Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Cryptocurrencies and interest rates: negative correlation

The specialised literature, as well as the one which is addressed to the general public, has dedicated large spaces to a phenomenon which finally was baptised with a pompous term, namely: "cryptocurrency industry". As a matter of fact, we are speaking about a huge "casino-type" activity where immense amounts of money were invested, with many of the "investors" in such a game having lost, simply, all their money invested in cryptocurrencies, via either loss of value or price collapse or, worse, via frauds.

As far as we are concerned, we have shown repeatedly that clear regulations are needed to be issued by the central banks* or by other regulatory bodies and from international financial organisations (like the International Monetary Fund (IMF), for instance, within the programs with member countries). More than ever, during the actual global crisis more financial education** is required, whose objective should be to send a very clear message: these "innovations" are in fact assets without any intrinsic value and investors should be prepared to accept the total loss of invested money (what actually happened in many cases).

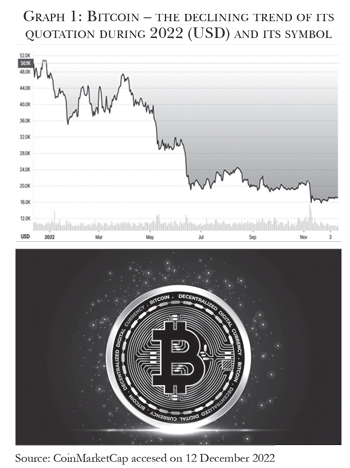

We have lived through an unorthodox regulatory environment with low or negative interest rates which prevailed until last year on the international capital markets. In some cases, the low or negative interest rates were kept in force by some central banks and European Central Bank for very long periods. Therefore, the commercial banks could not pay any interest for money kept in the large majority of current accounts or they have granted such interest at modicum or deleterious levels (0.01%). The interest rates paid for long-term deposits were also very low which was not justified from an economic point of view. This very fact determined savers to look for other instruments/opportunities to invest. This was one reason for the cryptocurrencies to thrive, as they started to be used not only by professional investors but also by the general public persuaded, especially during the crisis times, by the so-called "influencers" or "opinion makers" (highly and well-regarded personalities from business, arts, some journalists and the likes). Currently, (as of 6 January 2023), in accordance with data published by CoinMarketCap, there are more than 22,200 cryptocurrencies, whose market capitalisation has dramatically decreased from over $2 trillion in 2021 to some $814.0 billion. The evolution of quotations for Bitcoin (the cryptocurrency which has a share of 39.7% of the total capitalisation) during the last year is presented in Graph 1.

We have lived through an unorthodox regulatory environment with low or negative interest rates which prevailed until last year on the international capital markets. In some cases, the low or negative interest rates were kept in force by some central banks and European Central Bank for very long periods. Therefore, the commercial banks could not pay any interest for money kept in the large majority of current accounts or they have granted such interest at modicum or deleterious levels (0.01%). The interest rates paid for long-term deposits were also very low which was not justified from an economic point of view. This very fact determined savers to look for other instruments/opportunities to invest. This was one reason for the cryptocurrencies to thrive, as they started to be used not only by professional investors but also by the general public persuaded, especially during the crisis times, by the so-called "influencers" or "opinion makers" (highly and well-regarded personalities from business, arts, some journalists and the likes). Currently, (as of 6 January 2023), in accordance with data published by CoinMarketCap, there are more than 22,200 cryptocurrencies, whose market capitalisation has dramatically decreased from over $2 trillion in 2021 to some $814.0 billion. The evolution of quotations for Bitcoin (the cryptocurrency which has a share of 39.7% of the total capitalisation) during the last year is presented in Graph 1.

In short, we just wanted to remind our readers that Bitcoin was presented in a theoretical paper in 2008 by a person, Satoshi Nakamoto, or by a group of persons under this fake name (it was never clarified up to now) with the declared aim of obtaining monetary freedom against the central banks’ regulations considered then too restrictive and invasive. Bitcoin, which was launched in January 2009, is in fact a whole chain of codes obtained with the support of powerful computers. The "mining" activity is also linked to deciphering those codes. Like all other cryptocurrencies, this is highly risky due to wild and frequent fluctuations in their price. During the last calendar year only, the quotation for this cryptocurrency fluctuated from the lowest level ($15,599.05) to the highest ($48,086.84), not to mention the historical maximum registered on 9 November 2021 of $67,549.74. It is quite clear that those who bought during these high quotation times have lost so far, just through the market movements, some three quarters of their invested money.

Inverse correlation

Inverse correlation

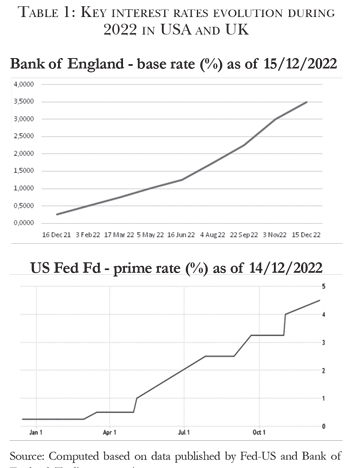

A closer look at the reasons based on which such an "industry" was established and developed is worthwhile. One of these reasons, maybe the most important from a monetary point of view, was the very low level of interest rates granted by the banks until recently. To bring into the discussion just two examples, data presented in Table 1 show, without any doubts, the extremely low levels of interest rates used in the USA and Great Britain up to the end of 2021. Basically, in these two countries and in Japan and Eurozone through the European Central Bank, the rates were kept at such low levels to support the economic re-launch so much needed after the great crisis of 2008. This monetary policy had been efficient up to a certain moment, but its use was unjustifiably prolonged. This interest rate policy, together with another invented instrument after the 2008 crisis (Quantitative Easing or QE) had major inflationary consequences. A word about QE would be just to mention that the effects on the prices (see the case of residential properties) are not yet clear and maybe a dramatic decrease could follow. The combination of these instruments with the negative impact of the COVID pandemic over the last three years and with the major negative impact of the energy crisis (unleashed by Russian Federation aggression against Ukraine since February 2022) has significantly contributed to the serious situations in which the majority of countries find themselves now.

Generally speaking, to demonstrate a statistical correlation between two series of numbers, a computation of correlation coefficient is required, a coefficient which is called in specialised terms as "r". The correlation between the level of interest rates and cryptocurrencies quotations is evidently a negative one (with "r" close to -1), that is when the interest rates are increasing, the quotations will decrease. The evolution of key interest rates in Table 1 and the quotations of the main cryptocurrency in Graph 1 demonstrate the inverse correlation of the two statistical series. As if it was not obvious enough! Quod Erat Demonstrandum! In reality, this was evident as that saving money had only a few options, of which cryptocurrencies were one, together with investing in gold, in order to maintain the value of assets. It is known, however, that gold lost its fundamental role to maintain its value after the Smithsonian Agreement in 1971 when it was "thrown out from the eternal city", as Academician Costin Kiritescu put it.

One other important reason identified by the emeritus economist G. C. Furtună, the Founder and the first President of MAIB, currently renamed as maib, (May1991-April 1996 and then Vice-president and member of the bank’s Council), would be the surplus of the monetary base (usually measured with the M3 – Broad Money indicator in accordance with the IMF statistics) in many of developed countries and, implicitly, at the global level, which made possible the appearance and flourishing of cryptocurrencies (as noted, over 22.200 of cryptocurrencies in circulation now). It may look strange at prima facie that in a situation, in which the monetary base is abundant/over-dimensioned and benefiting from free circulation, such assets appear with no intrinsic value and with no known issuers. Such a situation could be linked, on the one hand, to the declining trust in the US dollar as a refuge/reserve currency. On the other hand, the use of cryptocurrencies to hide income from illegal traffic with arms, drugs or even with human beings/prostitution and the fiscal evasion which is coming with this, could be another explanation. It is hard to imagine, especially due to a lack of the required political will, if there will ever be a success in reducing, even in a gradual manner, this monetary surplus by the developed states. This is more so in a situation in which there are currently forces and even states with very different and growing interests in this respect.

"Ethics" of the so-called industry and responsibilities

It goes without saying that cryptocurrencies’ evolution did not have just one cause. The large international financial scandals, in which parts related to fraud and/or money laundering were key factors, have profoundly shaken the cryptocurrency industry. The most recent example of this nature was that offered by the filing on 11 November 2022 in the USA for art. 11 by the trading platform FTX (the second largest in the world, with its HQs in the Bahamas), in the aftermath of which some one million creditors were not able to recover their invested money. Also, some other partners of this platform went bankrupt and were arrested. The Executive President and Founder, Sam Bankman-Fried, (who had a personal loan from the company of one billion USD and who was, strangely, close to the main political parties in the USA and financier of some of them) was arrested on 12 December 2022 in the Bahamas and extradited and then released on bail of $250 mln! However, his investigation by the American authorities will, most likely, not lead to the recovery of the invested funds by the large part of investors. Basically, a financial empire of some $32 billion was destroyed in a matter of days.

Responsibility for such a disaster must be shared between more participants. First of all, we are speaking about those who launched and have operationally managed such kind of platforms and their partners. In a bizarre way, some of these people speak about such huge losses covered by investors as a "normal event". "It happens sometimes!" or "Not guilty!" – some of them lament themselves post-factum. Such an attitude is unacceptable and only proves a gross lack of morality and a tendency to run away from responsibility. Moreover, the US Securities Exchange Commission, which is in charge to regulate this market, cannot be exonerated. Also, the central banks from many countries bear the burden of such responsibility, even in those cases in which the general public was warned that all the invested funds could be lost. Some celebrities who promoted this platform are, at the same time, investigated by the authorities and they are, of course, responsible for such monetary failures.

This recent scandal is not the first one and, most likely, will not be the last one either. Let us remind ourselves of the cryptocurrency "queen" of Bulgaria who led a large scam during the last recent years and is now sought after by the FBI for a fraud case of $4 billion. Another recent one is the case of Squid Game, with a fraud of millions of dollars undertaken by the technique of "rug pull" (that is attracting the investors, then closing the sites and disappearance of those involved).

The major voices from the international banking community have requested a long time ago that this sector of cryptocurrencies be regulated. The former Governor of the Bank of England, Mark Carney, as well as the current Governor, Andrew Bailey, the President of the International Bank for Settlements, Augustin Carstens, and governors of central banks, amongst which the Governor of the National Bank of Romania, Mugur Isarescu, Governor of the National Bank of Moldova, Octavian Armasu and, more recently, the IMF, to give just a few examples, have repeatedly requested clear regulations in this respect. The impact of the accumulated money in such assets and then their major fluctuations are only a few of the arguments used by those who asked for adequate regulations which would need to clarify these assets’ status, the way of avoiding money laundering and/or those of financing international terrorism and the taxation regime of the income from cryptocurrencies transactions as well. In reality, only very modest attempts were made to date, without implementing a uniform global regulation as it would have been (and still is) needed. The transparency in this sector continues to suffer.

Cryptocurrencies in Eastern Europe

Cryptocurrencies were initially a specific feature of the developed markets at the time when this gigantic "casino" was created. Meanwhile, however, mining has extended to Eastern Europe as well in those countries in transition to a market economy. Among those, the Russian Federation has played a "pioneering" role if one takes into account its lax regulations in this field, the availability of electricity and the low temperatures which are favourable to a more efficient mining process. Bulgaria and other former socialist countries are just other cases. In Transnistria (an internationally unrecognised region, but supported by the Russian Federation) there were mining activities on a large scale too. The electricity supplied to Transnistria was kept at very modest prices (or free of charge in some cases of fraudulent connections to the national electricity grid), which favoured the mining.

There is also currently a cryptocurrency of Romanian origins (the former Elron, re-named Multivers X, with major fluctuations of quotations), which is currently ranking among the first 40-50 cryptocurrencies with the largest market capitalisation.

Finally, we consider that both the developed countries and the emerging ones or those in transition, together with the international financial organisations are supposed to regulate the issue of cryptocurrencies as soon as possible globally and uniformly. Any further delays will lead to even greater shocks on the capital markets and, ultimately, to the need for some measures and social efforts even more painful to stave inflation, this scourge of the last few years.

Mihai RADOI is a Director of a specialised Investment Fund focused on Eastern Europe and a former Executive Director of the Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris. These represent the author’s personal views.

Mihai RADOI is a Director of a specialised Investment Fund focused on Eastern Europe and a former Executive Director of the Anglo-Romanian Bank, London, and previously of the BFR Bank, Paris. These represent the author’s personal views.

The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions/sources quoted. The assessment and data are based on information as of early-January 2023.

Short Interview at 100 articles

Alexandru M. Tanase, PhD, is a former Director, Senior Banker at EBRD and former IMF Advisor. Currently, in a new position as an independent author, he tries to transmit to future generations as much as possible from his over five decades of experience as a banker and/or in the field of public and international finances. "Cryptocurrencies and interest rates: inverse correlation" is his 100th written and published article. On this occasion, Profit Review publishes a short interview with Mr Tanase.

Alexandru M. Tanase, PhD, is a former Director, Senior Banker at EBRD and former IMF Advisor. Currently, in a new position as an independent author, he tries to transmit to future generations as much as possible from his over five decades of experience as a banker and/or in the field of public and international finances. "Cryptocurrencies and interest rates: inverse correlation" is his 100th written and published article. On this occasion, Profit Review publishes a short interview with Mr Tanase.

Recorded by Ilona Navruc

Profit: Mr A. M. Tanase, you have been present in the pages of our publication quite frequently. So, you have had a prolific activity?

A.T.: Yes, many thanks for this honour to have been published by such a prestigious magazine of the Republic of Moldova for many years. However, I have to mention that apart from Profit Review I have managed to publish many articles in other publications from Romania, Moldova, Japan, USA and Great Britain as well, such as Romanian Financial Times, BNE Intellinews, Emerging Europe, History Magazine, History Review, Public Finance and Accounting Review, Romanian Language Review and others. This last article is the 100th one. Apart from articles, together with Mr Mihai Radoi, I published a book in 2021: Finance and Current Monetary Issues (in Romanian and English), which can be currently found at great national and university libraries in the world, such as British Library, London.

Profit: What are the key messages which you would like to send to your readers?

A.T.: Throughout my efforts, or together with other partners, I have wished to bring a modest point of view on the macroeconomic equilibria/disequilibria such as inflation, GDP, gold, money and banks’ role during the transition to a market economy of the former socialist countries, risks related to cryptocurrencies for all countries in the world, external debts level, the issue of interest rates and many such other major topics. I have always tried to combine the learned lessons of the past with current efforts to identify solutions for contemporary problems which are more and more numerous and more difficult to solve, especially during the pandemic, energy and/or geopolitical crisis.

Profit: Who are your readers?

A.T.: Over the years I have received comments, appreciation and alternative points of view from various categories of readers, but the most important achievement of my writings would be the response from students in economics, finance and banking. If some of my articles have contributed in the least to the professional training of future generations, this would make me happy "beyond measure", to use one of the expressions coined by our greatest national poet Mihai Eminescu.

Profit: Do you consider that you succeeded and/or are you going to continue?

A.T.: My goal was, is and will continue to be in the future to transmit as much as possible to future generations from my modest experience of over five decades gained at prestigious institutions such as the Ministry of Finance – Bucharest, International Monetary Fund – Washington DC and European Bank for Reconstruction and Development – London. If I succeeded or not, only time will tell us.■

_____________________________________________________________________________________________

* See A. Tanase - Criptomonedele – viitorul banilor? Cryptocurrencies – future of money? in Revista Profit no. 4/April 2019, Chisinau (Romanian and English).

** A shorter version of this article was published by Ziarul Financiar, România on 5 December 2022 (in Romanian). See Opinion - A. M. Tanase and M. Radoi - The link between cryptocurrencies and interest rates….

Adauga-ţi comentariu