Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Macroeconomic and social aspects in some European emerging markets

Almost 30 years ago, in December 1991, a famous Romanian comedian and university professor Dem Radulescu, played in a monologue called Milogu’, famous now for depicting the difficulties of ordinary Romanians during the transition period of the 1990s that were even worse than in the aftermath of the dramatic events of December 1989. The economic and social Romanian system did practically collapse without being replaced by another system that was supposed to offer employment and social protection to large groups of Romanians which never been confronted with the market economy issues.

Almost 30 years ago, in December 1991, a famous Romanian comedian and university professor Dem Radulescu, played in a monologue called Milogu’, famous now for depicting the difficulties of ordinary Romanians during the transition period of the 1990s that were even worse than in the aftermath of the dramatic events of December 1989. The economic and social Romanian system did practically collapse without being replaced by another system that was supposed to offer employment and social protection to large groups of Romanians which never been confronted with the market economy issues.

This crash had brought fundamental changes in society. It was hoped that the transformation from a super-centralised economy to a market one will be done in a short period (to this effect see the Roman Government Program published in 1990, which was criticized at the time as unrealistic, in which it was estimated that the transition will be completed in approx. 2 years), which was of course wrong. From some points of view, many of the former socialist countries (currently labelled by the International Monetary Fund (IMF) as being emerging and developing markets) are still in the transition period even now three decades later since the start of these macroeconomic and social unique, but fundamental at the same time, transformations. In the above-mentioned sketch whose text was written by Dan Mihaiescu, (see Fig. 1), the great actor presented (maybe without intention) macroeconomic and social aspects of great relevance up to nowadays. Attentive and more detailed scrutiny is worthwhile to understand what was wrong during the transition to a market economy and if something could have been done differently (it is true, with the benefit of hindsight). The cases of Romania and Republic of Moldova (Moldova in this article) are especially illustrative for this whole transition process.

In the above-mentioned sketch whose text was written by Dan Mihaiescu, (see Fig. 1), the great actor presented (maybe without intention) macroeconomic and social aspects of great relevance up to nowadays. Attentive and more detailed scrutiny is worthwhile to understand what was wrong during the transition to a market economy and if something could have been done differently (it is true, with the benefit of hindsight). The cases of Romania and Republic of Moldova (Moldova in this article) are especially illustrative for this whole transition process.

One of the first challenging issues for transition countries was inflation. In many cases, as it was also the case of Romania, during the starting periods of transition, the countries from Central and Eastern Europe and the former republics of the ex-Soviet Union, registered rampant inflation or even hyperinflation. For instance, the consumer price index for Romania was at the level of 223% in 1991, 199% in 1992 and 296% in 1996 (end-of-period). The beggar played brilliantly by Dem Radulescu wanted by the end of the respective day "in office"/of begging, to buy „250 grams of mauve salami". With the little cash collected (small coins), he believed for a start that his money will be enough, but soon realised that the rapid increases of prices could be a significant issue for him. To quote the actor again: Let me see if what I have will be enough "as in the morning it was 460" (for a kilogram, in old prices, of course), "at 10 it was 530, at 12 – 670 and now how could I know how much will it be?…".

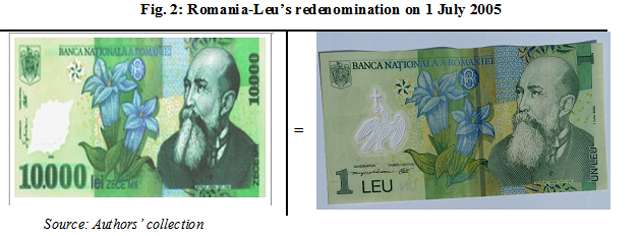

During those years, the evolution of the interest rates was lagging behind inflation as well and the leu’s depreciation on the international markets was not properly reflected by the average wage, whose increase was also slower. For instance, in 1990 the average salary for the whole economic sector was 4,010 lei. It is true that in 1991 this increased, but in reality, this did not evolve at the same speed as inflation and the rapid depreciation of the leu. This had disastrous effects on the savings of the population. Whoever had savings in those days became poorer and poorer in absolute and/or relative terms. The same is currently happening as the annual inflation rate is higher than the level of interest rates granted by the commercial banks for population’s savings both in lei or foreign currencies (the total volume of deposits amounted to 472.8 bln of lei equivalent as of end-September 2021, compared with 440 bln lei as of the end of last year and +14% as compared to September 2020). At the start of the transition, money did not lose yet in full its purchasing power, but this was going to happen finally. The result was the great re-denomination of the Romanian leu on 1 July 2005 during which 10,000 old lei were changed for a new leu (see Fig. 2).

It is true, of course, that the sketch mentioned above had a well-intended theatrical connotation, but the inflation issue was depicted in the best possible way. During 2021, Romania has no more hyper-inflation, but the increase of domestic prices is signalled by the National Bank of Romania (NBR) as being omnipresent and determined by many fundamental economic factors, amongst which first and foremost the large budgetary deficits registered in 2020 - 2021 (true in a pandemic context unheard of in the recent health history of the country). Following the data published by the NBR, the annual rate of inflation increased to 6.29% in September 2021, which is well above the targeted level. This has happened due to, amongst others, the international increase of the natural gas price and by the domestic increase of prices for gas and Diesel oil. The forecast for the whole year is even more concerning taking into account the increase of demand for energy products for the winter season which is coming, the persistent lack of supply for some foodstuffs due to slowing down of economic activity in the current pandemic situation, and, last but not least, the dramatic increase of the trade and current account deficits of the country and consequently the increase of its foreign debt. This last key indicator regarding the macro-economic equilibria reached the level of EUR 133.6 bln as of end-September 2021 (a level estimated to be above 50% of GDP).

Under such circumstances, the increase of monetary policy rate from 1.50% per year to 1.75% per year starting with 10 November 2021 and the corresponding increases of all other interest rates represented the right step aiming to reduce the consumption and implicitly inflation. Despite all of these, it should be clearly said that inflation cannot be reigned only by monetary instruments. Fiscal measures are imperiously needed. The political crisis in the country during the last 2-3 months did not help in this respect. The interference of the Government ousted from power in October 2021 in allocation, based on political criteria, of the state budget financial resources and funds received from the European Union (EU) has led to veritable financial chaos. The prospects are not at all encouraging and winter 2021-2022 will be a difficult season for many Romanians from many points of view!

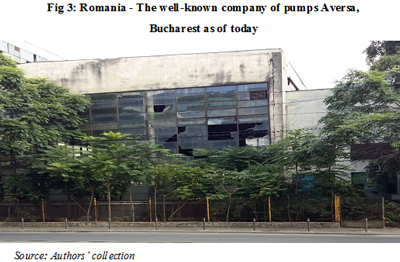

Coming back to Dem Radulescu’s sketch, one other fundamental aspect which is very well illustrated is related to the use of labour force during that period of starting years of transition. The character of this sketch is a former university professor, speaking a few foreign languages, which during the transition is forced to beg to be able to buy "half a pound of salami". Together with him, other colleagues became now beggars at the Sfanta Vineri (Saint Friday) Church or Lutheran Church (for those who speak the German language). Some of the students trained by these professors became, after finishing their studies, "lasso workers" at rendering services. Even more, the sketch has the merit to bring under the spot the issue of scientific doctoral studies for which access during the communist times in Romania was extremely difficult due to a wrong understanding of the authorities in those days. During the transition period, doctoral studies are largely accessible, but a PhD title does not serve anyone anymore. What a dramatic turn of values in a convoluted society in transition! More worrisome was and still is the fact that the Romanian economy did not offer sufficient employment opportunities. Many Romanian companies were pure and simple destroyed or sold as iron scrap. A case in point is that shown in Fig. 3.

Coming back to Dem Radulescu’s sketch, one other fundamental aspect which is very well illustrated is related to the use of labour force during that period of starting years of transition. The character of this sketch is a former university professor, speaking a few foreign languages, which during the transition is forced to beg to be able to buy "half a pound of salami". Together with him, other colleagues became now beggars at the Sfanta Vineri (Saint Friday) Church or Lutheran Church (for those who speak the German language). Some of the students trained by these professors became, after finishing their studies, "lasso workers" at rendering services. Even more, the sketch has the merit to bring under the spot the issue of scientific doctoral studies for which access during the communist times in Romania was extremely difficult due to a wrong understanding of the authorities in those days. During the transition period, doctoral studies are largely accessible, but a PhD title does not serve anyone anymore. What a dramatic turn of values in a convoluted society in transition! More worrisome was and still is the fact that the Romanian economy did not offer sufficient employment opportunities. Many Romanian companies were pure and simple destroyed or sold as iron scrap. A case in point is that shown in Fig. 3.

It could be said, without any doubt, that during more than 30 years of transition, the Romanian society has lost a part of its national fibre because of some major mistakes of the political management in the period starting with December 1989 up to today. Generally speaking, ordinary peoples have concerns about their daily life. Politeness and kindness are now placed on a secondary priority because of a major lack of material self-sufficiency means, a fact which large groups of the population are confronted with. On the other side, the church (one of the fundamental institutions of any society) has had an unclear attitude during the last two years of the COVID-19 pandemic. Taking into account the trust which has been placed in the church by the population, the Romanian Orthodox Church had to clarify its position regarding the vaccination of the population at large, but this happened only in the fall of 2021 during the fourth wave of the pandemic.

These mistakes of macro-economic policy, combined with those in the political and social sectors, had as a first result a large emigration of the Romanians, especially of the young ones. The resident population of the country decreased from over 23 million as of end-1989 to some 19.1 million at present times (data published by the National Institute of Statistics (NIS)) and the trend for the following period is not encouraging. This major social disequilibrium has led to the state’s inability to honour its commitments concerning pensions’ payment for the more than 5 million retired citizens. The social contract was broken and the impact of such a situation is not yet materialised in full. The active labour force is smaller than the number of retired and socially assisted people. This grave situation was "mended" or sustained through a massive external indebtedness. Greece’s example of a few years ago is the most conclusive one in this case. This country used external borrowings as a source to pay wages and pensions from the public sector, which finally led to catastrophic consequences for its economy and ordinary citizens and their small savings.

Similarly, in the case of Romania, the funds borrowed from the external markets has been used predominantly for consumption needs, including for payment of pensions. This situation, which represents a major macroeconomic disequilibrium, is not sustainable in the medium and long term. Corrective measures in this respect, including through the National Plan of Recovery and Resilience (NPRR) approved by the EU by the end-September 2021, are more than needed.

As for the Republic of Moldova, the evolution of the key macroeconomic indicators was in a way similar to that of Romania, although aspects in the political sector and the geopolitical interests in the region are very different in the two countries. Like Romania, Moldova started its transition 30 years ago with zero foreign debt. In the dissolution process of the former Soviet Union, Moldova opted for the so-called zero solution (zero external assets, including foreign currency reserves, zero foreign debt). However, the external debt of Moldova has increased at a speedy pace, reaching USD 8,504.9 million as of 30 June 2021, in accordance with the data published by the National Bank of Moldova (NBM). Although as of this date the ratio of external debt to GDP was slightly decreasing from 70.2% as of end-2020 to 66.1% as of end-June 2021, it should be noted that the level of external indebtedness is rather high. Moreover, Moldova is currently discussing a new arrangement/program with the International Monetary Fund (IMF) which most likely will be of Special Drawing Rights (SDR) 400 million (equivalent of USD 564 million) and which is expected to be considered by the IMF Board of Executive Directors in December 2021. In the context of fluctuating increase of prices for energy products which are needed by Moldova from import for the winter of 2021-2022, the country’s foreign debt will have most likely an ascending trend.  Inflation was also a persistent problem all along the transition period. The hyper-inflation periods from the start of the transition (1,283% in 1993 and 587% in 1994) are still alive in the citizens’ memory. Currently, in accordance with the data published by NBM the targeted level of inflation of 5% for 2021 will most likely be over passed. The annual inflation was already at 8.81% as of end-October 2021 and the impact of external prices increase for energy imports (see Fig. 4) will negatively affect the NBM’s efforts to fix this problem.

Inflation was also a persistent problem all along the transition period. The hyper-inflation periods from the start of the transition (1,283% in 1993 and 587% in 1994) are still alive in the citizens’ memory. Currently, in accordance with the data published by NBM the targeted level of inflation of 5% for 2021 will most likely be over passed. The annual inflation was already at 8.81% as of end-October 2021 and the impact of external prices increase for energy imports (see Fig. 4) will negatively affect the NBM’s efforts to fix this problem.

The social aspects mentioned in the sketch presented above are very much like those for Romania or even more dramatic. We have written on Moldova’s reduction of the population on many other occasions and described it as a grave trend*. The population of this country declined from 4.3 million in 1996 to 3.55 million in 2016 and 2.6 million residents nowadays, by the data published by the Moldovan National Bureau of Statistics. Although there were no precise statistics in this respect, it is estimated that more than one million Moldovans are living outside Moldova, mainly in the EU countries, Great Britain, the USA and the Russian Federation. This group of labourers sends an important amount of money to Moldova for the day-to-day support of the families left behind or (less so) for investments. For instance, during the first 6 months of 2021, the cumulative level of remittances was USD 569.3 million, which represents a major factor of macroeconomic stability.

Currently, Moldova needs support from both Western countries and Eastern ones. The Moldovan authorities’ ability to ensure the joint support of the Russian Federation and, at the same time, that of the EU, USA and the international financial institutions will be crucial in short term. A coherent strategy for the medium and long term is also a fundamental request in the current geopolitical context.■

Alex M. Tanase, PhD, is an independent author and former Associate Director, Senior Banker at the EBRD and former IMF Advisor.

Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London and previously of the BFR Bank, Paris.

These are personal views of the authors and are not of any quoted institution (including, but not limited to, those of the IMF, EBRD, NBR and NBM). The assessment and data are based on available information as of mid-November 2021.

* See Alex M. Tanase - Two currencies - Two Destinies: The Romanian Leu - The Moldovan Leu (in English) in Central Bank Journal of Law and Finance, Year IV, no. 1/2017, published by BNR.

Adauga-ţi comentariu