Profit №_12_2023, decembrie 2023

№_12_2023, decembrie 2023

Cryptocurrencies: future of money?

In the article ″Cryptocurrencies and transition″ signed by Alexandru M. Tanase and Mihai Radoi, published on 4 December 2018 by the prestigious publication Emerging Market, London1 , we have signalled the need for fast and clear regulations by the relevant central banks of all aspects related to this recent payment instrument (which is basically a string of computer codes and which started to be used for payments outside the monetary base of any country). Our plea is even more relevant these days as the market quotations of key cryptocurrency crashed or is behaving like a roller-coaster.

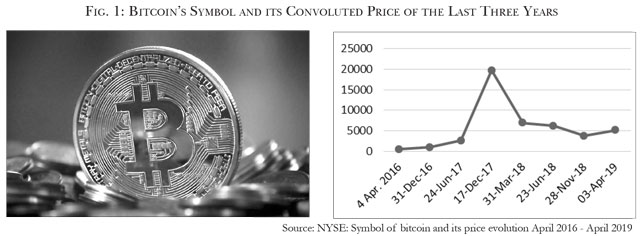

This was indeed the case of bitcoin, but other cryptocurrencies too followed a similar convoluted pattern. Billions of USD and other currencies were wiped out since the pick quote in December 2017. All cryptocurrencies were in a very ″bubbling″ mode during 2017-2018, but the case of bitcoin is extremely illustrative. Its ″price″ increased from USD 700 at the beginning of 2017 to the peak of USD 19,666 registered on 17 December 2017. It subsequently decreased to around USD 11,000 and again increasing to around USD 15,000 following severe warnings from regulators (such as China and South Korea) that such levels may not be sustainable and measures will be soon introduced. It is currently in the range of USD 4,000 - 5,000 (see graph), after a low of USD 3,251.3 was registered on 14 December 2018 after the peak mentioned above.

Bitcoin and other instruments using blockchain technology are not regulated by the central banks or indeed by any other financial authorities. One collateral result of the current distortions of markets (very low and/or negative interest rates, large unutilised liquidities, etc.), including of the Eastern European ones as further presented, is that many peoples started to turn to ″innovative″ schemes/platforms to place their money/savings. The requests from many central banks mentioned above to regulate it are correct, albeit long overdue.

In most cases, these instruments using blockchain technology are ″stateless″ ones, although strong voices of central banks are being heard that they should be regulated. Implications and consequences of such new instruments are not yet fully clear about even in the developed countries, namely if and how to regulate these new ″currencies″.

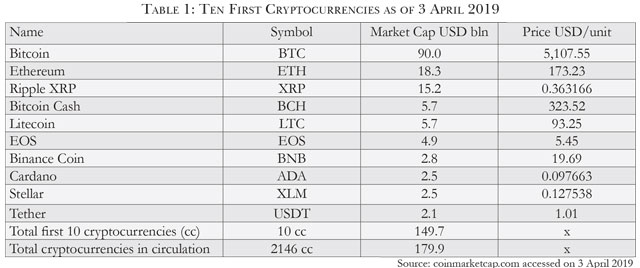

Even the concept of currencies is debated. Many countries publically declared that the cryptocurrencies are not ″legal means of payments″ in their respective jurisdictions. As such, they are treated more as assets or platforms rather than anything else, but their sheer volumes of trading raised additional questions on risks involved, the taxation aspects on gains made and the ways to bring them from shadow economies to the transparent fields. This would be similar to those in which the normal currencies (″fair money″), issued by the central banks, exist and operate. All countries still struggle to understand the essence of these instruments, a decade late after their introduction by elusive Satoshi Nakamoto. Of the large group of cryptocurrencies, the most used and known are ″bitcoin″, ″ethereum″, ″ripple″, ″bitcoin cash″ and ″litecoin″.

In the new schemes of the so-called ″cryptocurrencies″, amazing assets amounting to billions of USD have been so far accumulated. There are estimations that over 2,146 such cryptocurrencies were in existence/circulation with a total market capitalization of USD 180 billion as of 3 April 2019.

Disturbing Recent Developments

The Western mass media is quite attentive to events, trends and dynamics in the cryptocurrency markets. A recent surge in the price of bitcoin over USD 5,000 at the start of April 2019, following a non-transparent demand of USD 100 mln from China, excited the firm ″believers″ in the bright future of the cryptocurrencies.

Well known celebrities (see the case of Elon Musk who holds small amount of bitcoins and his team) even started to predict that maybe the world will need some more 10 years to renounce/abolish the currencies issued by the central banks.

We do not share such opinions. On the contrary, the recommendation made in December 2018 in the article mentioned above for fast and clear regulations is valid more than ever. Over the last few years there were disturbing developments which put a heavy question mark on the future of cryptocurrencies themselves. The case of the largest Canadian exchange company Quadriga CX is very illustrative. Basically, this was presented as an unfortunate event triggered by the sudden suspicious death of the main owner of the company in India while doing charity works. Some 115,000 investors lost an impressive amount of GBP 145 mln, according to The Times (9 February 2019). The ″cold wallet″ (in which the public and private keys or codes are kept) of this company was stored on a laptop but nobody else knew the passwords to access the money. This is an incredible story and, of course, conspiracy theories were flying around, especially in the context in which the owner’s wife acquired 16 houses in the last 2 years. This was not the first case and most likely it will not be the last one.

Previously, the suspicious bankruptcy of Mt. Gox, a Japanese exchange for cryptocurrencies, short of USD 61.6 mln and 234,000 bitcoins, is also famous. Some 80,000 bitcoins simply ″disappeared″. Their estimated value was of some GBP 240 mln (depending of the date of the quote). The story is similar by now with many other fraudulent cases. The owner changed the codes for Mt. Gox’s wallet. He was well-known as spending money on prostitutes, expensive houses and cars. The legal and forensic battles to recover the money invested will continue for a while (most likely with very small chances of success), but the stains left on the credibility of cryptocurrencies will not wash away soon.

There are speculations and/or allegations based on solid reasons that the cryptocurrencies are used for money laundering and other criminal activities as the issuers and the utilizers are anonymous (dark side of the internet). Cryptocurrencies could easily be labeled as similar to Ponzi schemes which will disappear when the trust in them will be lost. These connections with money laundering and financing of terrorism (some estimations put at 44% the transactions with bitcoins associated with illegal activities) are possible as the new ″currencies″ are ″stateless instruments″ which lack the basic transparency required on domestic and international transactions. All commercial banks should apply the Know-Your-Customer (KYC), anti-money laundering (AML) and fighting terrorism principles in their activities and this is not possible with such opaque assets/transactions/partners.

Cryptocurrencies in some Eastern European Countries

Central and Eastern European countries have faced many problems during their three decades of transition from centrally planned economies to market ones. Meanwhile, a new policy and monetary issue, amongst many others serious challenges, has been more and more debated by this group of countries, namely how to handle the cryptocurrencies. Regarding the legality of transactions with cryptocurrencies, there is currently a very large diversity of cases of Eastern European countries positioned between the two extremes, starting with being very prohibiting and going up to being very permissive.

North Macedonia and the Republic of Serbia are part of the first group. Belarus (where a ″super liberal″ regime was introduced in December 2017 providing official support for cryptocurrencies) and Ukraine (which abandoned the licensing of cryptocurrency companies in June 2018) and in a way the Russian Federation are good examples of a permissive approach. However, most of the transition countries (Romania, Republic of Moldova, Czech Republic, Croatia, Estonia, etc.) are somewhere in between the two very different approaches.

The technical aspect of the cryptocurrencies needs to be further explored.

It has obvious merits, but these are not the focus of this paper. One aspect which needs a closer look at is why the ″mining″ (the computerised process to generate a cryptocurrency) is encouraged and developed in some countries of Eastern Europe.

Ukraine, Russia, Belarus and Moldova are the front runners in the region. The mining requires a lot of electricity (energy intensive) which is still much cheaper in such countries than in the developed ones. According to some studies, the cost of mining a bitcoin, for instance, was around USD 3,500 on tariffs for energy valid in 2018. Even if compared to its current quotation (USD 5,107.55 on 3 April 2019 - NYSE Bitcoin Index) it is clear that producing a bitcoin is still a lucrative industry.

Thus, in such countries, there were established ″crypto-farms″ of computers and auxiliary equipments (containers, ventilation machines, etc.). These work continuously to obtain bitcoins within the technically predicted as maximum possible number of 21 million (there are currently some 17 mln in circulation and generation is an asymptotic process of costs (increasing) versus revenues (fluctuating)). The case of the Russian ″babushka″ from Irkutsk (Siberia) who is assiduously ″mining″ for new bitcoins was made famous by BBC in December 2018 as the extremely low temperatures are very conducive for mining. Of course, somebody else is behind that babushka who is dreaming up of a quote of USD 1 mln/unit. It is very likely that her dream of ″digital gold″ will never come true.

Second, the legislation was not introduced yet or was not clear enough (legislative blur) to provide precisely for what is allowed and what is not. Third, specifically for these cases, in this part of the region, there is an unrecognised and separatist so-called Republic of Transnistria (sandwiched between Moldova and Ukraine) where the rule of international law is not a priority and where the energy is produced with natural gas imported from the Russia. Transnistria issued a specific law in 2018 in which the mining of cryptocurrencies, mainly bitcoin, was made legal. An institution was established (TechnoPark OJSC) to coordinate this activity which is currently legal in any part of this separatist region, but for the time being the cryptocurrency mining is more developed in Bender (Tighina), Rabnita and Tiraspol.

There are already crypto-farms with computers and other auxiliary equipment being imported from China and other suppliers without any custom duties. The cryptocurrency mining is very much encouraged with the participation of mainly Russian, Austrian and German investors which is evident and publically declared. Moreover, the gas used by Cuciurgan Power Plant (GRES), controlled by Russia’s Inter RAO, is not paid by Transnistria. Thus, a large debt has been already accumulated and it is not immediately clear who is going to pay it. Therefore, the energy has been supplied to crypto-farmers at very cheap tariffs, if paid at all as scams and thefts are widespread.

Another case is that of a photo-voltaic park project in Moldova, which according to the Moldovan mass media was allegedly developed to generate cheap electricity for mining cryptocurrencies.

However, it will be fair to mention that the National Bank of Moldova (NBM) repeatedly cautioned investors that no cryptocurrency is a legal mean of payments on Moldova’s territory (see NBM’s press releases dated 10 July 2017 and 15 February 2018 and many interviews granted by the previous Governor of the NBM). Also, to be noted that Moldova is a member of the Governors of the Central Banks’ Club, together with other 25 countries from former Soviet Union (including Russia), Eastern Europe, Balkans, Turkey and others. The Club made it clear on 13-15 May 2018 in Istanbul that cryptocurrencies are not legal instruments and that the risks involved are majors (capital loss, reputational distress, association with money laundering and financing of terrorism, etc.).

Future of Money? - No way.

Despite being in existence for more than a decade, the cryptocurrencies are seen as ″short-lived curiosities″ by many well-known European bankers. Their evolution is highly speculative and it is very likely that these assets will eventually deflate. However, the risks of this unregulated segment in the Eastern European markets are much higher and have higher probability of happening than in the rest of the world, with material negative consequences. The requests from many central banks from emerging markets and from the European Union to regulate these activities are welcome. In September 2018, the Governor of the National Bank of Romania, to cite just one example, clearly requested that cryptocurrencies should be regulated before they become pyramidal schemes such as those which plagued Romania in early ‘90s (Caritas, National Investment Fund (FNI), to name just a few).

All non-transparent and opaque transactions with cryptocurrencies should not be encouraged and/or tolerated. No doubts, the Eastern European countries had and will still have many challenges to face, but handling the issue of cryptocurrencies in a proper way should be a high priority in the interest of much needed full transparency in this region.

On a more general note, the issue of the cryptocurrencies should be regulated by all countries involved not only by some. It is very unlikely that these instruments will ever replace the fair money issued by states over the centuries. The money issued by the central banks has the guarantee of the states behind it. Savers keeping their money with licenced banks in clean jurisdictions are even guaranteed by the respective states for specified reasonable amounts, while many investors still struggle to recover their ill-judged investments in such opaque schemes as crypto-currencies. The simple advice to everyone to keep money in safe palaces is an obvious one, if there was any need for that. As the cryptocurrencies world is full of major risks, such a decision should not be difficult to take.■

________________________________________________________________

* This article could be seen in full on https://emerging-europe.com/voices/cryptocurrencies-and-transition/. Some extracts were used in this article too.

_________________________________________________________________

Alexandru M. Tănase is an Independent Consultant and Former Associate Director, Senior Banker at EBRD and former IMF Advisor. These represent the author’s personal views. The assessments and views expressed are not those of the EBRD and/or the IMF and/or indeed of any other institutions quoted. The assessment and data are based on information as of mid-April 2019.

_______________________________________________________________

Cryptocurrency in simple words - Selected terms

For the general public, there is an evident need to get accustomed with the jargon of cryptocurrency industry. The financial education programs undertaken by some central banks (see the excellent case of the NBM’s such program which is under implementation) are good tools in this respect. Here are some selected terms:

Cryptocurrency: a virtual instrument generated by computer(s). It is basically a string of codes, using the blockchain technology;

Blockchain: a cryptographically secure ledger, updated from time to time to cater for new transactions;

Bitcoin: the first ever cryptocurrency introduced some 10 years ago by Satoshi Nakamoto. It is used by direct participants in specific transactions, without the interference of any party (governments, central banks, commercial banks, etc.);

Keys: unique codes attributed to each cryptocurrency. They are fundamental tools in accessing the wallets, executing transactions and finally recovering the money invested. They are used also for exchange of encrypted messages without sharing a codebook;

Mining: a process under which the computers finally solve complex options and generate some cryptocurrencies;

Wallet: a place in which the public and private keys are kept. A cold wallet would designate a place outside internet links;

There is a vast literature and many websites (such as Investopedia.com) in this respect. To cite just a few books: A. Rothstein - The End of Money - New Scientist, 2017 and D. Frisby- The Future of Money - Unbound, 2014. Western mass media grants large spaces to topics such as cryptocurrencies and their major risks

Adauga-ţi comentariu