Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Moldova: Three decades of banking changes

In an article recently published by Profit Magazine (no. 10/2020) on the major changes in the old banking city of Bucharest, it was mentioned that the banking sector of the Republic of Moldova (Moldova in this article) deserves a distinct analysis. The early starts of the Moldovan banking system and its evolution are indeed unique and they differ from many points of view when compared with other countries which started their transition more than 30 years ago. At the same time, the process was in a way similar to that of other Republics of the former Soviet Union (USSR), save for the Baltic states. We hope that this modest contribution will serve as a starting point for an encyclopaedia of the Moldovan banking sector for future generations, especially in the context of two largest banks celebrating in 2021 three decades from their respective registrations.

Early banking starts

The Moldovan banking system was established in a substantially different manner as compared with that of Poland, Hungary, Romania, the Russian Federation and the Czech Republic etc. Moldova inherited from the former Soviet Union four branches/regional divisions of the former state specialized banks of the USSR, including banks for:

a) food industry and agriculture and cooperative trade;

b) industry and large constructions;

c) local communities, state trade and social service for the population;

d) the former savings house which was transformed in a bank with additional attributions in extending private mortgages.

In those days, the accounts of the state budget, including the financing of the state budget, were open with all those four banks, as the case may have been. All activities of these state-owned banking divisions (with the exception of Banca de Economii) were taken over by the new three commercial banks as joint-stock companies, in accordance with the Government of Moldova’s Decision dated 8 May 1991.

After the dissolution of the Soviet Union in 1991, the issues related to the state ownership in the banks were finally resolved for good in a period of a few years thereafter. New banks became universal ones in a short period of time. Thus the largest commercial banks of Moldova were established: Moldova-Agroindbank (MAIB), Moldindconbank (MICB), Banca Socială and Banca de Economii (the last two banks and Unibank had entered into a liquidation process in 2016). Eximbank was established later, on 29 April 1994, through a reorganisation as well. All these banks were initially closed joint-stock companies, but in 1997 legislative changes were introduced, according to which the banks were transformed in open joint-stock companies. Currently, the Moldovan banking system does not include any banking institutions from the left bank of Dniester River, despite the fact that some private banks had branches in this region, which were closed following the recommendation of Moldova’s foreign partners.

After the dissolution of the Soviet Union in 1991, the issues related to the state ownership in the banks were finally resolved for good in a period of a few years thereafter. New banks became universal ones in a short period of time. Thus the largest commercial banks of Moldova were established: Moldova-Agroindbank (MAIB), Moldindconbank (MICB), Banca Socială and Banca de Economii (the last two banks and Unibank had entered into a liquidation process in 2016). Eximbank was established later, on 29 April 1994, through a reorganisation as well. All these banks were initially closed joint-stock companies, but in 1997 legislative changes were introduced, according to which the banks were transformed in open joint-stock companies. Currently, the Moldovan banking system does not include any banking institutions from the left bank of Dniester River, despite the fact that some private banks had branches in this region, which were closed following the recommendation of Moldova’s foreign partners.

From the very beginning, the largest commercial bank of Moldova was B.C. Moldova-Agroindbank S.A.. It began its activity on 8 May 1991, by reorganizing the regional division of Agroindustrial Bank of the USSR. As of end-1991, MAIB had entered its transition period with a balance sheet of 28.9 billion Soviet ruble and has succeeded through adequate managerial policies to increase its total assets, total own funds, number of clients, loan portfolio and attracted deposits (currently, the total assets of MAIB amount to 28.28 billion lei). The second-largest bank – Moldindconbank, established on 25 October 1991 through the reorganisation of State Bank for Industry and Constructions of the former USSR, has had a more tumultuous evolution, intertwined at certain points with Investprivatbank, another bank currently in liquidation. Both MAIB and MICB have at present time strong shareholders, which will allow them to have a sound further development.

Despite all the advantages bestowed on them at their starting points (in view of the reorganisation of the regional Soviet banking divisions), all these banks were small as compared with the banks of other countries in transition. Banca Socială and Banca de Economii had disastrous endings after many years of mismanagement, especially during the last decade. Banca de Economii had registered a continuous process of contradictory changes regarding its shareholders. Finally, the state lost its controlling stake and became a minority shareholder. Also, it is worth noting that the commercial banks which overtook the regional divisions of the Soviet banks, became at the same time responsible (apart from their pure commercial activities) for the heavy costs related to free of charge services (up to almost 1998) for public finances accounts and for the accounts of many budgetary institutions as well.

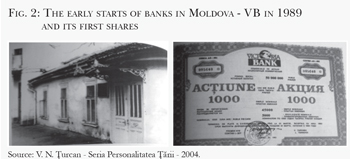

However, during the same period, Moldova offered a favourable environment for the development of the private banks which were established through a collection of some deposits from population and companies or through the attraction of existing customers from other commercial banks. This was the case of Commercial Bank Victoriabank (VB), the first private bank in Moldova established on 22 December 1989.

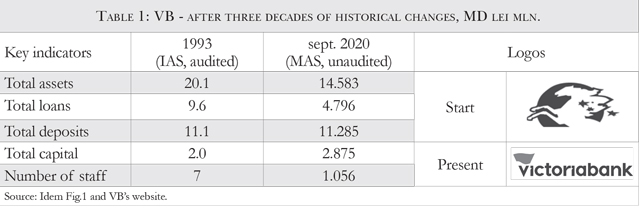

The pictures presented in Fig. 1 show its first shares and the early days of this bank, which finally after many difficulties, has succeeded to remain operational with the support of the European Bank for Reconstruction and Development (EBRD) and of other international financial institutions (IFIs). The founder and the main shareholder of VB managed to register the new bank with the former State Bank of the Soviet Union on 22 February 1990 (licence no. 246), in a period of time in which the Soviet Union had started to disintegrate. Two months later, on 12 April 1990, the first transaction was booked. On 1 September 1991, VB was reorganised as a joint-stock company and registered with the National Bank of Moldova (NBM) (licence no. 7). A branch network started to be developed immediately and Balti Municipality was selected on 1 February 1991 for VB’s first regional presence. This bank was the first and the most illustrative example of the immense difficulties faced by the commercial banks from their starts and up to nowadays. The spectacular evolution of this bank is summarized in Table 1.

International standards and relations with IFIs

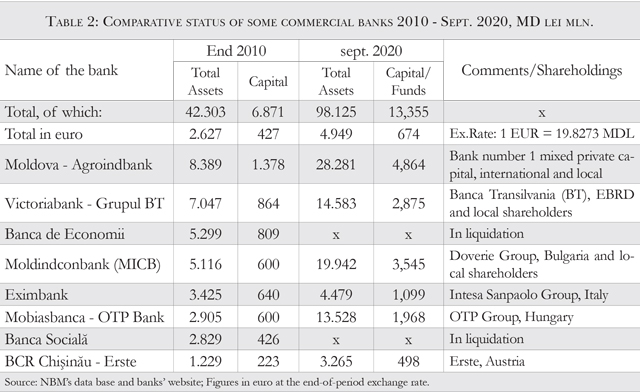

The accounting standards used by the commercial banks in the early days of transition were those inherited from the former Soviet Union. The secretarial works and correspondence, including those related to inter-banking payments and the banking terms, were all in the Russian language. The introduction of the banking terms expressed in the Romanian language was a very long and difficult process in which the international financial institutions (EBRD, IFC, IMF and others) have played a major role. All commercial banks from Moldova have started the gradual introduction of modern accounting and international audit. Many of them have succeeded to integrate themselves in the international banking system in a short period of time, but their expertise in this field has been still limited for a good part of the three decades of transition. A summary of major banking changes during the last decade is shown in Table 2.

Based on the data presented in Table 2, one can observe the dominant role played by the first four major banks (MAIB, MICB, VB and Mobiasbanca), and even more so the strong growth of MAIB during the last 10 years. Also, up to the fundamental changes in the shareholding structure of these four large banks, BCR Chişinău has been for decades a medium bank with professional management and with capital participation held by a prestigious shareholder (BCR Romania/Erste). As much as one can predict the future under the current pandemic crisis, these banks will continue to play a key role in the Moldovan market, if the political interferences will stop.

The big fraud (2012-2015), Laundromatand bankrupted/in liquidation banks

The big banking fraud in Moldova is unique amongst the transition countries. It will remain in the history of the Moldovan banks for many decades to come as a sad episode full of lessons to be learned. Since 2012 to the first part of 2015, the Moldovan banking sector suffered heavy losses, monetary and of credibility, in the aftermath of some fraudulent acts taken by a group of persons, amongst which high-level politicians, shareholders with wrong intentions and banks’ staff as well. These crooks benefited from the tacit approval/or from inactions of many Moldovan authorities. Basically, three banks (Banca de Economii, Banca Socială and Unibank) extended loans to some companies which were in special relations with a key shareholder. For all these non-performing loans, the NBM had to extend to the three banks emergency loans totalling 14 billion Lei ($1 billion at the historical exchange rates), despite the fact that there were no such regulations to allow this. These figures were later on confirmed by a few reports prepared by Kroll, an auditor hired by the Moldovan authorities as part of the conditionality requested by IFIs and other external partners of Moldova. The fraudulent loans were never re-paid and finally, the state budget of Moldova had to take them as part of the public debt. This was a heavy blow to the Moldovan banking system and to its image and more so from an external point of view. The external financing has been blocked for more than two years. The three banks were forced into liquidation on 16 October 2015 and have currently liquidators appointed by the NBM. The loss was not recovered and there is no legal final decision in this respect, despite the fact that some politicians or shareholders were in jail meanwhile, but without paying back the amounts fraudulently cashed.

Apart from the three banks mentioned above involved in this resounding scandal, more banks (11) have been declared bankrupted or were in liquidation during these three decades of transition. Amongst them: Întreprinzbanca, Business Bank, Bancosind, Investprivatbank, Banca Guineea, Basarabia Bank, Banca Turco-Română, Oguzbank and Universalbank. Each of them had very different fates, but in essence, they did not observe the basic banking prudential regulations. One more heavy blow to the image of the Moldovan banking sector was the so-called Russian Laundromat, which was possible in the context of clear deficiencies of the banking supervision in Moldova. Some banks conducted money laundering transactions of colossal amounts of money from Russia (very different amounts are estimated, between $25 billion - $47 billion). Up to now, nobody of those involved and/or from those from Moldova who "benefited" had any accountability/legal responsibility for their actions or inactions.

At the same time, it should be noted that the NBM has not fulfilled its duties in accordance with its charter and/or in line with international norms of banking supervision specific for any central bank if a reference is only made to the big banking fraud, the Russian money laundromat and the bankruptcy of the other banks. Central bank and monetary policies

Central bank and monetary policies

Moldova declared its independence on 27 August 1991, but the NBM was established ahead on 4 June 1991. It had a very restrictive monetary policy, to begin with. The refinancing rate for commercial banks reached 377% in March 1994, a level which was unusual on the credit markets. The minimum reserves requirement for commercial banks were also quite high (in 1994 at around 28%). Later on, the refinancing rate was gradually reduced up to 19% in April 1996, and the regulated level for the minimum reserves requirement was relaxed as well from 12% as of end-1995 to 8% as of end-1996. Currently, the refinancing rate fixed by the NBM is of 2.65% (reduced from 2.75% on 6 November 2020).

At the early stage of transition, Moldova was one of the countries which implemented in an exemplary manner the programs agreed with the IMF regarding the limits on credits. But, the recent years, the implementation of the financial programs agreed with the IMF during was many times very difficult, a fact which had a direct impact on the commercial banks. Based on the results registered in the implementation of the reforms, Moldova succeeded to obtain good ratings from the main international rating agencies during the '90 (Ba2 - Stable from Moody`s on 14 January 1997). However, this advantage was lost due to the serious negative political and financial-banking evolutions, especially over the last five years. For instance, the last rating from Moody's Investors Service was B3 - Stable on 13 January 2017, and this was possible only after a new agreement with the IMF.

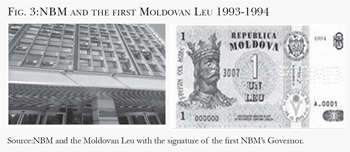

With respect to the national currency, Moldova is also a particular case. This country continued to use the Soviet ruble, then the Russian ruble and own coupons up to 29 November 1993 when, with the IMF support, it decided to introduce its national currency (the Moldovan Leu - see Fig. 3). The economic potential of this country was and still is quite high if compared to its geographic dimensions and human resources available, but this is used still in a reduced proportion. When the national currency was introduced, Moldova registered an obvious economic decline (-31% GDP in 1994 and -3.2% in 1995). Inflation reached a very high level (1.283% in 1993 and 587% in 1994) and the state budget had high annual deficits (around 5-8% of GDP). Under those circumstances, the Moldovan leu (MDL) still managed to remain relatively stable in the early days of transition. In November 1993, the exchange rate against the US dollar was established at 3.85 MDL/USD. By the end of 1996, the Moldovan leu registered only a mild depreciation up to the level of 4.65 MDL/USD. However, it had depreciated drastically up to the level of 20.87 MDL/EUR and 20.04 MDL/USD by the end-2016, mainly due to the banking fraud. Currently, this currency is quoted at 20.20 MDL/EUR and 17.12 MDL/USD (11 November 2020).

Despite the fact that it did not inherit any part of the debt of the former Soviet Union (Moldova opted for the so-called "zero option" in which it was not responsible for any part of the external debt, but it did not claim any external assets of the former Soviet Union either), the external debt of Moldova started to build up rapidly, reaching the level of over $1 billion in 1997 or some 50% of its entire GDP in those days. Thirty years later, the gross external debt of Moldova reached over $7.8 billion by the end-June 2020, according to the data released by NBM (around 66.1% of GDP of the country, this key ration depending this year on how much the GDP will contract; see IMF estimation in WEO October 2020: - 4,5%). Moldova’s foreign debt does include Transnistria’s one for the energy imports from Russia. The Moldovan foreign currency reserves have had a reasonable evolution($3.5 billion as of end-October 2020) if the export potential of the country and the level of remittances received are accounted for. Remittances should be more encouraged and focused more actively on investment once the pandemic is over.

All these monetary developments had a negative impact on the commercial banks most of the times. The big banking fraud is unique amongst the countries in transition. On top of everything, the pandemic crisis of 2020 should be also taken into consideration. The commercial banks currently operate under unprecedented uncertainty, but most of them are well-capitalized to withstand. Also, in this sense, a decisive role is played by joint domestic efforts, as well as the support of Moldova’s external partners’ support and that of the international financial institutions. The new agreement with the IMF will be essential in coagulating this support.■

Adauga-ţi comentariu