Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Cryptocurrencies - the last three tumultuous years

The cryptocurrency market is developing very dynamically, reaching an enviable market capitalization today. A few years ago, we could not even imagine that this could happen in such a short time. It became clear today that central banks need to regulate these virtual instruments. Moreover, there are people who, with the help of their advertising resources, cultivate the dream of quick and easy enrichment by investing in cryptocurrencies. This should not be encouraged any further, as the costs of the potential crash could be damaging for all economies, no matter their size.

Three years ago we have published in Emerging Europe a piece on the then-hot topic of cryptocurrencies. It is even hotter today! That particular article of December 2018 was extended, updated and republished a few months later in Profit Magazine in April 2019. In both articles, we have pleaded for the central banks and other regulators to observe and focus on the trends in a new market of cryptocurrencies that was not yet then a driving force. Three years later, it is fair to say that the cryptocurrencies issue became a central point of debate in mass media, both the specialised one (Financial Times and The Economist, to cite just a few of them) and also in mass media for the general public such as, for example in the United Kingdom, The Times, The Telegraph, The Guardian and many other local newspapers in their respective national languages. The issue has been debated by both international financial institutions led by the International Monetary Fund (IMF) and, at the same time, by central banks (including the US Federal Reserve System (Fed)) from developed countries and emerging markets as well.

Cryptocurrencies are not an issue for developed markets only, although it should be mentioned that it is an instrument invented by an anonymous creator (generally accepted, but not proven, as being Satoshi Nakamoto) based on the experience and tendencies in Western markets. The creator (creators, according to some other sources) wanted to have a payment instrument that is not controlled by any central bank and which gives full anonymity to the owner of such assets. The original creator did not envisage that soon the cryptocurrencies will also become a common thing in a special group of countries which after the dramatic events of 1989-1991 became countries in transition to a market economy.

Cryptocurrencies world

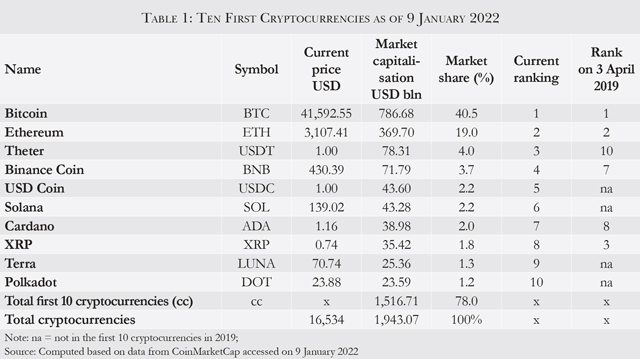

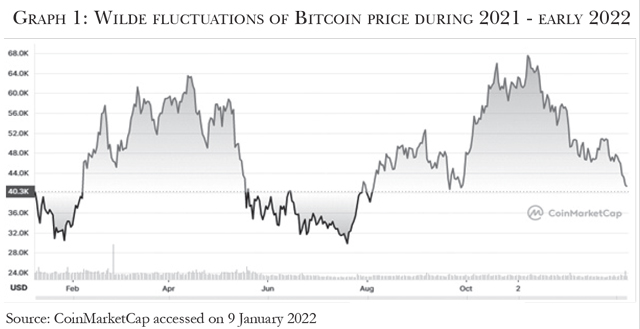

Today, cryptocurrencies are a global phenomenon that needs proper attention before is getting out of control. On 9 January 2022, the market capitalisation was at $1.94 trillion, as compared with a total market capitalization of $180 billion as of 3 April 2019 for over 2,146 such cryptocurrencies in circulation then. Moreover, during 2021 this key indicator was even higher. The current "reduced" level is due to large fluctuations (high volatility as defined by the IMF) of the price for the key cryptocurrency – Bitcoin (BTC), as presented in Table 1. The wide fluctuations of this price and subsequently of all 16,534 cryptocurrencies as of 9 January 2022 is presented in Graph 1. There is no need for any additional commentary on such fluctuations, except to remind all investors in such assets that they should be prepared to lose their money in full. This was indeed advised by many central banks, including by the National Bank of Romania (NBR) and by the National Bank of Moldova (NBM) since 2017-2018. Such advice sufficed for a while, but taking into account the current sizable market capitalisation, the implications of a potential crash for the macro-economic equilibria are much larger and by far more dangerous.

It could be easily noted from Table 1 that even at the top of the ratings, the fluctuations led to a lot of changes in the overall ranking. Some of the cryptocurrencies which are now in the top 10 were much below in 2018-early 2019. However, it should be noted that fluctuations happen in the whole group of these stateless virtual assets. The case of Elrond (EGLD), labelled as being a Romanian based crypto, is very illustrative, losing its ranking from number 30 in 2021 to 41 currently. Its market capitalisation has been also reduced substantially.

The year 2021 recorded quite a few interesting developments when it comes to cryptocurrencies. First and foremost, the dominant one, BTC, registered an all-time high at the level of $68,780.64 on 10 November 2021. It is now at $41,592.55, which is proving one more time if needed, the risks that investors had to face. A less known cryptocurrency – Solana (SOL) – had a spectacular evolution with a peak of $260.08 on 7 November last year. Same for Dogecoin (DOGE), but the peak was in May in this case. One other aspect which was intensively debated during recent years was the vast possibilities of fraud, money laundering, terrorism financing, tax evasion, etc. via cryptocurrencies. Activities on dark webs, anonymous wallets and accidental and/or intended losing of keys required to access accounts are very frequent. Many millions of USD were lost in 2021 in fraudulent schemes ($612 mln were stolen in the "poly network hack" only, according to CoinMarketCap) and it is very likely that this will continue if no adequate safeguards will be introduced. A recent study prepared by a committee chaired by the former Governor of Bank of England, Lord King, has identified without any doubts the systemic risks posed to commercial banks by cryptocurrencies. The same study cast doubt on the recent discussions and initiatives of some central banks to introduce their digital currencies (see in this respect the case of the Bank of China which intends to introduce the digital yuan). The central banks and all other regulatory bodies have a clear duty to properly regulate this issue. To do nothing is not an option anymore.

In parallel, one very controversial move was, however, made by a small country, El Salvador, which declared Bitcoin as its legal tender, despite repeated advice from the IMF not to take such a step. It is true that the financial impact of such a measure could be small on a global scale, but the psychological effect was very high.

Cheap money and cryptocurrencies

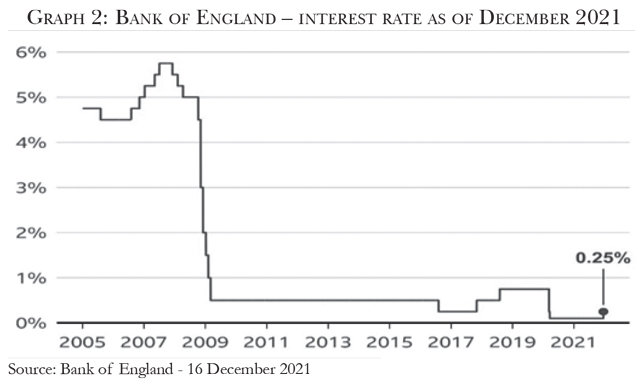

The financial and monetary implications of these assets are huge starting with the central banks. However, the creation and owing of such assets is nowadays a common thing for the general public for reasons which need to be explored in more detail. One aspect which could be mentioned upfront is the level of interest rates for the fiat money (money issued by the central banks). In most cases, these are kept artificially low to stimulate economic growth. The case of the United Kingdom’s interest rate is one of the most obvious. Bank of England kept its base rate at a low level without precedent since the 2008 financial crisis (see Graph 2) in order to stimulate the economic growth negatively impacted by many crises, including but not limited to, Brexit, COVID-19 pandemic, inflationary consequences of many large quantitative easing, costs of the international role played by the country and the likes. The increase of its interest rate from 0.10% to 0.25% on 16 December 2021 was a step in the right direction, but the key commercial banks in the country did not translate even this meagre increase in a raise of their interest rates granted to savers for their deposits. If a saver receives from its commercial banks an interest rate of 0.01% or nothing for money kept in current accounts, it is obvious that the respective person will turn to other instruments, one of which is cryptocurrencies. All these arguments of stimulus for a better economic increase are valid, but this is not the full story.

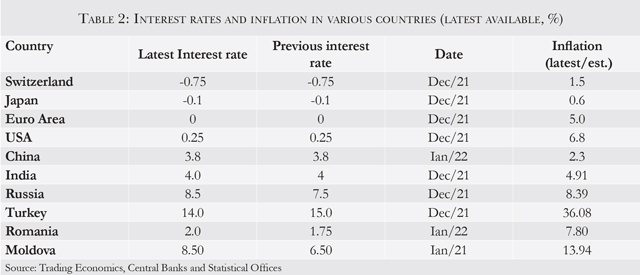

Meanwhile, let us have a quick look at other countries. Mutatis mutandis, the story is very similar to that of the United Kingdom. However, some cases are more dramatic than others. First of all, it should be noted the cases of Japan and Switzerland which still practice negative interest rates. Historically speaking, such types of monetary policies are very unorthodox. When somebody is using someone else’s money, interest is due as a matter of principle. In these two cases, such a well-established practice has been disregarded. Moreover, almost all other selected countries presented in Table 2 are in a situation in which the cost of money is lower than the level of inflation. The obvious result is that those who save are losing money. This has been, is and will continue to be a very strong incentive for savers to find alternative options of investment. Until recently, this role was played by the gold, but this metal lost its shine. It is known that in 1971, the gold was thrown out from the"eternal city". Since then, it struggled to recast a more fundamental role, but so far the results are modest. Mismanagement of monetary policies could well be the explanation for the vagaries of other currencies such as the Turkish lira. The interference of political leaders in the monetary policy of any country, such as in the case of Turkey, is a thing which is not recommended, of course.

All of the above are clear reasons for the flourishing of cryptocurrencies. As such, these assets have no intrinsic value. One investor will buy such assets hoping that it's/their value will increase and a proper yield will be obtained. In some cases, this hope was fulfilled, but in many other cases, the contrary was the final result. The non-coherent advice given so far by the central banks to investors to be prepared to lose their money are not sufficient anymore. The central banks were pure and simple not strong enough or determined in this respect.

To complicate things even more, all the countries on the planet have now to deal with very different types of issues generated by the two-year-old (and still going) COVID-19 crisis. It is more than clear that the attention of various Ministries of Finances and most Central Banks is now focused on the financial consequences of this pandemic of historical proportions. Large state budget deficits are registered even by most disciplined countries and subventions (which were almost prohibited before the pandemic) are generally accepted as the workforce is advised to work from home as and when possible. Many large sectors of economies (such as tourism, hospitality industries, aviation, transport and almost any other economic activities) are negatively impacted by the health crisis.

Need for immediate actions

The recent violent events in Kazakhstan could be analysed and interpreted in various ways and from different angles. From our topic’s perspective, one should note that the cutting of the internet has had a negative impact on the dynamics of cryptocurrencies, which showed, even more, the fragility of such assets. This could be explained in view of the fact that this country was well known as a "mining" country (some estimations are at 18% of the global mining market according to some analysts), as the energy was relatively cheap. The tentative price liberalisation of the price of liquid gas (used for cars as well) resulted in violent unrests (225 persons died and more than 4,500 were injured) and the resignation of the Government. Even more, armies from various former Soviet republics, led by the Russian Federation, were called in to calm/control the clashes.

For cryptocurrencies, the lesson learned from these events is that the assets need to be properly regulated. Last year, some central banks and the US Fed had discussions, together with the IMF, European Central Bank (ECB), Bank of International Settlements (BIS) and others to introduce their digital currencies (Digital Currencies of the Central Banks – DCCB), but the results are modest, to say the least. Moreover, during the last three years, there were discussions about whether cryptocurrencies are indeed the future of money. While we have never believed that this could happen, it is obvious that the central banks should regulate these virtual instruments.

There is a need for a comprehensive, consistent and coordinated global framework, as the IMF finally suggested in December 2021. China and South Korea made clear attempts in this regard, but, on the other side, there were very visible efforts made by investors holding funds measured in billions to promote them further. The example of PayPal which was accepted in 2021 to make payments in cryptocurrencies is just one of them. In many countries, including Romania and Moldova, there are well-known cultural personalities and other "influencers" with strong publicity resources, which all are in favour of these assets. They cultivate the dream of quick and easy enrichment. This should not be encouraged any further, as the costs of a crash could be extremely damaging for all economies, no matter their size. The pandemic of the last two years worsened the financial and monetary stability of most countries. A combination of this with the disastrous effects of a potential cryptocurrencies crash could be a lethal recipe for many, especially now in times of financial distress caused, inter alia, by the persistent pandemic of biblical proportions.■

![]() Alexandru M. TANASE, PhD, is an author and Ex. Associate Director, Senior Banker at EBRD and former IMF Advisor. These represent the author’s personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions/sources quoted. The assessment and data are based on information as of mid-January 2022.

Alexandru M. TANASE, PhD, is an author and Ex. Associate Director, Senior Banker at EBRD and former IMF Advisor. These represent the author’s personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions/sources quoted. The assessment and data are based on information as of mid-January 2022.

Adauga-ţi comentariu