Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Remittances: Romania and Moldova - A short parallel

In a previous article (see A. Tanase - COMMENT: Remittances bring large be-nefits and dire consequences) published in English by BNE Intellinews, London on 21 May 2018* the great benefits which are brought in to recipient countries were signalled, but also some macro-economic consequences of them, which, in some cases are alarming. The conclusions of that article are more valid today than ever.

Many emerging countries/countries in transitions from Europe and world wide receive on an annual basis billions USD/EUR as remittances from their citizens who decided to emigrate and work abroad. This is also the case of Romania and that of the Republic of Moldova. Remittances have had and most likely will continue to have a major positive role in the formation of the Gross Domestic Product (GDP), to a greater or to a smaller extent depending on the individual features of each country, the dynamic of foreign currencies flows, the structure and the size of the sender groups, more or less permissive regulations from the host countries and many other historical, logistic, banking and socio-cultural factors. Both the Romania's case and that of the Republic of Moldova are interesting from many points of view. A short parallel between the two countries is worthwhile to be made.

Romania has faced a massive exodus of its population after the December 1989 revolution. There are currently no official published figures regarding the number of Romanians who have emigrated starting with 1990, but, according with some estimations made by analysts dealing with the Romanian economy issues, some 5 millions Romanians are currently living abroad. The number is impressive. The Romanian mass media even speaks of the largest migration during peace times from a single country. A comparison with Syria is often made and it puts Romania in an awkward position.

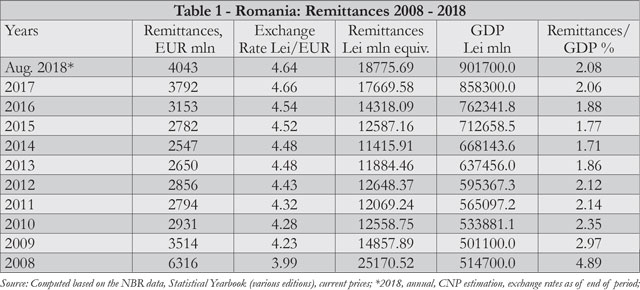

But what is even more alarming is the structure by ages of this massive group of Romanians. It is mainly about young peoples. This simple fact has dramatic macro-economic repercussions as it was presented in the article mentioned above. And more worrisome is the current trend in which many young peoples are leaving Romania as soon as they finish their high school studies. To go abroad to study is not something negative in itself (in the history of this country this has happened permanently, with the greatest national poet Mihai Eminescu himself being an intellectual product of an education made abroad), but the fact that most of them are not returning home anymore is the most dramatic situation. There is, of course, a favourable macro-economic impact derived from these transfers. Table 1 below is very illustrative. During the last decade, on an annual average basis, Romania received some EUR 3.4 billion as remittances. Their contributions to the Romanian GDP formation since Romania's membership to the European Union (EU) (on average of 2.35%, included as the last column of Table 1) has no need for any further presentation, especially in the specific case of this country which has accumulated a very large foreign debt (EUR 98 bln as of 30 September 2018).

There is, of course, a favourable macro-economic impact derived from these transfers. Table 1 below is very illustrative. During the last decade, on an annual average basis, Romania received some EUR 3.4 billion as remittances. Their contributions to the Romanian GDP formation since Romania's membership to the European Union (EU) (on average of 2.35%, included as the last column of Table 1) has no need for any further presentation, especially in the specific case of this country which has accumulated a very large foreign debt (EUR 98 bln as of 30 September 2018).

On the other side, what should be also a concern for the Romanian authorities is the trend of this foreign currency inflow. The graph below is quite illustrative for a very concerning situation. These remittances go visibly downward year by year (with some small exceptions), and the strategic analysis of this trend is not optimistic either. The foreign currencies inflows from abroad will continue to decrease because of a multitude of factors. The economic and geo-political situation of the host countries is just one of these factors. More recently, starting with March 2019, the exit of the Great Britain from the EU will have a clear negative impact on the remittances inflow for the Romania's balance of payments.

It is fair to note that the share of Great Britain is not a major one within the total volume of received remittances, but currently, the Romanian minority is one of the largest and very active in the United Kingdom (UK). The future of these Romanians in UK is not certain for the time being. An eventual UK hard exit, without any corresponding agreements will have negative consequences on the foreign currencies remittances sent to Romania. Moreover, apart from the direct impact on remittances, the Brexit will have one even more dramatic consequence as compared to the first impact mentioned above. Practically, depending on the final concluded agreement, the EU will have in its EU budget less GBP 8.6 bln, which represents the annual net contribution of the Great Britain. The natural consequence will be that the EU funds will decrease and the access to the structural funds of the new members, amongst which Romania is one, will have to decrease accordingly.

Up to now, Romania did not manage to absorb the structural funds which it was entitled to because it did not submit projects to EU as, for instance, Poland and Slovenia did. The great infrastructure projects which are badly needed by Romania did not receive the required attention. Until now, the priorities of the Romanian Government were more related to justice field than to the country's infrastructure and attraction of investments.

The case of the Republic of Moldova is even more interesting. First of all, the community of Moldovans living and working abroad is estimated to some 1 million persons, which relative to the demographic dimensions of the country is very closed (relatively speaking - some 22%), to that registered in the case of Romania, but a very large segment of this group of Moldovans lives in the Russian Federation and other CIS states, which is not the case of Romanians as well.

Moreover, during the last 10 years, the Republic of Moldova has received from abroad an annual average of some USD 1.3 bln. This foreign currency inflow has contributed to the Moldovan GDP formation in a proportion of some 20%, as presented in Table 2. The annual average during the period of 2008 - September 2018 was of 19.78%, which is one of the highest such macro-economic ration, not only as compared to Romania, but even on international level! What is more worrisome in the case of the Republic of Moldova, in fact like in the case of Romania, is the decreasing trend of remittances registered over the last years as compared to the mid-2000 years (the year with the highest level was 2008). The great banking and financial crisis in the aftermath of Lehman Brothers' bankruptcy on 15 September 2008 influenced in a very clear manner the international flow of money, including the flow of remittances to Moldova (and/or to Romania). This was the largest bankruptcy case in the USA history in which over USD 600 bln banking assets were involved, but the actual crisis was triggered in fact by the poor quality mortgages granted in USA by the commercial banks, including by the governmental agencies (sub-prime mortgages).

What is more worrisome in the case of the Republic of Moldova, in fact like in the case of Romania, is the decreasing trend of remittances registered over the last years as compared to the mid-2000 years (the year with the highest level was 2008). The great banking and financial crisis in the aftermath of Lehman Brothers' bankruptcy on 15 September 2008 influenced in a very clear manner the international flow of money, including the flow of remittances to Moldova (and/or to Romania). This was the largest bankruptcy case in the USA history in which over USD 600 bln banking assets were involved, but the actual crisis was triggered in fact by the poor quality mortgages granted in USA by the commercial banks, including by the governmental agencies (sub-prime mortgages).

The share of remittances received by Moldova from UK is not very high either (some 6% as of 30 September 2018), but Brexit's impact on the country will be felt in any case. Taking into account that Moldova is not an EU member or a member of Schengen space, it is possible/probable that the negative impact will be higher and of a longer duration than the simple share presented above. The post-Brexit monetary flows will not be the same and the situation of Moldova's external debt is more stringent than in the case of Romania. As of 30 June 2018, Moldova has accumulated an external debt of some USD 7.1 billion, which is more than 100% of country's GDP (see Table 3). However, as in the case of Romania, the Moldovan authorities did not pay the required attention to this topic. The parliamentary elections to be held in February 2019 should have brought already into debates this very issue which could be vital for the entire country and its citizens, irrespective if they are residents of Moldova or are temporary living abroad.

The Next Immediate Steps

The Romanian authorities should analyse carefully and into much details the Brexit's impact, for both cases (Deal, probable - No Deal, less probable), including on the remittances. A new strategy for long term is required taking into account the two trends which concern the future, namely the decline of remittances and the decrease of the structural funds from the EU. Romania is in need of immediate investments in infrastructure, education, health and other sectors (IT industry, for instance). This country needs also immediate measures to stop the emigration of its active labour force.

Even more, the demographic structure of population from both Romania and Moldova as well shows a rapidly growing ageing. The ageing demographic indicator has increased. In an interval of 15-25 years from now on, the lack of labour force will become more stringent and will be of a chronic nature if one takes into account the young people exodus. One of the top priorities in the case of both countries should be, for instance, implementation of a real and efficient cadastral system, introduction of a fair taxation scheme for properties and granting land to those who wish to hold agricultural land (Romanian and respectively Moldovan citizens, resident of their own countries or even from abroad if they wish to return). The young labour force will become increasingly difficult to find, therefore, the family farms will be certainly a valid solution. Both Romania and Moldova are in need of fundamental changes starting at the society base. The American model, for instance, was based on the sharing and granting of land to farmers and up to nowadays the American farmer has thus been the cornerstone of the USA. At the same time, it would be ideal that both countries implement measures to attract back the former compatriots who have accumulated some capital and know-how while in the developed countries. The return of the Romanians and Moldovans who left to live abroad was promoted by mass media only, not by the authorities themselves. Therefore, the cases of those who returned home were just a few and even fewer were the successful ones (many has left again).

At the same time, it would be ideal that both countries implement measures to attract back the former compatriots who have accumulated some capital and know-how while in the developed countries. The return of the Romanians and Moldovans who left to live abroad was promoted by mass media only, not by the authorities themselves. Therefore, the cases of those who returned home were just a few and even fewer were the successful ones (many has left again).

At the same time, in the case of both countries clear steps should also be undertaken regarding the consolidation of the remittances flows at least at the levels registered in 2017-2018, without which the economic growth and the living standards will be certainly affected. The fiscal stimuli, amongst which the non-taxation of the money gained abroad, should be granted to those who receive money from abroad so that they can save and invest it, with the help of commercial banks and of the EU (as the case may be), in private small and medium-size companies (SMEs). The design of a full set (multi-dimensional and multi-sectorial) of measures for an immediate and long-term counter-act of the negative impact, by each of the two countries, in dependence of the specific features of each of them, by the Governments and authorities of the respective countries, is not premature at this stage. On the contrary.■

*The full article is available at http://www.intellinews.com/comment-remittances-bring-large-benefits-and-dire-consequences-141733/?source=moldova

_________________________________________________________________________________________

Adauga-ţi comentariu