Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

QE, QT, SDR and interest rates: do they really work?

Basically, the main goal of this piece is to show that apart from very well-intended purposes, some monetary instruments could easily distort the markets, with obvious negative consequences for certain countries and in some cases for all international markets. Quantitative easing (QE) and quantitative tightening (QT) are such instruments used by central banks with high implications for capital markets. Prudence by the central banks and financial discipline are obvious solutions for the unintended consequences of these instruments. In some cases, these are overdue under the current convoluted geopolitical environments. Moreover, some of the unintended consequences were exacerbated by the still ongoing and unprecedented COVID pandemic of 2020-2022, the energy crisis, inflation and the aggression of the Russian Federation against Ukraine.

1. QE – QT and interest rates

Quantitative easing (QE as it is well known in economic literature) was labelled by some analysts as a euphemistic term for money printing. This piece tends to agree with such a view. Others may argue that QE programs served well their original purpose, namely to restart and/or to maintain economic growth in the respective countries in dire economic circumstances. However, under current very complex circumstances this “printed money” became an inflationary cause (along with some other factors) and needs to be cancelled. Unfortunately, the current international context is not the best moment for this. No wonder that the Quantitative Tightening (QT) or "normalization of the balance sheets" of central banks was delayed so many times in advanced countries, including in the USA. In the UK, for instance, there are also calls to postpone the QT which had a target to reduce the gilts held by the Bank of England (current stock at GBP 838 bln) by GBP 80 bln per year. At the last auction for selling short-term gilts on 1 November 2022, only a modest amount of GBP 750 mln was actually sold. Certainly, QT will need some more years to have a material impact.

The QE practice of the central banks from the major countries – the USA, the United Kingdom, Japan and the European Union (via European Central Bank) – to buy government bonds was introduced in the aftermath of the global banking crisis of 2007-2008. This was a historical "innovation" to save the governments and commercial banks from imminent bankruptcy in the mayhem created by the crisis (incidentally started by the sub-prime mortgage-covered bonds in the USA). However, it should be said that this monetary instrument did not benefit at that time from any theoretical debates and/or economic analysis based on specific data to clarify or justify its viability and efficiency or otherwise. To put it very simply, it was an ad-hoc instrument created in the aftermath of a serious financial and monetary crisis (2008) whose utilization continued for many years and the consequences of such actions are to be faced and dealt with now.

From 2008 to 2017 a huge amount of USD 22 trillion of bonds were acquired by the central banks of the countries mentioned above, of which a sizable portion was bought by the European Central Bank (ECB) (EUR 2.3 trillion). ECB recently hinted at the end of the QE program because of fears that Eurozone will overheat. With some delays though, but as expected, Europe indicated also via ECB that it will follow America’s new trends for reasons mentioned already. This should have been done much earlier in order to avoid a weakening EUR and other major European currencies. This is more so where the interest rates were negative for a good period of time until this year (currently at 2%). Also, the Bank of England held as of end-November 2020 an amount of GBP 895 bln of bonds purchased since 2009, of which GBP 450 bln accumulated during the COVID crisis. Currently, it still held a stock of GBP 838 bln in gilts. This was gradually reduced, but more needs to be done.

Another sizable part of this huge stimulus program was acquired by the US Federal Reserve System (the Fed) with holdings of $3.5 trillion by 2017. The efforts of the Fed to start deleveraging its balance sheet were well noted and in the right direction. First, it was said that it would not buy any new bonds and, furthermore, it would start selling small amounts of the existing stock. This put pressure on interest rates to rise, a process which was already underway in the USA. Interest rates (the Fed funds rate), currently at 3.75-4.00%, started to be increased by the Fed on 16 December 2015 (it was unchanged since 2006!). Sharper increases were implemented in 2022. The current levels should be seen in the historical dimension with its all-time high on 19 December 1980 at 21.50% for the prime rate. These recent increases were possible in the USA in the context of good economic growth and decreasing unemployment. All of the above are mere reflections of an abnormal situation in which savers are covering the costs of the banks and the proper re-distribution function of the interest rates does not apply. In fact, one could say that these are very distorting cases with an unpredictable macroeconomic impact (most of the time, a negative one). Finally, as of 18 January 2022, Fed increased its balance sheet to USD 8.87 trillion, according to Statista.

The financial and monetary implications of these assets are huge, starting firstly with the central banks, but continuing also for the general public as well. First of all, it should be noted the cases of Japan and Switzerland had negative interest rates. Japan still had its base rate at -0.1% (October 2022), but most likely this will not continue for much longer as the yen is very weak compared to the USD. Historically speaking, such type of monetary policies are very unorthodox. When somebody is using someone else’s money, interest is due as a matter of principle. In these two cases, such a well-established practice has been disregarded. Moreover, almost all other selected countries presented in Table 1 are in a situation in which the cost of money is lower than the level of inflation. The obvious result is that those who save are losing money. The role was played by the gold, which lost its shine, especially after 1971, when this metal was thrown out from the "eternal city". Since then, it struggled to recast a more fundamental role, but so far the results are modest.

All of the above were and in a way still are clear reasons for the flourishing of cryptocurrencies, which are assets with no intrinsic value. To complicate things even more, all the countries on the planet have had to deal with very different types of issues generated by the almost three-year-old Covid-19 crisis. It is more than clear that the attention of various Ministries of Finances and of most Central Banks has been focused on the financial consequences of this pandemic of historical proportions. Large state budget deficits are registered even by most disciplined countries and subventions (which were almost prohibited before the pandemic) were generally accepted as the workforce was advised then to work from home as and when possible. Real sectors of economies were strongly hit!

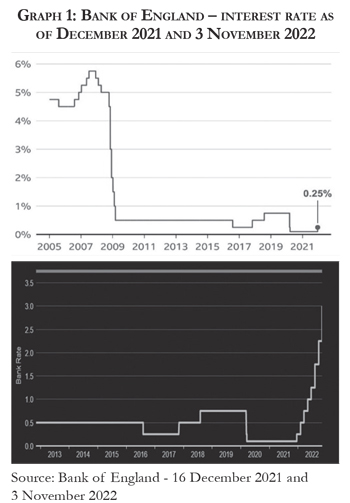

In most cases, the interest rates as a monetary tool were kept artificially low to stimulate economic growth. The case of the United Kingdom’s interest rate is one of the most obvious. Bank of England kept its base rate at a low level without precedent since the 2008 financial crisis (see Graph 1) in order to stimulate the economic growth negatively impacted by many crises, including but not limited to Brexit, Covid-19 pandemic, inflationary consequences of many large QE, costs of the international role played by the country, energy crisis, the war in Ukraine, the 2022 political turmoil and the likes. A strange situation was sensed by the general public that "cheap money" was the "new normal". It was not! The increase of its interest rate from 0.10% to 0.25% on 16 December 2021 was a first step in the right direction, but the key commercial banks in the country did not translate in full the 2022 increases in better rates for savers. On 3 November 2022, the base rate of the Bank of England was increased to 3.00%, which was, it should be noted, a very fast pace.

In most cases, the interest rates as a monetary tool were kept artificially low to stimulate economic growth. The case of the United Kingdom’s interest rate is one of the most obvious. Bank of England kept its base rate at a low level without precedent since the 2008 financial crisis (see Graph 1) in order to stimulate the economic growth negatively impacted by many crises, including but not limited to Brexit, Covid-19 pandemic, inflationary consequences of many large QE, costs of the international role played by the country, energy crisis, the war in Ukraine, the 2022 political turmoil and the likes. A strange situation was sensed by the general public that "cheap money" was the "new normal". It was not! The increase of its interest rate from 0.10% to 0.25% on 16 December 2021 was a first step in the right direction, but the key commercial banks in the country did not translate in full the 2022 increases in better rates for savers. On 3 November 2022, the base rate of the Bank of England was increased to 3.00%, which was, it should be noted, a very fast pace.

If a saver receives from its commercial banks an interest rate of 0.01% or nothing for money kept in current accounts, it is obvious that the respective person will turn to other instruments, one of which is cryptocurrencies. One could say that the low and/or negative interest rates were bringing the economic and banking world into uncharted territory where any prediction could have been negated.

2. Special drawing rights (SDR)

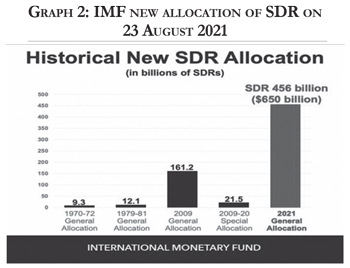

As compared to QE, the special drawing rights (SRD) is not a new monetary instrument. It was established back on 20 September 1967 and confirmed through the IMF Charter change on 28 July 1968. It was designed to supplement the international reserves of all the countries participating in the SDR Department. In those years, gold suffered a major setback (August 1971) as its role as a reserve in the international monetary system was abolished. A very modest allocation of SDR 9.3 bln was done in 1970-1972 (with almost equal distribution over three years). Quite a few more allocations were also implemented by the IMF (two general allocations and one smaller special allocation), but the most important one is the last one approved by the Board of Governors on 2 August 2021 to help the participating countries in their fight against the COVID pandemic. This huge "shot in the arm" during an unprecedented crisis (as the IMF Managing Director put it) was disbursed to all participating countries on 23 August 2021 to help countries strongly hit by the pandemic (see Graph 2).

The distribution by countries was not equal and the actual impact of this historical allocation may not have been as positive as hoped for in the case of emerging markets and/or developing countries, including low-income countries. This latter group of countries received only $275 bln (some 30% of the total amount), while 70% of the total amount allocated went to G20 economies.

This monetary instrument was also the subject of strong criticism from its inception and a good part of the criticism was precisely related to its distribution. Moreover, in the past, this instrument was labelled as "the first cause of inflation". Therefore, the inflationary role of such a good instrument should be closely supervised. The other part of the criticism was related to the fact that there is no material substance behind this instrument ("thin air draped as currency", as it was put by some analysts at the time), like in the case of normal money issued by the central banks which are backed by wealth and goods produced by a certain country. The allocation and functioning mechanism of this instrument is properly run by the IMF and therefore the negative impact could be controlled. As the interest rate applied for the amount of SDRs allocated is properly computed by the IMF based on the interest rates in the international markets, the actual cost of such allocations for participating countries could be moderate. Apart from the principal itself, the cost of using this instrument could be a strong stimulus for developing countries, if (again) the inflationary aspect is kept under control.

3. Romania, Moldova – QE and SDRs

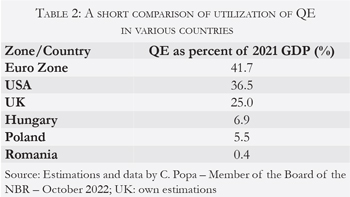

According to the National Bank of Romania (NBR), Romania was quite prudent in using this unorthodox instrument of QE. This is known in Romania under euphemistic terms called "printing machine" or "tiparniţa" in Romanian, which says a lot about its benefits and its theoretical classification. A short comparison of the utilization of QE in various countries is presented in Table 2. If the figures are accurate, then the NBR should be indeed commended for its prudent monetary policy.

According to the same opinion, Romania did not use the QE to relax its monetary base. Its primary objective was to restart the secondary markets for state bonds, as the state is borrowing massively lately, including externally with a foreign debt of €141.7 bln as of August 2022. There is no immediate information on the utilization of QE by the Republic of Moldova (Moldova in this article), although the balance sheet of the National Bank of Moldova (NBM) shows holdings of Moldovan state bonds by the NBM. Concerning the SDR, Romania, an emerging market and former country in transition to a market economy had in 2021, for instance, an allocation of SDR 1,736 mln, which was the equivalent of €2,100 mln, while Moldova had an allocation of SDR 165.3 mln (€199.9 mln), according to IMF data.

4. Monetary tools or distorting instruments?

A few years ago, the USA and its Fed had some room for an increase in the rates, which started on 13 December 2017. Many analysts considered this normalization in the level of interest rates and the adjustments of the central banks’ balance sheets (including QT) as steps in the right direction. They have argued that this new trend should be followed by other economies as well. However, the normalization exercise has also its critics. Many argued that the increase of interest rate by the Fed will also have an unwanted collateral result, namely the reduction of the funds following emerging markets and countries in transition (as money is more expensive and more scarce). As this is a valid concern, a fine balance should be achieved. A gradual normalization could be the solution.

While supporting the economic increase, the historically low level of interest rates is distorting the distribution of the national wealth and the saving and investment processes. The fate of the savers (amongst which the pension funds and pensioners) was not of the highest priority for the current decision-makers. The same holds for the EUR area. This could have a negative economic impact (as the savings of the population could continue to decrease) but, more importantly, a social impact difficult to quantify. The long-suffering savers will still have to wait, while a negligible interest has been paid to them on their deposits until very recently.

The interest rates are fundamental parameters of the macroeconomic policies of any country, but their utilization is more intense or more effective in the developed markets. As such they could be easily labelled as macroeconomic tools, as they are instrumental for the key decision makers (central banks, strategists, parliaments, politicians, commercial banks etc.). Controlling inflation is a key objective of both major international financial institutions, such as the IMF, and the countries themselves. Prima facie, it seems that inflation could be primarily influenced ("controlled" is maybe too much to admit, but it is not far from the truth) by changing the interest rates, starting with the prime rates or refinancing rates, which are normally amongst the attributions of the central banks.

5. Final remarks

There is no doubt that the role of QE and low-interest rates have been positive in recent times in helping economic growth, but the over-stimulation of consumption and the creation of additional debt damaged the investment processes and the interest of the savers as well. It is fair to say that these played a positive role in re-launching major economies after the 2008 crisis, but the time for their reversal is overdue. The historical pandemic is not yet over and therefore may be more time required for the reversal of QE via QT. The incipient actions in this respect announced by the Fed and other major central banks were not implemented in full. There are now calls for postponements. Reasons for this could be easily identified, but the danger of inflation, recession and erosion of the population’s savings is imminent.

Such situations had very distorting macro-economic consequences, with macro-economic disequilibria placed on the shoulders of future generations, not only in the concerned countries but in some cases with a far-reaching global spread. A more balanced approach is imperiously required before it is too late. The reasons for "emergency" low levels of interest rates and QE expired long ago. The key objective of financial stability would have been in peril if the deleterious low or even negative rates would have continued. Actions to change this situation should be taken by central banks and commercial banks alike.

SDR is an instrument which is well monitored by the IMF and therefore its distorting macro-economic impact could be controlled as done so far since its introduction back in 1967-1968. A big plus will be if and when a mechanism will be found for SDR allocation more in favour of developing countries which needed it most.

Also, the specific needs of emerging markets (including Romania and Moldova) should be taken more into account by all international financial institutions, the European Union in the case of Romania’s National Plan for Recovery and Resilience and by all other major financiers. Moldova’s process of becoming an EU member should be fully supported by the EU as well. In both cases, their efforts should be also encouraged.

We are living through extraordinary times and adequate measures (even painful ones) should be implemented to survive!■

______________________________________________________________________________________________________

Alexandru M. TANASE, PhD, is an author and ex. Associate Director, Senior Banker at EBRD London and former IMF Advisor. These represent the author’s personal views.

Mihai RADOI is a Director of a specialized Investment Fund focused on Eastern Europe and a former Executive Director of the Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris.

These represent the authors' personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions/sources quoted. The assessment and data are based on information as of early-November 2022.

______________________________________________________________________________________________________

Adauga-ţi comentariu