Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Bucharest: Major changes in the old banking city

The old banking City of Bucharest has suffered major changes over the last half of the century. The most important changes were determined by the December 1989 events and by the transition process thereafter. Practically, the current banking system is almost unrecognizable if compared to that one prevailing by the end of 1989. The share of the private sector in the banking sector was almost 0% by the end of the socialist era and it is now at 89.9%. Under such circumstance, a short presentation of the significant banking changes which took place in the "City" on the banks of Dimbovitza river is worthwhile to be undertaken.

The last five decades have brought historical changes in the Romanian banking system and consequently in the old banking town from Bucharest. The December 1989 events had profoundly shaken the Romanian society and had, as expected, major repercussions in the banking system as well. The Romanian transition to a market economy took place in an extremely convoluted international context. With the benefit of hindsight, one could say that the last 50 years were amongst the most tumultuous ones in the modern history of the world and of Romania. The centrally planned economies of the former socialist states were thoroughly reformed and the new countries in transition, including the Republic of Moldova (Moldova in this article), have continued their sinuous way to market economies. On 21 September 2020, the Bucharest Stock Exchange (BSE) announced that the Romanian capital market became and Emerging Market (based on the FTSE Russell indices).

Romania became a NATO country on 29 March 2004 and since 1 January 2007, Romania is a full member of the European Union (EU). Moreover, with pluses and minuses, Romania has remained a zone of geopolitical stability over the last 50 years. This is an achievement which deserves a special accolade. On the other side, Romania, like many other countries in transition has suffered and continues to suffer because of the corruption which has become a national/regional scourge. At the same time, Romania has registered material macro-economic disequilibria such as chronic trade deficits, major current account deficits, persistent budgetary deficits, non-satisfactory attraction of the funds made available by the EU and significant inflation (hyperinflation during some stages).

Finally, in 2020, like many other countries in the world, it was strongly hit by the Covid-19 pandemic. Also, during the last 30 years, the country (like Moldova as well) lost an extraordinary advantage which it had at the start of the transition, namely a very low external indebtedness. The external debt of Romania has now reached dizzy levels (EUR 111.5 bln as of end-July 2020 as compared to zero in 1989). „The ghost" of the uncontrollable external debt of Greece and the former Yugoslavia haunts the Balkans!

End of Socialism and Starting of Transition

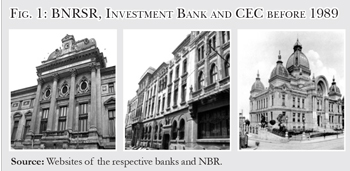

The December 1989 events found the Romanian banking system in a super-centralized shape, with a central bank established since 1880 (later renamed as the National Bank of the Socialist Republic of Romania) and four specialised banks (Investment Bank (BI), Romanian Bank for Foreign Trade (BRCE), Bank for Agriculture and Foodstuff Industry (BAIA) and Savings Bank (CEC)). Few branches of foreign banks such as Chase Manhattan Bank (former Chemical Bank and former MHT Bank) and Société Générale existed from the socialist era and they were important both from a banking point of view and also from politic and cultural point of view as they were the only branches of Western banks in entire Eastern Europe.

Everything changed radically in September 1991. As in any normal case, the functions held by the former National Bank of the Socialist Republic of Romania (BNRSR) were split between commercial functions and those of a central bank. The National Bank of Romania (NBR) was established as a central bank, while the Romanian Commercial Bank (BCR) took over all the commercial functions attributed to any commercial bank from the former BNRSR, with the attributions in serving with high priority the industrial sector, transport and trade. At the same time, other commercial banks were established/re-organised as universal banks. The universality of banks, both concerning the sectors served and concerning the range of services and transactions undertaken, was one of the monetary policy objectives soon after 1989.

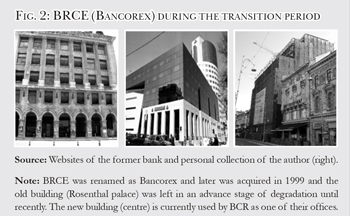

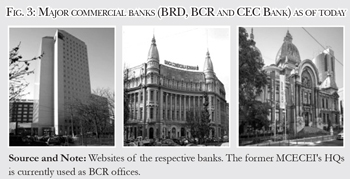

The development of the private sector in the banking system was the second major objective. BCR was taken over in 2005 after many delays/failures by Erste Group, Austria for a total amount of EUR 5.2 bln. BRCE, later re-named Bancorex, was taken over by BCR in 1999, Banca Agricolă was acquired by Raiffeisen Group (RZB), Austria in November 2001 for a modest price of USD 60 mln and Banca Romana de Dezvoltare (BRD) was bought by the French group Société Générale in many successive stages between 1998 - 2004. On top of these actions, the Romanian Parliament re-organised Casei de Economii şi Consemnaţiuni (CEC, currently CEC Bank) as a banking entity with a single shareholder, namely the Romanian state. The foreign capital managed to enter boldly the Romanian banking sector, a fact which represented a clear appreciation of the business potential of Romania and of the banking sector strength. By investing during this period, the foreign banks aimed in fact for the business potential of a market which is second in the Central and Eastern Europe, after Poland.

By the end-1996, the commercial banks' balance sheets reached USD 13.6 bln. Apart from a nominal growth in lei which could be characterised as substantial, one can also note that the volume of external assets was higher than that of liabilities, which by itself implies a creditor's position of the Romanian commercial banking sector in its relations with foreign entities. In accordance with the data published by the NBR, one can easily see that as of the same date the central bank was in fact in a net external debtor position of about USD 534 mln (a figure in a permanent increase since then to nowadays). The Romanian monetary policy during the transition period was very convoluted, issued under inflationary conditions and most of the times under immense political pressure based more on social criteria rather than on solid arguments of a market economy. This was more so valid during election periods such as the ones in September and December 2020. There were also periods when the emission of the monetary base was higher than the GDP increase, a fact which exacerbated, even more, the inflation, while the interest rates were kept almost flat, especially during the first years of transition. The NBR withdrew for the first time the licence issued to a commercial bank such as Fortuna Bank on 11 July 1996 only, after which Dacia Felix and Credit Bank followed. Under these circumstances, the analysts of the Romanian monetary policy rightly remarked that "too little, too late" was done.

Commercial Banks Privatisation

Commercial Banks Privatisation

This was also a field in which the hesitation and non-coherence of the Romanian authorities had a negative impact on the stability of the leu, a fact which determined a "wait and sees" attitude from the part of foreign investors during the first years of transition. One of the issues which has not been achieved by the Romanian authorities was that of a clear option with regards to the banks which were to be privatised. Various governments l

aunched few possible privatisations under which BRD, Bancpost and/or even Banca Agricolă (former BAIA) were successively included. That hesitation was also determined by a series of complex technical problems which needed to be handled when the state-held large commercial banks were to be privatised. One of these issues was the selling price of the shares. This particular issue raised serious technical and practical difficulties in determining the BCR's market price. For this method to be applied, one of the basic requirement was the preparation of the international auditing reports (IAS).

Some commercial private banks such as Banca Comerciala "Ion Tiriac", which was taken over by Unicredit Group (Italy), Banca Bucureşti (which was acquired by Alpha Bank Greece) and foreign banks, in general, were very active in the market. As of end-April 2020, the Romanian banking sector was comprised of 34 banks, of which 7 were branches of foreign banks. As of the same date, all the commercial banks authorised by the NBR had total net external assets of Lei 561.3 bln (EUR 115.9 bln, at the end of the period exchange rate).

Changes in the City - Banks Bankrupted, Taken-over or Dissolved in Transition

At the first sight, in the banking sector, one can find out that at least 20 banks were established and then disappeared during the transition, out of which 10 banks were bankrupted, dissolved or taken-over as emergency cases. The most striking case was that of Bancorex, (former BRCE, taken over by BCR on 30 July 1999), but also those of Volksbank (taken-over by Banca Transilvania (BT) on 31 December 2015) and of Banca Turco-Romana (bankrupted on 3 July 2002) all of which brought serious image damages to the banking sector where the trust is the most valuable asset. At the same time, during the same period, large banks were taken-over due to difficult situation of the shareholders (Bancpost, initially privatised with GE Capital and finally bought by EFG Bank, Greece and acquired by BT in 2018 due to very difficult state of mother-bank and more generally due to the economic conditions in Greece), while Banca Carpatica was taken over by Patria Bank due to integrity issues of some of the main shareholders. Other banks (Columna Bank, Bankcoop, Dacia Felix, Demir Bank, Nova Bank, etc.) were pure and simple bankrupted after 2000 or were taken-over due to bad management.

All these major changes have impacted the old banking "City" from the old town of Bucharest in which today remained only NBR, BCR and CEC Bank. BSE has also moved from its old building to a new one outside the City. The former Banca de Investiţii built a new modern headquarters (BRD) located in Piaţa Victoriei. Banca Agricolă (former BAIA), renamed RZB Bank after 2001, has also a new HQs on Mircea Voda Street in Bucharest, while the HQs building of the former BAIA at 3, Smârdan Street is currently a neglected one, with a different destination. The insurance company ADAS also changed its name and moved out of the City. The most interesting case is though that of the BRCE established in 1968, specialized in foreign trade transactions for whole Romania, which was bankrupted up to 1999. Its HQs on Calea Victoriei was neglected a long period. Currently, this building is under consolidation and repairs after it was pure and simple neglected for almost three decades. On the other hand, there were recent consolidation/repair works in the old City (see the cases of the building of the former Ministry of Domestic Trade and that of the former Ministry of Light Industry from the socialist era) which give us reasons to believe that the old town will continue to exist, albeit not in the shape and structure prevailing at the start of the transition. Meanwhile, the largest commercial bank from the old town of Bucharest has ceded its no. 1 rank in the classification of banks to Banca Transilvania with its HQs in Cluj-Napoca. NBR will have to manage a substantial foreign debt (more than 40% of GDP, depending on how much GDP will contract this year in the context of the current pandemic and double elections) and the adoption of the EUR.

Certainly, the world has changed dramatically and irrevocably during the last 50 years and this is valid for the old City of Bucharest as well. The tumultuous changes in the old banking town of Bucharest offer a reason to pause and think for many other countries in the region, including for Moldova. Mutatis mutandis, the profound changes, of which some were dramatic in nature, in the Moldovan banking sector during the last 30 years deserve a distinct analysis.■

Adauga-ţi comentariu