Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Banks and interest rates during turbulent times

Banking activity, both retail and commercial, has changed fundamentally in recent years. These changes were possible due to new information technologies which have revolutionised the banks’ interactions with their clients. Moreover, the last two years of the COVID-19 pandemic and the recent geo-political crises in Eastern Europe, the energy crisis and the out-of-control inflation in the majority of countries have had a major impact on commercial banks’ activities. The central banks and other regulatory bodies are required now to introduce adequate measures to the new realities. The above-mentioned crisis has impacted the macroeconomic equilibria, will reduce the global economic growth and will stimulate inflation and the central banks and the commercial ones must be prepared for these changes. The utilisation of interest rates as instruments to stave inflation became imperious.

1. Commercial banks

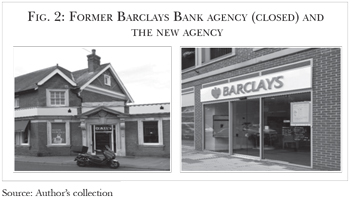

Over the last decade, commercial banks from developed countries have suffered essential changes in their constant endeavour to ensure the required profits for development and investment. However, it should be noted upfront that not all changes were in favour of the clients as well. A more detailed analysis is needed. One trend which could be labelled as strange at first sight was the dramatic decrease of the number of bank units (branches, sub-branches, agencies, representative offices and the like). The case of Great Britain, as presented in Graphic no. 1 below, is not the only one. Apart from the normal mergers and acquisitions process where the elimination of double presence of certain banks was the rationale (in many cases the units were double present in the commercial centres or in the local communities), a reduction of the bank's units took place pure and simple. The reasoning in this latter case was provided by a banking ratio from the efficiency system of indicators, namely the cost-income ratio, other than interest incomes. Many commercial banks argued for these closures with the reduced number of clients who would actually come into a bank to make a banking transaction.  This is an obvious development in the banking communications era in which banking transfers, payment of services, opening/transacting/closing accounts and the likes could be done online. One other key development which was used by the banks as a reason to close their territorial units was the utilisation of cash or cheques for making payments less frequently. Many of the banks’ units which were located in very well-known spots in the commercial centres became overnight cafeterias, coffee shops or empty spaces, as presented in Fig. 1 and 2, left. In some other cases, the banks decided that instead of the old branches to open smaller agencies in new buildings which are more efficient from the cost point of view. To come back to the case of UK banks, the number of territorial units decreased from 9,807 in 2015 to 4,949 estimated for this year (effectively half of them are gone). This was called "branch apocalypse". The list of the banks which make such reductions is long. Between 2019 and 2021, a total number of 1,221 units were closed by TSB (260 units), Barclays (260), Santander (193), HSBC (the largest British bank and one of the banking giants in the world - (116)), Lloyds Bank (110), NatWest Group (54), to mention just of few of the most significant cases, in accordance with data published by The Times. In developed countries, virtual banks already appeared, without any territorial networks and without contacts with their clients, apart from online services.

This is an obvious development in the banking communications era in which banking transfers, payment of services, opening/transacting/closing accounts and the likes could be done online. One other key development which was used by the banks as a reason to close their territorial units was the utilisation of cash or cheques for making payments less frequently. Many of the banks’ units which were located in very well-known spots in the commercial centres became overnight cafeterias, coffee shops or empty spaces, as presented in Fig. 1 and 2, left. In some other cases, the banks decided that instead of the old branches to open smaller agencies in new buildings which are more efficient from the cost point of view. To come back to the case of UK banks, the number of territorial units decreased from 9,807 in 2015 to 4,949 estimated for this year (effectively half of them are gone). This was called "branch apocalypse". The list of the banks which make such reductions is long. Between 2019 and 2021, a total number of 1,221 units were closed by TSB (260 units), Barclays (260), Santander (193), HSBC (the largest British bank and one of the banking giants in the world - (116)), Lloyds Bank (110), NatWest Group (54), to mention just of few of the most significant cases, in accordance with data published by The Times. In developed countries, virtual banks already appeared, without any territorial networks and without contacts with their clients, apart from online services.

All these arguments are right, but life is a little bit more complicated. This is how in many villages, communes or smaller local communities, the number of present banks was reduced from 4-5 to one or even none. The situation was even more alarming in many cases in which the clients (especially those living in the rural zones) are forced to travel 10-20 km to reach the nearest location of the banks where they need to do a transaction. The situation is even more dramatic in the case of retired people and older clients who do not have enough developed IT skills to implement online transactions or in the case of those (mainly rural) zones, where the internet signal is weak or is not available at all. At the same time, one of the most affected segments of clients is the less affluent ones who prefer to work in cash in order to avoid a degree of indebtedness which could be out of control when credit cards are used. In many such cases, complaints were submitted even to the British Parliament and Government. Apart from the closing down of units, the commercial banks have implemented one more change which is also difficult to understand, namely the reduction of the number of ATMs(Automatic Teller Machines). Because of fierce banking competition, many banks were forced to reduce the fees charged for ATMs utilisation and many transactions were basically free of charge (cash withdrawal, interrogation of outstanding balances etc.). The operating costs of these ATMs have finally led to the closure of many such machines, which has affected even more the clients of the respective banks. The total number of ATMs in the country has been reduced from 53,008 in 2018 to 40,830 in 2022, according to data published by Which? magazine.

2. Interest rates during inflationary times

A contemporary definition of the interest, which is correct from a banking point of view, is that published by Investor Words which defines the interest as "a price paid by the borrower to the lender for the utilisation of the borrowed money and which is normally defined as an annual percent from the borrowed amount"*.Together with the exchange rates, the interests are one of the key monetary instruments for the developed countries, for the developing ones and/or for the emerging markets as well, including for the countries in transition to a market economy. The developed countries prepare strategies for the level of interests, despite the fact that the public concept recommends that the level of interest should be determined by the market forces themselves. For instance, in the US, the level of interests is determined by the Federal System of Reserves(Fed), with declared objectives to first of all sustain the economic development and reduce inflation. Practically, the interests are the results of a set of indicators such as GDP, monetary base, unemployment, level of inflation, current account, investments, credit etc. Based on a very complex system of indicators, Fed takes decisions from time to time regarding the level of interest rates, as it did along its entire history, up to and including years of 2020 - 2022, convoluted years from geo-political point of view. Increases of prime rate were implemented during the last months (up to the current level of 2.25 - 2.50%) to stave a rampant inflation in USA (9.10% - June, the highest during the last 41 years). In Europe, one of the key term related to the interest is the well-known indicator LIBOR (London Interbank Offered Rate), which practically was a rate calculated daily, based on the proposals/offers submitted by the main commercial banks present in the UK. This is an indicator important not only for UK but for the international markets as well. The great majority of international borrowing transactions were and some still are based on LIBOR. After EUR introduction in what is called Euro zone, EURIBOR, as published by the European Central Bank (ECB), started to be used in parallel with LIBOR. Despite all of these, LIBOR was undermined a few years ago by a series of major scandals of "manipulation" and was replaced with SONIA. Starting on 1 January 2022, many LIBOR quotes are not published anymore. SONIA index (Sterling Overnight Index Average) was present in the capital markets since March 1977, but was reformed by Bank of England in 2018. This indicator is the average of the interest rates paid by the banks for overnight borrowing (for one day). Since 3 August 2020,quotations started to be published for each working day in London. In short, the LIBOR scandal is a clear illustration that, in some cases, the interests are manipulated depending on the objectives of those who participate in their computation.

In Europe, one of the key term related to the interest is the well-known indicator LIBOR (London Interbank Offered Rate), which practically was a rate calculated daily, based on the proposals/offers submitted by the main commercial banks present in the UK. This is an indicator important not only for UK but for the international markets as well. The great majority of international borrowing transactions were and some still are based on LIBOR. After EUR introduction in what is called Euro zone, EURIBOR, as published by the European Central Bank (ECB), started to be used in parallel with LIBOR. Despite all of these, LIBOR was undermined a few years ago by a series of major scandals of "manipulation" and was replaced with SONIA. Starting on 1 January 2022, many LIBOR quotes are not published anymore. SONIA index (Sterling Overnight Index Average) was present in the capital markets since March 1977, but was reformed by Bank of England in 2018. This indicator is the average of the interest rates paid by the banks for overnight borrowing (for one day). Since 3 August 2020,quotations started to be published for each working day in London. In short, the LIBOR scandal is a clear illustration that, in some cases, the interests are manipulated depending on the objectives of those who participate in their computation.

Moreover, sometime the interest are (indirectly) influenced by the politicians which try to obtain the votes and which, usually, fixed the rates at low levels to obtain the votes of the many who borrow. The major problems which the central and commercial banks are currently facing is that, in many cases, the interests, as monetary instruments, were/are artificially kept at low levels to stimulate the economic growth. The case of interest rate in England is an obvious one. Bank of England has kept the base rate at an unprecedented low level since the financial crisis in 2008 to stimulate the economic growth negatively impacted by many crisis amongst which Brexit, Covid-19 pandemic, inflationary consequences of some great financial and monetary relaxations (QE), costs of the international role played by this country and many other similar factors. The impression was even created that the low level of interests is the "normal" one, which was obviously wrong. The increase of the base rate from 0.10% to 0.25% on 16 December 2021was the first step in the right direction.Since4 August 2022, the base rate reached 1.75% (increased from 1.25%), with a clear upward trend in the future. However, the commercial banks in this country did not transfer all and/or operatively these modest increases to those saving for their deposits with the banks.

If a certain client receive from the commercial banks an interest of 0.01%or even nothing for its money held in current accounts, it is clear that the respective person will focus on other instruments, of which one is that of the cryptocurrencies. Of course, the argument that low interest rates will help the economic growth is a valid one, but this is not the whole story. There are some limits in this regard. On long term, the interest cannot be kept in negative territories (this is how the European Central Bank did up to 22 July 2022, when it finally abolished the negative interest rates which are now fixed at zero for the first time after 11 years) as this will bring the economic and banking world into unchartered waters in which no economic forecast could be made and the fight against inflation will be almost impossible.

The quantitative easing (QE) are known in the specialised literature as euphemism for printing money, a label which in fact we support. For this case it is also possible to argue that this instrument also helped the economic relaunch in difficult conditions. It was used by the USA, European Union (UE) (via the ECB), Great Britain, Japan and other countries. As a matter of fact, QE as monetary instrument would deserve a distinct analysis in view of its strong inflationary effects this instrument has.

3. Romania and Moldova cases

Both in Romania and the Republic of Moldova (Moldova in this article), the transition process which started in the early ’90 had brought a rapid extension of the number of private banks. At the same time, new banking technologies started to be implemented. The case of bringing the first ATM in Moldova by one of the large commercial banks is illustrative. During the years of 1996-1997, the executive management of the respective bank raised the issue of the costs involved by the first ATM in the country. It was sincerely believed that these would need to be permanently guarded by the police to avoid hold-ups. It was later demonstrated, of course, that such a cost was not needed as soon as population started to understand the major benefits of these banking technologies. Today, in both countries, the presence of AMTs is something very normal and appreciated as such by the clients of commercial banks. In Romania, CEC Bank has the largest territorial network. The number of units held by the commercial banks in Moldova decreased from 661 as of end-2020 to 619 as of end-May 2022, according to NBM data. It is possible that in both countries we will assist in the future at the establishing of the first virtual banks, based on the models already developed.

Like in the case of many other countries, the issue of interests in Romania must be analysed from a historical, economic and even social prospective. Currently, the base rate is still low if compared to the level of inflation of 14.94% (July) (despite the fact that a few increases were implemented by NBR), namely at 5.50% per annum starting on 8 August 2022 (increased from 4.75%), according to the published data. Starting on 10 January 2022, NBR decided to adjust also the interest fluctuations around the base rate (symmetric corridor) at +/- 1.00% from +/- 0.75%. Three month ROBOR, which is a key indicator for mortgage loans, increased to 7.93% in the first part of September 2022.

The level of interests is clearly higher (21.50%, increased since 4 August 2022 from 18.50%, with a symmetric corridor of +/- 2.0%) in Moldova to reduce the much higher inflation in this country (34.29% in August 2022). However, what is specific in this case is the very complex geopolitical situation. The consequences of the military conflict started on 24 February 2022 ("special military operation" of Russia in Ukraine) were obvious and of immediate nature for Moldova. As of now, more than half a million of refugees from Ukraine crossed the border of the country, of which some 85,000 remained in this country and this had a major impact on the budget and, consequently, on banks, inflation and interests. This case deserve a detailed analysis as soon as the military conflict will stop.

These levels of interest rates could have a positive effect on the credits extended to the real sector of economy, but, at the same time, they have a perverted negative impact, like in the developed countries, on the savings of the population and on its attitude regarding the saving process. There is, of course, no incentive to save in a currency which depreciates itself and which does not offer a meaningful interests to start with. Even more, the trust of the population in their national currencies and in their purchasing power will have a decreasing constant trend in real terms (adjusted to inflation). Those saving will need to continue waiting until will make sense to save again and to keep the money with the commercial banks.

3. Instead of conclusions

We believe that will be quite risky to draw a unique or definitive conclusion to this article. What could be clearly said is that the "normal interest" level is one of the key macroeconomic instrument with efficient functions verified over hundreds of years. The interest rates had played and will continue to play a major role in any society over the foreseeable future. If this instrument will be used based on strict economic reasons, its efficiency will no doubt be high. The amassing of large debts (such as mortgages, credit cards, personal loans, loans for cars and other white goods, leasing etc.) has become a distinct feature of many developed markets. And not only. The key objective of the financial stability, namely to keep inflation under control, is in danger if the law interest rate policy will continue.  The central banks have the statutory obligations to eradicate without delays these trends. The monetary discipline must be reinstated! The last two years pandemic has impacted the financial and monetary stability in many countries. A combination of the disastrous effects of this pandemic of biblical proportions with, for instance, a potential crash of cryptocurrencies (another artificial monetary instrument which is highly risky and unregulated so far) could be fatal for many, especially during times of financial stress. To all of these, the financial consequences of the war between the Russian Federation and Ukraine will also add, without doubt, together with the economic and monetary consequences of energy and foods crisis of 2022.

The central banks have the statutory obligations to eradicate without delays these trends. The monetary discipline must be reinstated! The last two years pandemic has impacted the financial and monetary stability in many countries. A combination of the disastrous effects of this pandemic of biblical proportions with, for instance, a potential crash of cryptocurrencies (another artificial monetary instrument which is highly risky and unregulated so far) could be fatal for many, especially during times of financial stress. To all of these, the financial consequences of the war between the Russian Federation and Ukraine will also add, without doubt, together with the economic and monetary consequences of energy and foods crisis of 2022.

For the emerging markets, all of the above will apply mutatis mutandis. It is very likely that the commercial banks from Romania and Moldova will adjust their territorial networks and the ATM number along with the implementation of new IT technologies and with the improvement of banking education of the population. We believe that the specific needs of this group of countries will be taken into account by the international financial institutions and, on a case-by-case basis, by the European Union (EU) (within the National Plans for Reconstruction and Resilience) and by other major participants in the international financial and capital markets. Romania is a full member of the EU since 1 January 2007 and Moldova obtained the EU candidate state status quo on 23 June 2022, at the same time with Ukraine. It goes without saying that the own efforts of those affected by the pandemic, by the geopolitical, energy and foods crisis will need to be encouraged. In this international unprecedented environment, Romania and Moldova will also need to integrate in the international democratic efforts, which efforts are led by the EU, USA and other developed countries.■

* See also Alexandru M. Tănase – Interests and interest rates: Macroeconomic tools or distorting instruments? - a study published by "Central Bank Journal of Law and Finance" - year IV, no. 2, 2017 of the National Bank of Romania.

Adauga-ţi comentariu