Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Victoriabank - three decades of challenging developments

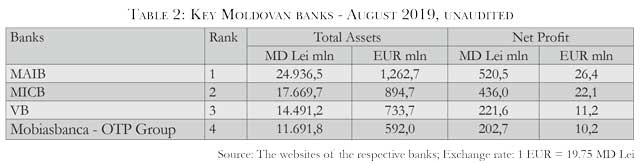

Banca Transilvania (BT), the largest Romanian commercial bank, became the main shareholder of the commercial bank C.B. Victoriabank (VB) from the Republic of Moldova in early 2018. Together with the European Bank for Reconstruction and Development (EBRD), BT has the majority ownership of VB. This represented a major change in the destiny of the first private commercial bank in Moldova and the case is full of lessons to be learned by VB, as well as by other commercial banks in transition.

A new management (President and Vice-President) of VB was appointed on 5 March 2018 to replace the previous one which allegedly was linked to various political groups of influence in Moldova. While BT was not the first Romanian bank to invest in the Moldovan banking sector, it was for sure the most important one. VB has been entirely reorganised with two distinct lines of business (Retail and Corporates) following BT’s best practices in Romania, an EU country since 1 January 2007.

A new supervisory board was recently elected with local and international members. The future of VB is much brighter now than it was before. A new strategy for sale sound banking products has been implemented since the new strategic shareholder acquired its stake. For instance, the initiative of the Romanian BT Club was launched in April 2019 in Moldova for the personal and professional development of entrepreneurs, consultancy services and networking, in addition to the First Year Free-of-Charge Account implemented since October 2018. Many other new products (SME dedicated ones) for the Moldovan market have been tested and introduced.

Currently Moldova has 11 commercial banks with full banking licence. Several other commercial banks were bankrupted or dissolved since the country started its transition to a market economy. The Moldovan banking sector was created in 1991 on the structure of the banking sector inherited from the former Soviet Union. Many commercial banks were established on the former branches of the specialised Soviet banks (agricultural, industrial, constructions. commerce, social sector, savings, etc.), but the story of the establishment of the first private commercial bank VB in 1989 and its destiny is fascinating and deserve a special presentation.

How it all started

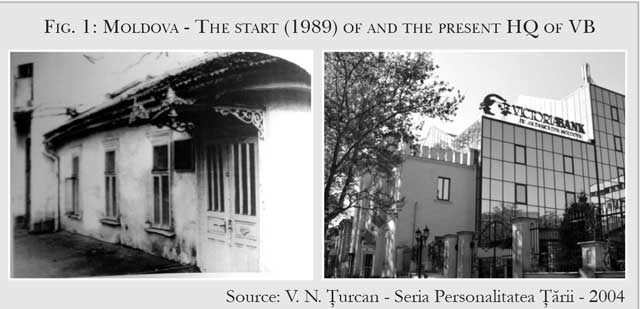

On 22 December 2019, VB will celebrate its first three decades since the historical general meeting of shareholders on 22 December 1989 when the name of the bank was decided. Nobody, even the two key founders (Victor Turcan and Galina Proidisvet), could have predicted what was going to follow. Looking back, it is quite clear that VB has been finally a success story. A short presentation of its magnificent trip since the turbulent days of Soviet Union dissolution to today is worthwhile to be made. The photos in Fig. 1 below present the start and the present of this bank as they were shown by the Founding President Victor Turcan for this banking experiment which finally, after many challenges, succeeded with the EBRD and other international financial institutions’ support.

In what appears today as a very courageous and bold adventure, the founder and key shareholder of VB managed to register the newly born bank with the then State Bank of the Soviet Union on 22 February 1990 (licence no. 246), in a period when the Soviet Union started to disintegrate.

Two months later, on 12 April 1990, the first transaction was booked.

It should be noted that VB’s founders started from zero as compared to other key Moldovan banks who had very different starting points provided by the former Soviet bank branches. In pa-rallel, Moldova declared its independence on 27 August 1991 and the National Bank of Moldova (NBM) was established on 4 June 1991. On 1 September 1991, VB was reorganised as a joint stock company and registered with the NBM (licence no. 7). A branch network started to be developed soon, with the Municipality of Balti being selected on 1 February 1991 for VB’s first territorial presence.

First contacts with EBRD

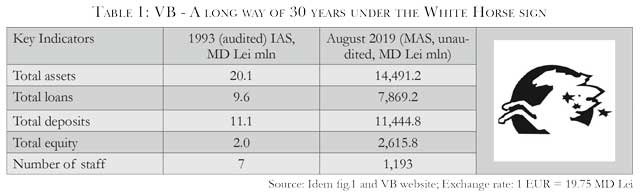

In a visionary move, the founder of the bank started the first contacts with the international financial institutions (IFIs) in 1993. Exploratory meetings were held in the original building (currently demolished) of VB, in a very tiny office of the Chairman and CEO, Victor Turcan. Preparations for a credit line begun in earnest, but many technical issues needed to be overcome. The presentation of a set of fully audited accounts to IAS prepared by an international reputable auditor was amongst the first one, as the international community struggled a lot to understand the real size of the bank after a few years from the starting operations. With the support of EBRD, KPMG Netherlands was selected for this challenging task.

The first audited accounts in an international format were prepared for 1993 and 1994 years. The task was a very complex one, namely to translate the Moldovan accounts into an international format. On top, a complicated factor was the introduction of the national currency on 29 November 1993 and the abolishment of the Soviet roubles, Russian roubles and Moldovan coupons as monetary signs valid in Moldova.

The approval process at EBRD was also challenging in view of the size of the bank. Some key managers were not able to understand if the prepared figures were denominated in "millions" or in"thousands". They were expressed in USD thousands! To their shocks, VB was so tiny by international standards that the only possible solution from the credit risk point of view was a small equity investment. Therefore, on 1 July 1995, a historical agreement was signed between the EBRD and VB for a credit line of USD4 mln for Small and Medium Sized-Enterprises (SMEs) and an equity investment of 25% (decreased up to 15.06% until June 2016 and currently at 27.56% after many capital increases and many dramatic changes in VB’s shareholding, as described below).

This changed the fate of this small private bank operating in a small country which was not always sure in which direction should go after its independence. It opened new unlimited possibilities to access other IFIs financing such as the International Finance Corporation (IFC) and to become (again with the full support of the EBRD), on 1 October 1999, the first bank in Moldova accepted by VISA as VISA GOLD credit card issuer not only for VB’s clients but for all credit card customers in Moldova. Many other financial instruments were used by VB in cooperation with EBRD and other IFIs such as Trade Facilitation Programmes (TFPs), including one recent such facility signed on 4 July 2019 of USD 5 mln, additional multiple credit lines for SMEs, a micro-lending program, technical assistance and others.

What an extraordinary journey, up to the very top of the Moldovan banking sector in May 2009!

But it was not plain sailing at all times. One should remember that many other standard banking requirements were faced by this very young institution, like all other commercial banks which were at their very beginnings. VB’s Charter and the banking rules and regulations needed material changes. These were implemented with technical assistance from EBRD, Danube Fund and Alpha Bank Romania (a subsidiary of Alpha Bank Greece) which were convinced by the EBRD to become shareholders of VB.

In implementing these changes, a constant dialogue was organised with the NBM, although it has to be noted that this dialogue was not always very easy and/or conducted in a professional manner from the Moldovan side. The vested interests of the newly born Moldovan oligarch surrounding VB found their ways to influence some of the top managers of the NBM. Therefore the quality of decision taken and the supervisory act by the central bank suffered many times up to April 2016 when a new management of the NBM was appointed by the Parliament.

The first 10 years of VB were years of real sound growth and the bank had reasons to celebrate the 10th anniversary.

The situation changed dramatically after that. The great financial crisis of August 1998 had serious financial consequences on the country and its banking sector, including on VB. Also, many banks were penetrated by shareholders which had no banking experience, no real money and no good intentions. This was unfortunately the case of VB as well.  The Danube Fund, one of VB’s key shareholders, needed to exit from this investment. Its divestment in 2004 was done in a hasty manner. The consequence was that the corporate governance of the bank suffered, while the NBM took a passive role. In October 2005, the Executive President was arrested. He was accused of requesting a bribe in order to grant a loan. This had never been proven, but the event as such had grave consequence of the morale of top management and of VB’s staff as well.

The Danube Fund, one of VB’s key shareholders, needed to exit from this investment. Its divestment in 2004 was done in a hasty manner. The consequence was that the corporate governance of the bank suffered, while the NBM took a passive role. In October 2005, the Executive President was arrested. He was accused of requesting a bribe in order to grant a loan. This had never been proven, but the event as such had grave consequence of the morale of top management and of VB’s staff as well.

The bad practices continued and the Supervisory Board meetings on 4 May 2006 and 2 June 2006 were extremely tense and confrontational. Therefore, the Chairman of the Board of Directors, the First Executive Vice-President of VB, the Secretary of the Board and other members submitted their resignations on 2 June 2006 in protest of non-sound banking principles promoted by new opaque shareholders.

The minutes of these specific meetings were never signed by the participants in the respective meetings. This was a gross breach and should have triggered NBM’s intervention. Instead of taking measures against the culprits, in line with supervision rules, the NBM adviced the case to be submitted to the Moldovan courts, generally known in those days for dubious rulings. The Executive President was unexpectedly fired in November 2007 and many years of unclear status of VB followed.

There were long period of times in which VB’s Supervisory Board did not function at all. This was without precedent and unheard of in the international banking sector or even in the banking sectors of countries in transition to a market economy. This was the period (up to April 2016) when vested interests were stronger than good corporate governance.

2018 major change

A historical joint trip took place on 6 February 2014 by the top management of EBRD and European Investment Bank (EIB) to de-block the situation. Finally, after many years of such an unclear status of VB, the EBRD decided on 6 June 2016 that it will buy the stake of Alpha Bank Romania of 12.50%. Thus, it consolidated its position at the level of 27.56% shareholding in VB. However, the real major change in VB’s shareholding happened in early 2018 when BT bought a stake of 39.21% in VB. The joint shareholding of EBRD and BT thus reached 66.77%.

As mentioned already, on 22 December 2019, VB will celebrate its first 30 years of operational challenges and successes. By international standards this is still a very young institution, but by Moldovan standards VB is and will always be the first private bank of the country. Nobody can predict where VB will be in the next 30 years, but one thing could be certain at this stage, namely that VB has now a responsible strategic shareholder dedicated to make VB an even greater success. The trust of the Moldovan customers, shareholders, staff and management, on one side, and of the international capital markets and international financial institutions, starting with EBRD, on the other side, should be preserved and further consolidated.

Many happy returns, Victoriabank!■

____________________________________________________________________________

These represent the authors’ personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or the NBM and/or BT and/or VB and/or indeed of any other institutions quoted. The assessment and data are based on information as of end-October 2019.

Adauga-ţi comentariu