Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

The transition, gold and crises

The title of this opinion could bring you the memory of the iconic Romanian movie "The Prophet, Gold and Transylvanians", shot in 1978, as the first episode from the well-known trilogy of the Centrala Romania Film.

Of course, we are not talking about this. The objective of this short article* is to explore some of the gold issues during the transition period of the former socialist countries to market economies which started after 1990 and especially its role during the last years when humanity was haunted by the most unexpected crises. These crises started with the pandemic in March 2020 (not yet finished), the geopolitical crisis provoked on 24 February 2022 by the aggression of the Russian Federation against Ukraine (with a very uncertain end as well), the energy crisis and its disastrous consequences on the living standards, Brexit (one of the largest crisis of European making, with a negative impact of more than 4% of Great Britain’s GDP), and many other health and sanitary crisis with major implications on inflation and macroeconomic equilibria. Clearly, we are living through a very turbulent time!

The transition, which started in 1990 after the falls (violent sometimes) of regimes in various socialist countries and the dissolution of the former Soviet Union in 1991, was a period which was wrongly predicted and aimed by some politicians (see also the case of Romania and its first transition program of Petre Roman Government) to last a limited period of just 2-3 years. In reality, in the cases of most countries, it lasted 2-3 decades or during one whole generation. Moreover, in some countries, the transition process to a market economy has not yet been closed. In some other cases of countries which declared themselves as "graduated" (see the case of Poland, Czech Republic, Slovenia, Hungary and others) or in other cases such as those of Ukraine, Bulgaria, North Macedonia, Albania, Republic of Moldova (Moldova in this article) etc., the current situation was gravely impacted by the Russian war in Ukraine and/or by regional political interests. The case of this latter country is a special one and would need a distinct analysis.

In October 2018, in an article called "Countries in transition should give more priority to gold", published by the prestigious magazine Emerging Europe, we advised a greater role for gold in the international reserves of some countries in transition, based on the refuge asset role played by gold even after the Smithsonian Agreement dated August 1971 when gold was "thrown out from the eternal city", to use a very adequate expression proposed by Academician Costin C. Kiriţescu. Throughout history, gold was permanently a way to preserve value. We believe that this role, despite being diminished and many times disputed, will continue to be played. Under these circumstances, the central banks from the transition or emergent countries need to find out an answer to the following question: how much gold is sufficient and what are the costs as compared to the benefits of holding this non-productive asset in the structure of the international reserves of the respective states?

Photo 1: Gold - the divine object or a "non-productive" monetary asset?

Source: National Bank of Romanian

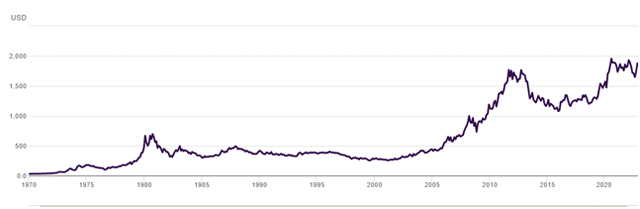

During its convoluted history, gold price, which was used in various forms as means of payment for some 3,500 years, was frequently manipulated during contemporary times. Even during these last years, prestigious analysts of capital and precious metals markets think that the gold price was manipulated to make it easier for large international debtors (such as the USA) to continue to borrow at lower costs. The international crises mentioned already led to the case in which the shares, T-bills and cash do not offer strong guarantees anymore for investors/holders and pushed the quotations for gold to very unusual levels, as presented in Graph 1.

Graph 1: Gold quotations during the transition (USD/ounce, 1/1/70 -16/02/23, LME)

Source: Fast Markets, ICE Benchmark Administration, Thomson Reuters, World Gold Council

The actual increase in the quotations of the key precious metals (such as on the London Metal Exchange – LME) during the last five years was, at the same time, to the benefits of the transition countries which had reasonable gold holdings within their international reserves (as was also the case of Romania) or had conducted public monetary policies after 2018 aiming to increase gold holdings as was the case of Hungary or Serbia. Under the well-known assumption that gold is a non-productive reserve asset, one justified question could arise of how much gold is sufficient to be held by the transition countries? Data from Graph 2 will help us to respond to this question.

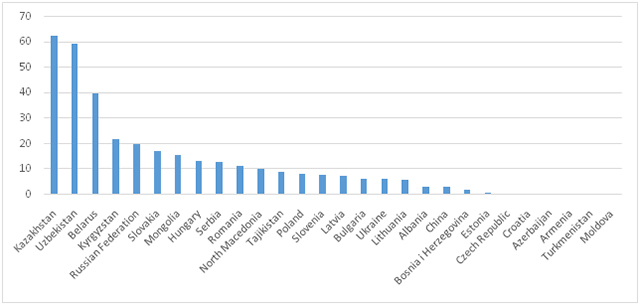

Graph 2: Share of gold holdings in total reserves (%) as of 30 September 2022

Source: Own computations based on data published by the central banks, IMF-IFS, World Bank and World Gold Council

Looking at the data, one can easily observe the large range of cases, starting with Kazakhstan and Uzbekistan which have gold holdings of over 50-60% of their total reserves up to the cases of other countries such as Croatia (country admitted on 1 January 2023 in the Euro Zone), Azerbaijan, Armenia, Moldova etc. in which cases the gold holdings are very modest or, from a monetary point of view, almost non-existent.

Based on the statistical data published by the World Gold Council, the central banks and the international financial organisation (IMF and World Bank) it is possible to compute a simple average of gold holdings within the total international reserves. As of end-September 2022, this share computed for a sample of 123 countries (including the USA) was at 12.21%. The USA case is, however, an unusual one and therefore we believe that it distorts the average for the whole group. If a new computation is done without the USA in the selected group, then the average was at 9.50% only, a level which we found more illustrative for the remaining 122 countries included in the computation. However, more illustrative is the case of the countries in transition where the average for 27 countries (inclusive of the Russian Federation) was as of the same date of only 6.92%. But even in this case, the presence in the group of the Russian Federation, which is indeed an important producer and holder of gold (together with China, Australia and South Africa) is distorting the result. Russia had major problems with the gold of other countries (see the case of 93.4 tonnes of gold and gold coins of Romania, sent for safekeeping to Moscow in 1916-1917 and which were never returned) and will also distort the average and the joint reality of many countries in transition. The exclusion of the Russian Federation from the group would result in an average of 4.80%, a level which we consider more representative and quite close to optimum.

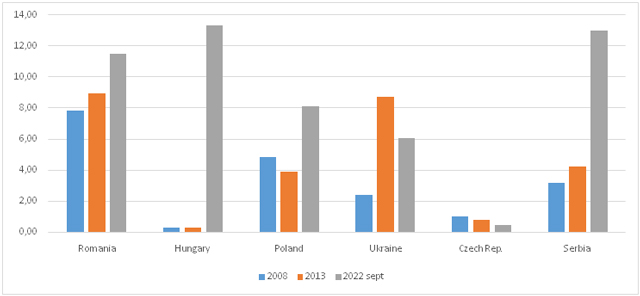

Graph 3: Gold/total reserves (%) 2008 - Sept. 2022

Source: Own computations based on World Gold Council data

If we are to judge based on the data presented in Graphs 1 & 2, it will be easy to conclude that Romania has an adequate policy regarding its gold holdings (11.5% of total international reserves**, respectively 103.6 tonnes of gold or 3.33 mln fine troy ounces with a market value of €5.9 billion as of 31 January 2023), holdings which are in the country and abroad (of which 60 tonnes deposited with Bank of England). These reserves, especially those held abroad, have a major positive influence in determining the country's rating and standing, based on which Romania, like other states, borrows from the international markets. In this particular case of Romania, it is even more important than in the case of other states as the indebtedness level of the country has already overpassed 50% of its GDP. With an external debt of €142.7 bln (as of end-2022), Romania needs guarantees, independently assessed, that it will be able to repay all its outstanding amounts related to its external debt. From this point of view, Romanian gold plays the role of the key pillar in the country rating architecture. Moreover, the extremely turbulent context at the northeastern border of Romania is one more argument regarding the level and the place where the gold holdings are kept. The lesson of the Romanian gold sent to Moscow over one hundred years ago for safekeeping and never returned should not be forgotten.

The case of Moldova is quite different as compared to Romania’s one from a few points of view. This young state declared its independence on 27 August 1991, in the aftermath of the dissolution of the former Soviet Union. From a monetary point of view, a historical moment was that of 29 November 1993, when the Moldovan Leu was issued with the help of the International Monetary Fund (IMF). During those years, Moldova had no external debt, but, at the same time, it should be noted that it has no international reserves and/or gold holdings. It is well-known that in the dissolution process of the former Soviet Union, Moldova decided on the following option: "no part of the foreign debt, but no part of international assets either", which explain from the historical point of view the lack of gold holdings. The starting point in transition "without external debt" was a major positive factor, but the lack of any gold holdings has haunted this currency up to nowadays. Moldova’s gold holdings started to be gradually consolidated, but their level is still low (valued at $4.5 mln as of 10 February 2023, following the data published by the National Bank of Moldova (NBM)) if compared with other states with similar economic potential as Moldova’s one.

However, the extraordinary advantage of starting the transition without foreign debt was speedily lost during the years of transition to a market economy. Currently, the accumulated external debt during the first three decades of transition has reached a high level ($8.9 bln as of 30 September 2022, which represented 62.1% of its GDP, according to NBM), and the current geopolitical context is not favourable anymore as the one which prevailed after the independence declaration. More than other countries in the region, Moldova has suffered a strong economic, financial and humanitarian impact following the war started by the Russian Federation against Ukraine one year ago (24 February 2022). Moreover, Moldova needs to ensure its energy resources are from alternative sources, other than traditional ones. In all these undertaken efforts, Moldova was fully and constantly supported by the European Union (the country has currently a candidate status since 2022), international financial organisations (especially by the IMF, World Bank, EBRD, EIB and others), and the European and international community (especially the USA). Since 16 February 2023, Moldova had a new Government, with a new Program which will require special efforts and continuous, constant and consistent international support, in an extremely difficult geopolitical context.

Both in the article published back in 2018 and in the current one, we have recommended that transition countries should consolidate their gold holdings. Apart from a monetary impact as such, the presence of gold within the international reserves of a certain country has a powerful psychologic impact. This very fact has been even more valid under the current conditions when we are navigating through "uncharted waters".■

_________________________________________________________________________________

Alexandru M. Tanase, PhD, is an Author and Ex. Associate Director, Senior Banker at EBRD London and former IMF Advisor.

Alexandru M. Tanase, PhD, is an Author and Ex. Associate Director, Senior Banker at EBRD London and former IMF Advisor.  Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris.

Mihai Radoi is a Director of a specialised Investment Fund focused on Eastern Europe and former Executive Director of Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris.

These represent the author’s personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions/sources quoted. The assessment and data are based on information available as of end-February 2023.

_________________________________________________________________________________

* A shorter version of this article written in the Romanian language, signed by the same authors, was published in Ziarul Financiar, Romania on 13 February 2023.

** Technically, the increase in the share of gold in Romania's international reserves is due to an increase in the price of gold in foreign markets. The physical amount of gold held has remained relatively constant.

Adauga-ţi comentariu