other cases, the frequency is more stringent with a meeting required on a monthly basis. This will raise the issue of the costs of having monthly meetings by the Board, especially where the Board meetings are attended by expats which need to have the travelling costs and accommodation covered (on top of their fees). Again, the Chairman and the Executive Management should exercise good judgement in calling the meetings. On the other side, the need for approval of large transactions as prescribed by the charters is evident, which will inevitably required more meetings. With the electronic means of 21st century, it is recommended that some meetings are organised by correspondence (fax, e-mail, skype, video conferences and the likes) so that the operativity and flexibility is ensured. The international experience also vetted the practice of having the documents submitted for the Board’s approval by the lapse of time which needs to be experimented in Moldova as well. The role of the Secretary of the Board is obviously of more and more importance and this very aspect should be properly reflected in the Moldovan legislation and implicitly in the charter of the commercial banks.

2.6 Running the ″Show″

One of the key prerogatives of the Chairman of the Board (or of the Vice-Chairman, in his/her absence) is to smoothly and efficiently run the meetings of the Board and of the General Meeting of the Shareholders (unless otherwise decided by the shareholders present at such meetings). Unfortunately, this has not been the case in many instances in Moldova. The Chairman is required to show professionalism, tact and skilfulness in organising the meetings. Many times, the advance discussions with the key shareholders and/or with the frustrated minority shareholders could bring positive results in this respect. This is not regulated by the Moldovan law and/or by the charter of the banks, but it proved to be a good practice. The international experience should be fully ″imported″ with the benefit of efficiency in mind. Nevertheless, the  Chairman should allow the shareholders to express their views, even to vent their ″furies″, but this should be done in an organised manner so that the quality of the respective meeting is well above the standards. From the previous experience, it was observed that the presence of good lawyers in the Board meetings (as invitees and/or even as full members) and at the General Meeting of Shareholders could be full of benefits in taking appropriate and legal decisions. This should be more encouraged in all banks and a positive impact will surely be visible. Proposals/suggestions/critics should also be encouraged in the interest of transparency which should be amongst the major goals of any democratic management tools such as the Board of any banks in Moldova.

Chairman should allow the shareholders to express their views, even to vent their ″furies″, but this should be done in an organised manner so that the quality of the respective meeting is well above the standards. From the previous experience, it was observed that the presence of good lawyers in the Board meetings (as invitees and/or even as full members) and at the General Meeting of Shareholders could be full of benefits in taking appropriate and legal decisions. This should be more encouraged in all banks and a positive impact will surely be visible. Proposals/suggestions/critics should also be encouraged in the interest of transparency which should be amongst the major goals of any democratic management tools such as the Board of any banks in Moldova.

2.7 Avoiding conflict of interests

This is crucial. The disastrous fate of the three Moldovan banks under liquidation since November 2015 might have been avoided if the basic principle of avoiding transactions with conflict of interests would have been observed. But they were not! Vested interests led to the historical fraud of USD 1 billion (or perhaps even more, still under clarification) and this was done with the implicit support of the respective Supervisory Boards. They simply failed or, even worse, colluded. Lessons should be learned and measures to recover the missing funds should be implemented without any delays. Kroll-2 Report will be a handy instrument in this mammoth task. The supervision power of the NBM should be reinforced to make sure that this will not happen again.

2.8 Remuneration and responsibilities

The professionalism and high integrity of the Board members should be properly remunerated (though not excessive) as they are taking high personal risks in supervising and guiding the banks. If they are not properly remunerated they will be prone to mistakes which could have far more serious consequences. The attitude of the shareholders that they should not be paid too much is wrong and the opportunity to attract talented, dedicated and qualified members will be wasted. Of course, any Supervisory Board should be a cost-effective body itself and should supervise the cost-effectiveness of the bank. An effective Remuneration Committee of the SB, as prescribed by the 2018 law, will be of great help in real life. On the other side, the respective members should be clear on their responsibilities (individual and/or collective) when they accept to stand for elections and, if elected and approved, when they exercise their duties. All these are not adequately des-cribed in the law or in the charters of the banks and not made clear enough in Moldova, a situation which needs to be corrected. Mass media could play a very useful role in this respect. Education in universities is actually the starting point in this endeavour.

2.9 Minutes and follow-ups

Sometimes, the usefulness of minutes of Board’s meetings is not properly recognised. This attitude is full of perils as the minutes should be a precious collection of decisions/positions/guidance from the Boards to Executive Management and staff of the banks for their day-to-day activities. The charters of some banks in Moldova should be clearer in this respect. The Chairman and the Secretary of the Boards are directly responsible for this task and a proper performance will protect them (sometime even in courts).

III. Some concluding remarks

While the updated and newly approved legislation for commercial banks’ activities are in reasonable good shape, the actual practice has not been and it is not yet in all cases up to the required standards of excellent corporate governance. Therefore, the law should be further refined. It may well be that technical assistance is still needed, including the support of the International Financial Institutions, especially in the cases of some ″significant″ banks where an important part of the shares held by non-transparent shareholders were ″restricted″ by the NBM and are currently for sale to qualifying investors. There are continuous efforts undertaken by the central bank and by the banks themselves to identify and attract appropriate strategic shareholders which could bring more capital, excellent experience, good reputation, extensive banking knowledge and good corporate governance. The recent case of Banca Transilvania buying shares of VictoriaBank is an encouraging example and a proof that this is not an ″impossible mission″. Of course, it is not going to be easy, but after all what is easy in life? It is the task of the NBM and of the 11 active commercial banks to enhance their efforts to bring the Moldovan banking sector to higher standards of good corporate governance and, in this case, sooner is the better.■

Adauga-ţi comentariu